Why Understanding Franchise Compensation Models is Critical for Business Success

Franchise compensation models dictate the financial relationship between franchisors and franchisees. Getting this structure right is essential for your investment’s success. Here’s a quick overview:

Key Compensation Types:

- Initial Franchise Fees: A one-time payment, typically $25,000-$50,000.

- Ongoing Royalties: Monthly payments based on gross sales, usually 4-12%.

- Advertising Fees: Contributions to marketing funds, often 2-4% of sales.

- Technology Fees: Monthly payments for systems and software.

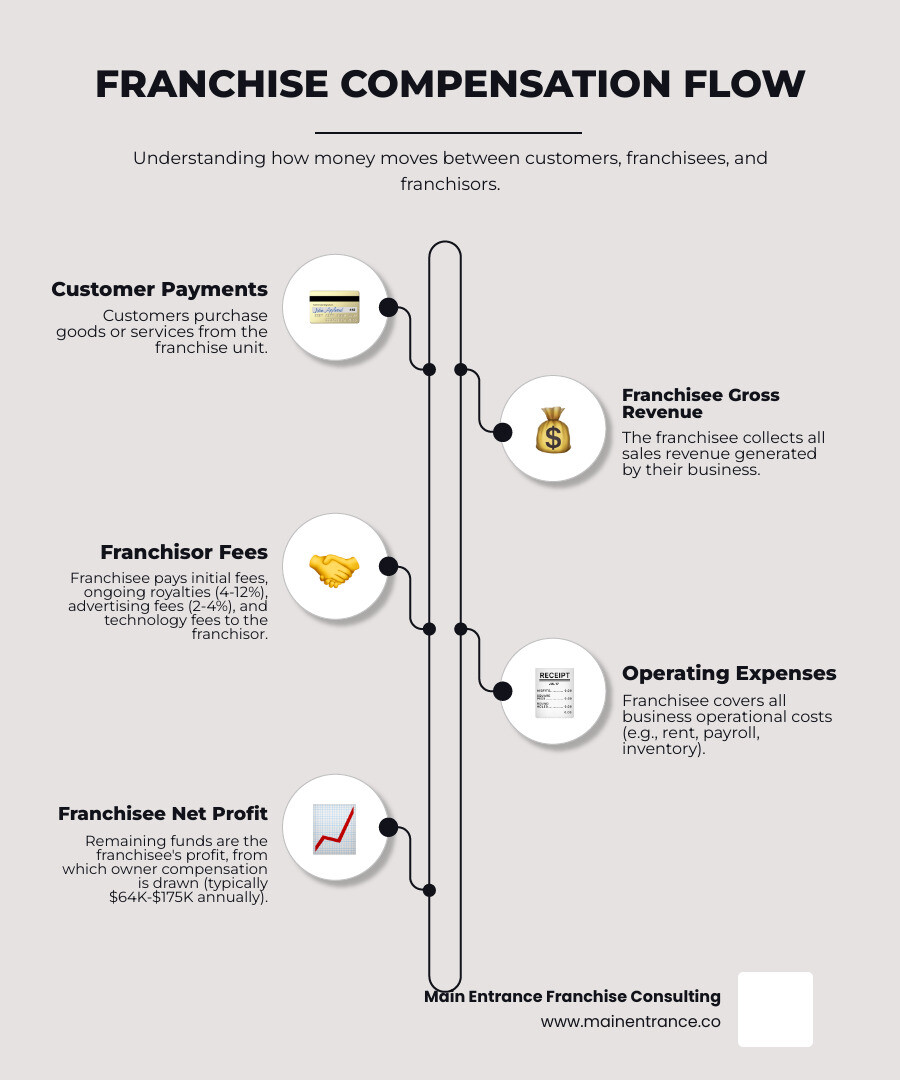

How Franchisees Get Paid:

- Franchisees keep the profits after paying all expenses and fees.

- Owner compensation comes from business profits, not a salary from the franchisor.

In franchising, you generate revenue, pay required fees to the franchisor, and keep the remainder as profit. This structure aligns everyone’s interests: when franchisees generate more sales, franchisors earn higher royalties. When franchisors provide better support, franchisees often see improved profitability.

Understanding these models before you invest is crucial. The wrong fee structure can drain profits, while the right one creates a foundation for long-term success.

I’m Max Emma, a Certified Franchise Executive. I’ve built successful franchise businesses and worked with over 100 brands to optimize their compensation structures. My experience as both a franchisor and consultant has shown me how the right financial framework creates thriving partnerships.

The Building Blocks: Initial Fees and Ongoing Costs

Franchise compensation models are the financial foundation of the franchise relationship. When you buy a franchise, you’re not just buying a business; you’re investing in a proven system with established brand recognition and ongoing support. This partnership involves specific costs.

The initial franchise fee is your first major investment, typically ranging from $25,000 to $50,000. This one-time payment grants you the right to use the brand name, access proprietary systems, and receive initial training and support.

After the initial fee, you’ll have several ongoing costs:

- Ongoing Royalties: Regular payments that fund the franchisor’s continued support, system updates, and brand development.

- Advertising Fees: Pooled resources for marketing campaigns that benefit the entire network.

- Technology Fees: Payments to keep your systems current and competitive.

- Operational Costs: Standard business expenses like rent, utilities, inventory, and staff.

How Initial Fees Impact a Franchisee’s Earnings

The initial franchise fee is a significant upfront investment that affects your capital requirements and return on investment calculation. This fee is an investment in a proven system that reduces the risks of starting from scratch. You’re paying for the franchisor’s expertise, a tested business model, and comprehensive training. While it doesn’t generate immediate earnings, it’s a key part of your business launch costs and open ups the earning potential of an established brand.

Understanding Ongoing Fees

Ongoing fees are your regular investments in the continued success of the franchise system.

Royalty payments, usually a percentage of gross sales, align your interests with the franchisor’s. When your business grows, the franchisor benefits too, ensuring they are invested in your success.

Technology fees cover systems that would be expensive to develop independently, while local marketing obligations help drive customers to your specific location.

While these fees impact your profitability, they also fund the support and innovation that help your business succeed long-term. When structured fairly, ongoing costs create a sustainable partnership. For more on marketing and advertising funds, understanding how they’re managed can help you appreciate their value.

Revenue Sharing and Royalty Structures Explained

The core principle of revenue sharing in franchising is simple: everyone wins when the business succeeds. When a franchisee’s sales grow, the franchisor’s royalty income grows too. This alignment of interests makes franchising a powerful business model, creating genuine partnerships where mutual success is the goal. A sustainable franchise revenue sharing model is crucial; excessive fees can harm franchisee profitability, while underreporting sales damages the entire system.

Common Types of Revenue Sharing Models in Franchising

Franchisors use several revenue sharing models, each with different characteristics:

- Percentage of Gross Sales: This is the most common model. The franchisee pays a set percentage of total revenue to the franchisor. It’s transparent, easy to calculate, and directly aligns the interests of both parties.

- Fixed Fee Models: Franchisees pay a flat amount regardless of sales volume. This offers predictability but can be a burden during slow periods.

- Tiered or Sliding Scale Royalties: These complex models adjust the royalty percentage based on sales thresholds, often rewarding high performers with lower rates.

- Minimum Royalty Fees: This acts as a safety net for franchisors, ensuring a baseline payment even if a location has low sales. It can, however, add pressure on new franchisees.

- Profit Sharing: The franchisor takes a percentage of the franchisee’s net profit instead of gross sales. This model requires significant trust and financial transparency but offers the truest alignment of interests around profitability.

How Royalties and Profit Sharing Work

Understanding the difference between gross revenue and net profit is critical.

Gross revenue is the total income before any expenses are paid. Most royalty calculations are based on this figure because it is simple and verifiable.

Net profit is what remains after all business expenses are paid, including rent, labor, inventory, and royalties. This is the money that ultimately goes to the franchisee.

The power of royalties is in their scalability. As a franchise system grows from 10 to 100 locations, the royalty income for the franchisor compounds, demonstrating the long-term value of a successful network.

Transparency and reporting requirements are essential for this system to function. Franchise agreements specify how sales must be reported, maintaining the trust that underpins the entire relationship. Accurate reporting allows franchisors to provide better support and improve the brand for everyone involved.

The Franchisee’s Paycheck: From Gross Revenue to Personal Income

How do franchise owners get paid? Unlike a traditional job, franchise owners earn money from their business’s profits. The path from revenue to personal income is straightforward: from your gross revenue, you subtract all operating expenses, including rent, wages, inventory, and franchisor fees. What remains is your net profit, which is the source of your personal income.

This direct link between business success and personal earnings is a key motivator for many entrepreneurs, as highlighted in The 4 Freedoms That Motivate Successful Franchise Owners.

How Franchise Owners Determine Their Salary

New franchise owners must understand the difference between an owner’s draw and a salary. You are not an employee of the franchisor, so you decide how to compensate yourself from business profits.

- An owner’s draw is a flexible approach where you take money from profits as needed. This is common for new businesses with variable cash flow.

- A salary is a consistent, regular payment to yourself. This provides stability and often makes sense for mature franchises with predictable profits.

The best choice depends on your business’s profitability and cash flow. Many owners start with modest draws, reinvesting early profits back into the business to accelerate growth. Consulting a CPA is recommended to determine the most tax-efficient strategy.

Factors That Influence Franchisee Compensation

Franchise owner earnings vary dramatically. Several key factors influence your potential income.

- Industry and Brand: Some industries have higher profit margins. A well-established brand with strong customer recognition provides a significant advantage.

- Location and Market: A prime location with high traffic and strong local market demand for your services is critical for boosting sales volume.

- Management Skills: Your ability to manage operations, market effectively, and control finances is often the most important factor. Two identical franchises can have vastly different results based on the owner’s skill.

Average franchisee salary data shows a wide range, with some owners earning over $175,000 annually and others closer to $64,000. This proves that “average” can be misleading and that your performance is the primary driver of your income. Your success is in your hands, supported by the franchisor’s proven system.

Best Practices for Structuring Fair Franchise Compensation Models

A fair and effective franchise compensation model builds a partnership that works for everyone. When structures are transparent and encourage mutual growth, they become the foundation for a thriving system. The best models are scalable, legally compliant, and create genuine alignment between franchisor and franchisee.

Navigating these complexities is where professional guidance becomes invaluable. The advantages of working with a Certified Franchise Executive (CFE) are clear when designing these critical structures.

Challenges and Pitfalls to Avoid

Franchisors must avoid common compensation traps:

- Unfair Fee Structures: Royalties that are too high can stifle franchisee profitability, while rates that are too low can prevent the franchisor from providing adequate support. Finding the right balance is key.

- Lack of Transparency: Franchisees must understand how their fees are used. Clear communication about advertising funds and royalty calculations builds trust.

- Miscommunication: Vague terms in franchise agreements lead to disputes. Clarity from the outset is essential.

- Poor Dispute Resolution: Without a fair process for handling disagreements, minor issues can escalate into costly legal battles. Effective mediation strategies can preserve relationships.

The Role of Equity and Technology in Modern Models

Modern franchise compensation models are evolving with new opportunities:

Equity compensation is an emerging trend where franchisors offer franchisees ownership stakes through stock options or grants. This creates powerful performance incentives by giving franchisees a direct financial interest in the brand’s overall success.

Technology has revolutionized compensation management. Modern royalty management tools and data analytics platforms simplify revenue tracking, ensure transparent fee calculations, and provide valuable performance insights. Our technology and analytics in franchise management services leverage these tools to drive efficiency.

Legal and Tax Implications

Getting the legal and tax aspects of compensation models right is critical.

- The Franchise Disclosure Document (FDD) must detail every fee and financial obligation, ensuring transparency.

- The franchise agreement creates legally binding contractual obligations for all parties.

- Tax liabilities differ based on the compensation structure and whether a franchisee takes a salary or an owner’s draw.

- State laws on franchising vary, adding another layer of complexity. The FTC resources offer guidance on federal compliance.

Expert guidance is a wise investment to steer these legal and tax considerations and avoid potential disputes or penalties.

Frequently Asked Questions about Franchise Compensation

Here are answers to some of the most common questions about franchise compensation models.

What is a typical franchise royalty fee?

Most franchise royalty fees fall between 4% and 12% of gross sales. This ongoing payment to the franchisor covers continued support, brand development, and system improvements. The exact percentage often depends on the industry, with service, food, and retail concepts having different structures. The key is to understand the value you receive for this fee. Fees are typically collected weekly or monthly.

How much do franchise owners actually make?

Franchise owner earnings vary dramatically based on performance. While average salaries are reported to range from $64,000 to $175,000 annually, this doesn’t capture the full picture. Top-performing franchisees in a system can earn significantly more than the average, sometimes generating millions in annual revenue.

Your actual take-home pay is the profit left after all expenses are paid, including rent, labor, and franchisor fees. Your income is directly tied to your ability to manage costs, market effectively, and run your operations efficiently.

Can a franchise owner just take profits instead of a salary?

Yes. Many franchise owners take an “owner’s draw” instead of a fixed salary. This flexible approach allows you to take money from business profits as needed, which is especially useful for new businesses with fluctuating cash flow.

The choice between a draw and a salary often depends on your business’s legal structure (e.g., LLC vs. S-Corp) and has tax implications, so consulting a CPA is wise. This method requires careful cash flow management to balance personal compensation with reinvesting in the business for future growth.

Conclusion: Building a Win-Win Compensation Structure

Understanding franchise compensation models is about building a successful partnership. From initial fees (typically $25,000 to $50,000) to ongoing royalties (usually 4% to 12% of gross sales), every element should foster a win-win relationship.

The key takeaway is alignment. A fair, transparent compensation structure ensures that when the franchisee succeeds, the franchisor does too. This requires thoughtful planning and a focus on mutual growth.

For prospective franchisees, due diligence is crucial. Dig into the fee structures and understand their impact on your potential profitability. For franchisors, regularly reviewing and adapting your compensation model is essential to remain competitive and fair.

Expert guidance makes all the difference. At Main Entrance Franchise Consulting, we specialize in creating clear, fair, and strategic compensation structures. We help both aspiring franchisees and growing franchisors steer these complexities to build a foundation for long-term success.

Whether you’re exploring a franchise or looking to develop your franchise with expert help, we’re here to help you create the win-win structure that every successful system needs. The best franchise compensation models are those where everyone thrives together.