Why Franchise Performance Evaluation Is the Key to Long-Term Success

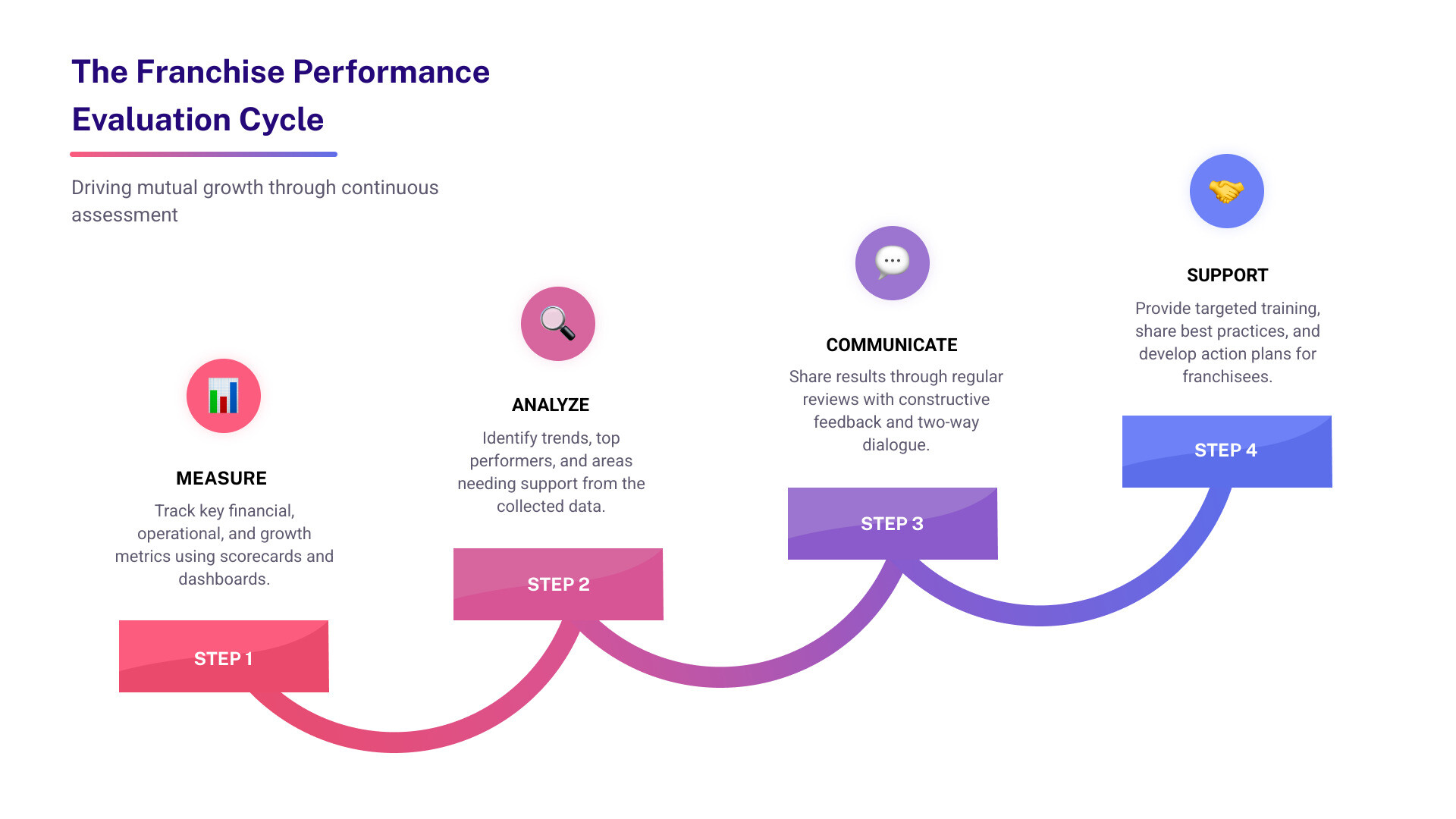

Franchise performance evaluation is the systematic process of measuring, analyzing, and improving how individual franchise units and the overall system are performing. For both franchisors and prospective franchisees, understanding these metrics is essential for making data-driven decisions that foster mutual growth.

Here’s what franchise performance evaluation includes:

- Financial Metrics – Revenue, profit margins, same-store sales growth, ROI

- Operational Metrics – Customer satisfaction, employee turnover, brand compliance

- Growth Metrics – New unit openings, closure rates, franchisee satisfaction

- Regular Reviews – Structured assessments using scorecards, dashboards, and benchmarks

- Support Systems – Using data to identify training needs and share best practices

The franchise industry continues to thrive, but close to 70% of franchisors don’t include financial performance data in their disclosure documents, making independent evaluation critical.

Proper evaluation isn’t about finding fault; it’s about building a healthier system. It helps franchisors maintain brand consistency and support struggling units. For prospective franchisees, it’s the best tool for determining if an opportunity is a sound investment.

Think of it as a report card for the business. It gives everyone a clear picture of what’s working and what needs to change, with the goal of helping everyone achieve higher levels of success.

I’m Max Emma, a Certified Franchise Executive (CFE) who has worked as both a franchisor and a consultant for over 100 brands. At Main Entrance Franchise Consulting, I use this insider perspective to help aspiring entrepreneurs evaluate franchise opportunities and make confident, informed decisions.

The Core Subjects: Key Components of a Franchise Performance Evaluation

This section breaks down the essential metrics, or “subjects,” on your franchise report card. It covers the financial, operational, and growth indicators that paint a complete picture of a unit’s health and the system’s overall strength.

A franchise performance evaluation requires looking at multiple categories. You can’t judge a franchise’s health by revenue alone. I break performance into three main areas: financial health, operational efficiency, and growth potential. Together, they reveal if a system is truly sustainable.

Financial Health Metrics

Financial metrics answer the most basic question: Is this business making money?

- Gross revenue: The total money flowing in before expenses. The average franchise generates about $1.1 million annually, but this varies widely by industry.

- Net profit margin: What’s left after all bills are paid. The average is 8.54%. Consistent profitability is more important than high revenue.

- Same-store sales growth (SSSG): Compares revenue from existing locations over time. Growth here indicates a healthy, working business model.

- Cost of goods sold (COGS): What you spend to deliver your product or service. Small improvements here significantly boost profitability.

- Return on investment (ROI): How long it takes to get your initial investment back. This is critical for franchisees.

- Break-even point: The moment when total revenue equals total costs. A shorter path to break-even is highly attractive.

For more on these indicators, this resource on evaluating franchise financial performance offers additional insights.

Operational Efficiency Metrics

Operational metrics reveal how well a franchise runs day-to-day, delivering consistent quality and happy customers.

- Customer satisfaction: Often measured with Net Promoter Score (NPS). High scores mean loyal customers who act as marketers.

- Customer lifetime value (CLV): The total revenue expected from a customer over time. Increasing customer retention by just 5% can boost profits by 25% to 95%.

- Employee turnover: High turnover often points to issues with management or culture and hurts service quality.

- Inventory turnover: Measures how efficiently products are moved. Finding the right balance keeps costs down.

- Average transaction value: How much customers spend per visit. This can be increased through strategic upselling and bundling.

- Brand standards compliance: Covers everything from store appearance to service protocols. Consistency builds customer trust.

Growth and Expansion Metrics

Growth must be healthy and sustainable, not just rapid.

- New unit growth rate: Shows how fast the franchise is expanding. The rate at which new franchise units open varies significantly across industries, but too-fast growth can outpace support systems.

- Unit closure rate: A high closure rate is a major red flag, indicating potential problems with the business model or support.

- Territory penetration: Helps you understand how much room for growth remains in available markets.

- Franchisee satisfaction: Happy, supported franchisees are successful. Low satisfaction often predicts future problems before they appear in other metrics.

The Grading System: How to Measure and Track Performance

Establishing a clear and consistent “grading system” is vital. This involves creating the right tools, leveraging technology, and understanding how to interpret the data you collect to make fair and objective assessments.

Knowing which metrics to track is the first step. The next is building a system to measure them fairly and consistently. This is where franchise performance evaluation moves from theory to practice.

Developing Your Franchise Performance Evaluation System

A strong evaluation system must be clear, fair, and practical.

- Checklists: Ensure every unit is evaluated on the same criteria, turning subjective observations into objective data. For a comprehensive approach, use a checklist to regularly assess performance.

- Scorecards: Provide a visual snapshot of performance across key areas. Franchise Scorecards: A grading system for franchisee success should be simple and highlight controllable expenses.

- Key Performance Indicators (KPIs): Focus on the 5-10 metrics that truly drive success in your system, like same-store sales growth or customer satisfaction.

- Benchmarking: Compare individual unit performance against network averages and industry standards to provide context and identify top performers.

- SMART goals: Set Specific, Measurable, Achievable, Relevant, and Time-bound goals to give franchisees a clear roadmap for improvement.

The Role of Technology in Tracking Performance

Technology makes franchise performance evaluation faster, more accurate, and more useful.

- CRM software: Tracks customer interactions to understand acquisition costs and lifetime value.

- Business Intelligence (BI) tools: Consolidate data from multiple sources into easy-to-understand dashboards.

- Data automation: Eliminates manual entry errors and frees up time for analysis.

- Real-time dashboards: Provide a live view of network performance, allowing for quick responses.

- Mobile applications: Make performance data accessible to franchisees and field consultants anywhere.

- Predictive analytics: Analyze historical patterns to forecast future performance and identify potential issues early.

Overcoming Common Evaluation Challenges

Even with great systems, challenges can arise.

- Data inconsistency: Solved by standardizing templates, timing, and definitions for data submission.

- Lack of franchisee buy-in: Overcome by emphasizing that the goal is improvement and support, not punishment.

- Misinterpreting data: Avoid this by always seeking context behind the numbers before drawing conclusions.

- Fear of confrontation: Approach reviews with empathy and a focus on collaborative problem-solving.

- Setting unrealistic benchmarks: Base benchmarks on actual historical data and industry standards to keep franchisees motivated.

- Ensuring fairness and objectivity: Use standardized tools and let the data speak for itself to build trust in the process.

Parent-Teacher Conference: Conducting Reviews and Supporting Franchisees

Data is meaningless without action. This section focuses on the human side of evaluation—changing performance data into constructive conversations, targeted support, and a stronger franchise network.

This is where franchise performance evaluation becomes truly meaningful. After gathering data, you must sit down with franchisees and turn insights into improvement. The goal is a partnership where everyone feels supported and motivated to grow.

Best Practices for a Constructive Franchise Performance Evaluation

A positive approach to reviews can strengthen your business and relationships.

- Use a regular review schedule: A mix of informal monthly check-ins and formal quarterly reviews creates predictability and allows for both quick adjustments and strategic planning.

- Encourage two-way dialogue: A review should be a conversation, not a lecture. Understanding the franchisee’s perspective is crucial. How do you evaluate the performance of your franchisees? Open communication provides the full picture.

- Act as a coach, not a judge: Frame feedback constructively to help franchisees improve, not to punish them for shortcomings.

- Create a clear action plan: End every review with specific, measurable steps and realistic timelines so the franchisee knows exactly what to do next.

- Follow-up is essential: Schedule check-ins to ensure the action plan is implemented. This shows you’re invested in their success. Understanding The 4 Freedoms That Motivate Successful Franchise Owners can help frame these conversations effectively.

Using Data to Support and Improve Franchisees

A solid franchise performance evaluation system reveals opportunities for system-wide improvement.

- Identify training gaps: If multiple franchisees struggle with the same metric, it signals a need for targeted training.

- Share best practices: Identify what your top performers are doing differently, document it, and share it with the entire network.

- Optimize local marketing: Use data to guide franchisees toward marketing tactics that have a proven ROI in their specific market.

- Refine operational processes: System-wide data patterns can highlight a need to improve processes like inventory management for everyone’s benefit.

- Celebrate wins: Publicly recognize franchisees who hit targets or show significant improvement to boost motivation.

Identifying and Addressing Underperformance

Addressing underperformance is necessary to protect your brand and support struggling franchisees.

- Watch for early warning signs: Regular data monitoring can flag declining sales or rising complaints, allowing you to intervene early.

- Conduct a root cause analysis: Before acting, have an honest conversation to understand why performance is suffering. The solution depends on the correct diagnosis.

- Develop a remedial action plan: Work with the franchisee to create a custom, collaborative plan with clear milestones.

- Provide mentorship: Pairing a struggling franchisee with a successful peer can be a powerful tool for learning and support.

- Know when to consider termination: If a franchisee consistently fails to meet standards despite all support efforts, parting ways may be necessary to protect the brand. This decision should always follow your franchise agreement and involve legal counsel.

Extra Credit: A Prospective Franchisee’s Due Diligence

For those considering buying a franchise, evaluating the franchisor’s system is your most important homework. This involves looking beyond the marketing and digging into the data to assess the health and viability of the entire network.

If you’re thinking about buying a franchise, your own franchise performance evaluation of the opportunity is critical. My job at Main Entrance Franchise Consulting is to help you look beyond the glossy presentations and dig into what really matters. You are grading the franchisor, and this report card will tell you if the opportunity is a solid investment.

Reading the Report Card: The Franchise Disclosure Document (FDD)

The FDD is your primary source for understanding a franchise. This legal document must be provided to you at least 14 days before you sign or pay anything.

- Item 19 (Financial Performance Representations): This section may show historical sales or profit data from existing units. However, many franchisors omit this to avoid legal liability. If it’s missing, you’ll need to gather financial data elsewhere.

- Item 20 (Outlets and Franchisee Information): This lists current and former franchisees, providing their contact information. It reveals the system’s growth, unit closure rates, and gives you a list of people to call for research. High closure rates are a red flag.

- Item 7 (Initial Investment): This breaks down the estimated startup costs. I advise clients to add a 20% buffer for unexpected expenses.

A thorough FDD analysis is time well spent. Look for patterns like lawsuits, unusual restrictions, or inadequate territory protection.

Talking to Current and Former Students (Franchisees)

The FDD is the franchisor’s story; franchisees tell you what it’s really like.

- Make validation calls: Talk to as many franchisees as possible—new, established, and even former ones—to get a complete picture.

- Ask about profitability: Franchisees can be more candid about finances than the franchisor. Ask directly about revenue, profit margins, and the time it took to break even.

- Inquire about support satisfaction: Does the franchisor deliver on its promises for training, ongoing support, and marketing assistance?

- Gauge the franchisor-franchisee relationship: Is it a partnership or a top-down dictatorship? Explore the System’s Values and Culture to ensure it aligns with your own style.

- Talk to former franchisees: Their perspective is invaluable. Find out why they left. Consistent complaints from multiple former franchisees are a serious warning sign.

At Main Entrance Franchise Consulting, we guide clients through this exact due diligence process. Our goal is to ensure you move forward with your eyes wide open, armed with the data needed to make a confident decision.

Frequently Asked Questions about Franchise Performance Evaluation

What are the most important metrics to track for franchise performance?

A balanced franchise performance evaluation requires a mix of metrics. The most important ones are:

- Financial: Net Profit (is the unit making money?) and Same-Store Sales Growth (are existing units gaining momentum?).

- Operational: Customer Satisfaction (are customers happy?) and Brand Compliance (is the experience consistent?).

- Growth: Franchisee Satisfaction (are owners happy and engaged?). Happy franchisees are the best predictor of long-term system health.

These categories work together to provide a complete picture of a franchise’s health.

How often should franchisors conduct performance reviews?

Consistency is key. A layered approach works best:

- Monthly Reviews: Focus on key financial and operational KPIs to spot trends and make quick adjustments.

- Quarterly Reviews: Deeper conversations about progress, challenges, and strategy.

- Annual/Semi-Annual Reviews: A comprehensive evaluation of all performance areas and long-term goal setting.

This rhythm provides continuous monitoring without overwhelming franchisees. New or struggling units may benefit from more frequent, informal check-ins.

What is the first step in addressing an underperforming franchisee?

The first step is open and honest communication, focused on support, not punishment.

- Present the data clearly and objectively.

- Stop talking and start listening. Ask for their perspective to understand the context behind the numbers.

- Identify the root cause. The problem could be operational, market-related, or even personal. The solution must address the actual cause.

Approaching this conversation as a supportive partner, rather than an enforcer, is crucial for finding a collaborative solution. This is the heart of effective franchise performance evaluation—using data as a tool to build a stronger system for everyone.

Conclusion: Graduating to a Healthier Franchise System

A robust franchise performance evaluation process is not about policing franchisees; it’s about partnership. By establishing clear metrics, fostering open communication, and using data to provide targeted support, franchisors can build a stronger, more profitable, and more resilient brand for everyone involved. Navigating this process requires expertise and a clear strategy. The team at Main Entrance Franchise Consulting is dedicated to helping you understand every facet of the franchise world. My personal journey through franchising has taught me that the most successful systems are those where everyone is invested in each other’s success.

Ready to find a franchise that makes the grade? Learn more about our franchise buying services.