Why Choosing the Right E-2 Visa Franchise Matters

How to choose an e-2 visa franchise is a critical decision that determines both your path to living in the United States and your financial future. Here’s what you need to consider:

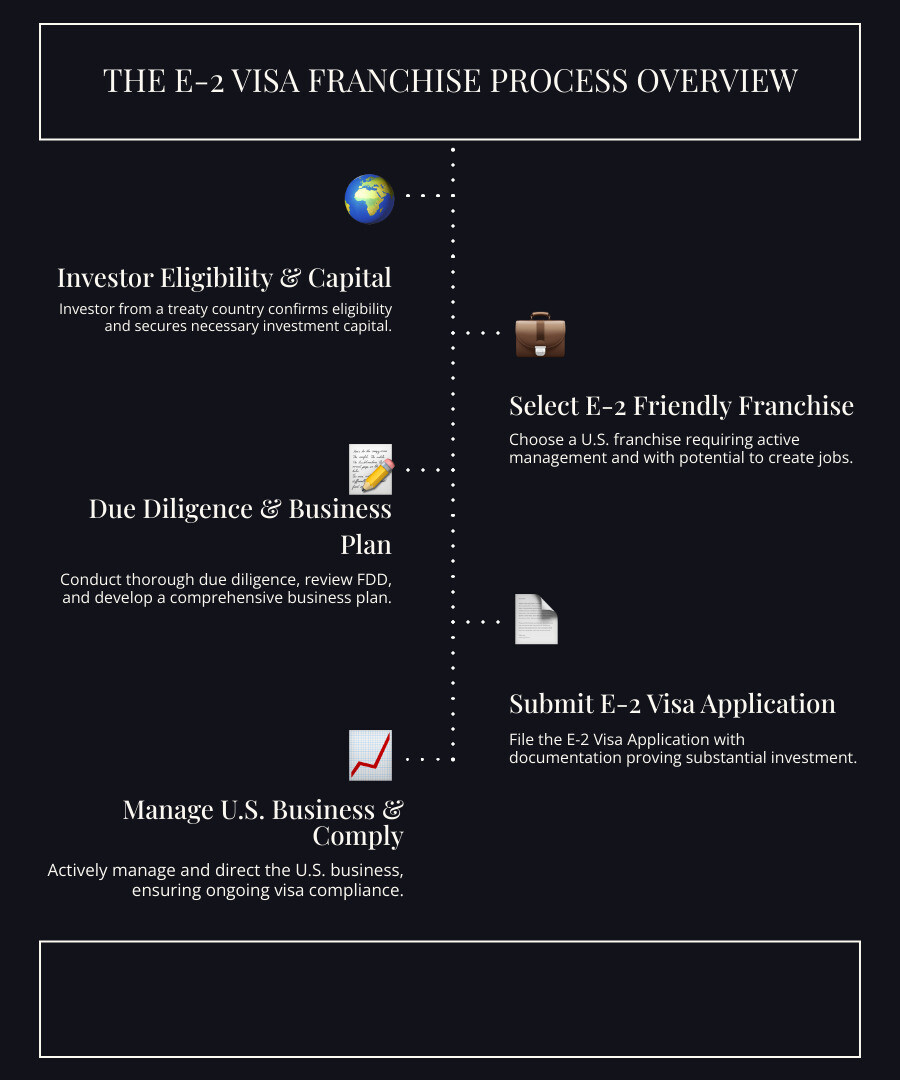

- Verify E-2 eligibility – Ensure you’re from a treaty country and can invest at least $100,000-$150,000

- Select an E-2-friendly franchise – Choose businesses that require active management and create U.S. jobs

- Conduct thorough due diligence – Review the Franchise Disclosure Document (FDD) and speak with existing franchisees

- Match to your skills and goals – Align the franchise model with your experience, lifestyle, and income targets

- Prepare comprehensive documentation – Develop a detailed business plan showing financial viability and job creation

- Work with professionals – Partner with a franchise consultant and immigration attorney who specialize in E-2 visas

The E-2 Treaty Investor Visa offers foreign entrepreneurs from over 80 treaty countries a pathway to live and work in the United States by investing in and operating a business. Unlike starting from scratch, franchises have a much higher approval rate for E-2 visas because they come with proven business models, established operational systems, and documented financial performance.

But not all franchises qualify—and not all qualifying franchises are the right fit for your situation.

Some franchises require passive investment, which disqualifies them. Others demand investments too small to meet the “substantial investment” threshold. And many simply don’t align with the job creation or income generation requirements that immigration officials scrutinize.

The good news? With the right guidance and a systematic approach, you can identify franchise opportunities that satisfy E-2 visa requirements and position you for long-term success in the U.S.

I’m Max Emma, a Certified Franchise Executive (CFE) and founder of Main Entrance Franchise Consulting, and I’ve helped countless entrepreneurs steer how to choose an e-2 visa franchise that meets both immigration requirements and their personal goals. My experience as both a franchisor and franchisee gives me unique insight into what makes a franchise truly viable for E-2 investors.

Understanding the E-2 Visa and Its Synergy with Franchising

The E-2 Treaty Investor Visa allows individuals from treaty countries to enter the United States by investing a substantial amount of capital in a U.S. business. The visa’s core purpose is to stimulate economic growth through foreign investment and job creation.

For entrepreneurs looking to make their American dream a reality, the E-2 visa is a popular option. You can learn more about the official definition and purpose of the E-2 visa directly from USCIS.

When it comes to E-2 visa applications, franchises often have a higher approval rate than independent startups. Why? Because they offer a ready-made business framework. Franchise businesses boast more stability and a higher success rate compared to starting a business from scratch. This is largely due to their proven business models, established brand recognition, and the comprehensive operational support and training provided by the franchisor. U.S. immigration authorities view franchises favorably precisely because they present a lower risk of failure, which aligns with the E-2 visa’s goal of fostering stable economic activity.

The Benefits of a Franchise for Your E-2 Application

Choosing a franchise for your E-2 visa application offers several compelling advantages:

- Easier Visa Approval: Investing in a franchise can simplify the E-2 visa process because it’s a proven, operational business with documented financials and existing support systems. This reduces the perceived risk and ambiguity that immigration officials might associate with a brand-new startup.

- Established Systems and Processes: Franchises come with a pre-established operational framework, including standard operating procedures, supply chains, and marketing strategies. This means the business is ready to operate as soon as your visa is approved, satisfying a key E-2 requirement.

- Clear Financial Documentation: Franchisors typically provide detailed financial performance representations (FPRs) and clear breakdowns of initial investment costs. This transparency makes it easier to demonstrate that your investment is “substantial” and “at-risk,” as franchise fees and other investment opportunities are usually set in advance and well-documented.

- Franchisor Training and Support: New entrepreneurs, especially those unfamiliar with the U.S. market, benefit immensely from the extensive training and ongoing support systems offered by franchisors. This support is crucial for the success of your business and helps demonstrate your intent to actively direct and develop the enterprise.

- Brand Recognition: Investing in a recognized brand gives you a significant head start. Customers already trust the name, which can accelerate your business’s path to profitability and stability—a positive signal for immigration authorities.

Potential Risks and Drawbacks to Consider

While franchises offer many benefits, be aware of potential drawbacks:

- High Initial Costs: While some franchises can be relatively low-cost, many require significant upfront investment, including franchise fees, equipment, and initial working capital. These costs can sometimes be higher than starting an independent business.

- Ongoing Royalty Fees: As a franchisee, you’ll typically pay ongoing royalty fees (a percentage of your revenue) and marketing fees to the franchisor. These reduce your profit margins and are a contractual obligation regardless of your business’s performance.

- Less Autonomy and Creative Control: Franchises operate under strict guidelines and brand standards. This means less freedom to innovate or deviate from the established business model. For entrepreneurs who thrive on complete independence, this can be a significant limitation.

- Strict Contractual Obligations: Franchise agreements are legally binding documents that outline your responsibilities, operational procedures, and duration. Violating these terms can lead to serious consequences, including termination of your franchise agreement.

- Dependence on Franchisor Performance: Your business’s success is, to some extent, tied to the overall health and reputation of the franchisor’s brand. If the franchisor faces negative publicity or financial difficulties, it can impact your individual franchise, a risk factor beyond your direct control.

Key E-2 Visa Requirements for Franchise Investors

To successfully obtain an E-2 visa through a franchise investment, you must meet several strict eligibility criteria set by U.S. immigration law. We need to ensure that the chosen franchise fits neatly within these requirements.

- Treaty Country Nationality: First and foremost, you must be a national of a country that has a treaty of commerce and navigation with the United States. Without this, you are not eligible for an E-2 visa. We recommend you check the current treaty country list on the State Department website for eligibility.

- Substantial Investment: You must have invested, or be in the process of actively investing, a substantial amount of capital in a bona fide enterprise in the U.S. We’ll dive deeper into what “substantial” means shortly.

- Active Investment vs. Passive: The investment must be “at risk” and committed to the business. This means the funds must be unsecured and not merely deposited in a bank account. Crucially, the E-2 visa requires active involvement; it’s not for passive investors.

- 50% Ownership Rule: You must own at least 50% of the U.S. enterprise or possess operational control through a managerial position. The E-2 visa is about your direct involvement.

- Intent to Direct and Develop the Business: You must intend to enter the U.S. solely to develop and direct the investment enterprise. This means you’ll be actively involved in the day-to-day operations and strategic management, not just an absentee owner.

- Marginality Requirement: The enterprise must be more than “marginal.” This means it must have the present or future capacity to generate significantly more income than just a living for you and your family, or it must make a significant economic contribution, such as creating U.S. jobs.

- Job Creation for U.S. Workers: While not explicitly a minimum number, the business should ideally create jobs for U.S. citizens or permanent residents. This strengthens your application and demonstrates the economic benefit of your investment.

What is a ‘Substantial Investment’ for an E-2 Franchise?

One of the most frequently asked questions about the E-2 visa is: “How much money do I need to invest?” The answer is a bit nuanced because there’s no official minimum dollar amount. Instead, the investment must be “substantial” relative to the total cost of purchasing or establishing the business.

U.S. immigration uses a “proportionality test” to determine if an investment is substantial. This test considers the total cost of the business and the amount of capital you’ve invested. For example, investing $100,000 in a $120,000 business might be considered substantial, whereas investing the same amount in a $1 million business might not be.

While there’s no official minimum, most successful E2 applications involve investments of at least $100,000 to $150,000. This generally covers:

- Franchise Fee: The initial fee paid to the franchisor for the rights to operate the business.

- Equipment and Inventory: Costs for necessary operational equipment, initial stock, and supplies.

- Location Build-out/Leasehold Improvements: Expenses for preparing your physical location, if applicable.

- Working Capital: Funds to cover initial operating expenses (rent, utilities, salaries, marketing) until the business becomes profitable.

Many successful applicants invest between $200,000 and $500,000 to ensure they meet the substantial investment requirements while also providing adequate working capital for the business’s first year. An investment of $150,000 or more generally makes a stronger case for an E-2 visa than an investment below $100,000. This demonstrates a serious commitment to the U.S. economy and the viability of your enterprise.

E-2 Visa Benefits for Your Family

The E-2 visa also extends to eligible family members, allowing you to start this new chapter together:

- Dependent Visas for Spouse and Children: Your spouse and unmarried children under the age of 21 can obtain E-2 dependent visas, allowing them to live with you in the United States.

- Spouse Eligibility for Employment Authorization: E-2 spouses are eligible to apply for employment authorization (an EAD card), which allows them to work for any employer in the U.S. without restriction. This provides significant flexibility and additional income potential for your family.

- Children’s Access to U.S. Public Schools: Your children can attend U.S. public primary and secondary schools, providing them with quality education and opportunities to integrate into American society.

- Freedom to Travel: E-2 visa holders and their dependents can travel freely in and out of the U.S., allowing you to visit your home country or other destinations as needed.

How to Choose an E-2 Visa Franchise: A Step-by-Step Guide

The journey to finding the right E-2 visa franchise is a strategic process that combines self-assessment, meticulous research, and thorough due diligence. It’s not just about finding any franchise, but the ideal one that aligns with your goals and visa requirements. We guide you through this important Franchise Buying journey.

Step 1: Identify E-2 Visa-Friendly Franchise Industries

Not all industries are created equal for E-2 visa purposes. Some business models naturally align better with the visa’s requirements for active management, job creation, and substantial investment.

Here are some types of franchises generally considered suitable or ‘E-2 visa friendly’:

- Service-Based Franchises: These often have lower overheads than retail or food establishments, making them accessible. Examples include cleaning services (like OMEX or MaidThis), senior care (like Options for Senior America), and educational tutoring (like Amazing Athletes). The U.S. short-term rental market, for instance, is projected to exceed $103 billion by 2033, making property management a booming service sector. Service franchises often require lower initial investments, typically ranging from $75,000 to $250,000. Low-cost E-2 visa franchise opportunities, especially home-based or mobile service concepts, can range from $50,000 to $150,000.

- Business-to-Business (B2B) Services: Franchises that provide services to other businesses, such as consulting, marketing, or administrative support, can be excellent choices. They often require professional skills rather than extensive inventory. Consulting services, in particular, are viable E-2 visa business ideas, offering flexibility and potentially lower investment compared to traditional businesses.

- Home & Property Services: This broad category includes everything from home inspection and repair to landscaping and property management. With the U.S. short-term rental market reaching $42.1 billion in 2024, property management franchises (e.g., All County Property Management, with investment ranges of $72,450-$170,400) are becoming increasingly attractive.

- Children’s Education & Enrichment: Franchises focused on child development, sports, or educational programs (like Amazing Athletes, which can range from $58,000 to $91,000) tap into a consistent market demand.

- Senior Care: The aging global population means the senior care industry is experiencing continuous growth. With 8,000 to 10,000 Baby Boomers reaching retirement age daily, franchises like Options for Senior America (investment range $85,000 to $110,000) are highly advantageous due to high demand and recession-resistant growth.

- Insurance Agencies: Franchises like Estrella Insurance (investment range $49,950 to $84,000) have a robust business model and strong support networks, making them a favored option for E-2 investors.

Industries that are generally more challenging for E-2 visas include highly capital-intensive businesses (unless you’re investing significantly above the minimum threshold) or those that require minimal active management from the investor.

Step 2: Conduct Thorough Due Diligence

Once you’ve identified potential industries and specific franchise concepts, the real investigative work begins. This is where you roll up your sleeves and get to know the business inside and out.

- Reviewing the Franchise Disclosure Document (FDD): The FDD is a legal document that franchisors must provide to prospective franchisees. It contains 23 items of crucial information, including the franchisor’s history, fees, obligations, initial investment, and financial performance representations.

- Analyzing Item 19 (Financial Performance Representations): If the franchisor provides one, Item 19 offers insights into the earnings claims of existing franchisees. This is invaluable for projecting your potential profitability and ensuring the business can generate sufficient income to meet the “marginality” requirement.

- Speaking with Existing Franchisees (Validation Calls): This is arguably the most critical step. The FDD will provide a list of current and former franchisees. Reach out to several of them! Ask about their experiences with franchisor support, training, profitability, marketing, and overall satisfaction. Do their stories match the franchisor’s claims?

- Assessing Franchisor Support and Training Systems: A strong franchisor provides comprehensive training, ongoing operational support, and effective marketing assistance. This support is vital for your success, especially if you’re new to the U.S. market or the specific industry.

- Understanding All Fees: Beyond the initial franchise fee, be clear on all ongoing costs: royalties, marketing funds, technology fees, and any other regular payments.

- Checking Litigation History: Item 3 of the FDD will detail any past or current litigation involving the franchisor or its executives. This can be a red flag if there are recurring issues with franchisees.

Step 3: How to choose an E-2 visa franchise that aligns with your goals

After extensive research, it’s time to zero in on the franchise that’s the perfect fit for you. This involves a deep dive into your personal and professional aspirations.

- Matching the Franchise Model to Your Skills and Experience: While not always mandatory, having relevant business or industry experience can significantly strengthen your E-2 application and increase your chances of success. Choose a franchise where your skills are transferable, or where you have a genuine interest in learning the ropes. Many successful investors emphasize choosing franchises that match their skills and interests.

- Aligning with Personal Lifestyle Goals: Do you want a business that requires your presence 60+ hours a week, or one that offers more flexibility? Consider the work-life balance, the number of employees you’ll manage, and the overall demands of the business.

- Meeting Your Financial and Income Goals: Based on your due diligence, does the franchise have the realistic potential to generate the income you need to support your family and reinvest in the business, demonstrating that it’s “non-marginal”?

- Ensuring Territory Availability: Is the desired territory available, and does it have the demographic and economic characteristics to support your business? A good franchise consultant can help you analyze this.

- Evaluating Scalability and Long-Term Growth Potential: Think beyond the initial investment. Does the franchise offer opportunities for expansion (e.g., opening multiple units) or diversification, ensuring long-term viability and growth in the U.S.?

Preparing Your Application and Avoiding Common Pitfalls

Once you’ve identified your ideal E-2 visa franchise, the next phase is preparing a robust visa application. This is where meticulous documentation and strategic planning become paramount. The goal is to present a clear, compelling case to immigration officials that your investment is legitimate, substantial, and ready for success.

Crafting a Compelling E-2 Franchise Business Plan

Your business plan is the cornerstone of your E-2 visa application. It demonstrates to the U.S. government that your business is viable, substantial, and meets all E-2 requirements.

Here’s how a franchise business plan differs from a plan for an independent business and what it should include for an E-2 visa application:

- Leveraging Franchisor Data and Projections: Unlike a startup where you’re guessing, a franchise allows you to incorporate actual data from the franchisor’s FDD (especially Item 19) into your market analysis and financial projections. This provides a strong, credible foundation.

- Executive Summary: A concise overview of your business, your investment, and how it meets E-2 visa criteria.

- Company Description: Details about the franchise brand, its history, and its products/services.

- Market Analysis for Your Specific Territory: Don’t just copy the franchisor’s national data. Conduct detailed research on your chosen location, including demographics, competition, and local demand.

- Operational Strategies: How you plan to operate the business, adhering to franchisor guidelines, including staffing, marketing, and customer service.

- Management Structure and Your Active Role: Clearly outline your position, responsibilities, and how you will actively develop and direct the enterprise. This is crucial to avoid being seen as a passive investor.

- 5-Year Financial Forecast: This must include projected profit and loss statements, cash flow analyses, and balance sheets. Be realistic but demonstrate growth and profitability. Ensure it shows the business generating more than enough income to support you and your family.

- Job Creation Timeline: Detail how and when you expect to hire U.S. workers, showing your contribution to the American economy.

Common Reasons for Denial and How to Avoid Them

E-2 visa denials related to franchise investments often stem from specific issues that can be avoided with proper preparation:

- Insufficient Investment: Investing too little, or an amount that isn’t considered “substantial” relative to the business’s total cost. How to avoid: Aim for at least $100,000-$150,000, and ideally more ($200,000-$500,000), ensuring the funds are fully committed and at risk.

- Business Deemed “Marginal”: The business plan fails to convince officials that the enterprise will generate significant income beyond merely supporting you and your family, or that it won’t create jobs for U.S. workers. How to avoid: Develop a robust business plan with strong financial projections and a clear job creation strategy.

- Inadequate or Unrealistic Business Plan: A poorly researched, generic, or overly optimistic business plan that doesn’t reflect the specific franchise or market. How to avoid: Tailor your plan specifically to your chosen franchise and territory, using realistic data and projections.

- Unclear Source of Funds: Inability to clearly document the legal source of your investment funds. How to avoid: Maintain meticulous records tracing your investment funds from their origin to their commitment in the U.S. business.

- Appearing as a Passive Investor: Failing to demonstrate your clear intent to actively develop and direct the business. How to avoid: Emphasize your managerial role, responsibilities, and hands-on involvement in your business plan and during any interview.

- Not Meeting Basic Eligibility: Such as not being a national of a treaty country. How to avoid: Verify your eligibility at the very beginning of the process.

Frequently Asked Questions About E-2 Visa Franchises

Here are some common questions we hear from aspiring E-2 visa franchise investors:

Can I use a loan to finance my E-2 visa franchise investment?

Yes, but with significant caveats. The E-2 visa requires that your investment capital be “at risk.” This means it cannot be secured by the assets of the business being purchased. While some loans can be part of your investment, a substantial portion must generally come from your own unencumbered personal funds. Unsecured loans (like a personal loan not tied to the business assets) may qualify, but loans secured by the business’s future earnings or assets typically do not count towards the “at-risk” investment. Always consult with an immigration attorney to ensure your financing structure meets this critical requirement.

What happens if my franchise business fails?

If your franchise business fails, you may lose your E-2 visa status, as the visa is directly tied to your investment in and operation of that specific business. However, all is not necessarily lost. You may be able to invest in another qualifying business or franchise to maintain your status, provided you can demonstrate that the new investment meets all E-2 visa requirements. This underscores the importance of thorough due diligence before your initial investment to mitigate risk as much as possible. Consulting with an immigration attorney immediately if your business faces significant challenges is crucial for understanding your options.

Do I need prior business or franchise experience?

No, you do not strictly need prior business or franchise experience to qualify for an E-2 visa. Many franchisors provide comprehensive training programs specifically designed to equip new owners with the knowledge and skills needed to operate their business successfully. Immigration officials recognize that franchise systems are built to help inexperienced operators succeed with proper training and support.

However, having relevant business or management experience can certainly strengthen your E-2 visa application, as it demonstrates a proven ability to manage and lead. If you lack direct experience, highlight any transferable skills (e.g., leadership, sales, project management) in your business plan and during your visa interview to show your capability to develop and direct the enterprise.

Your Guided Path to U.S. Franchise Ownership

Starting on the E-2 franchise journey is more than just a business transaction; it’s a strategic path to a new life in the United States. This is why a guided, education-first process is so vital. It helps you steer the complexities of both franchise selection and immigration law with confidence.

We believe in the power of professional experts. A skilled immigration attorney is indispensable for ensuring your visa application meets all legal requirements. Alongside them, a knowledgeable franchise consultant plays a crucial role. If you’re wondering What is a Franchise Consultant?, think of us as your personal guide through the vast world of franchising.

At Main Entrance Franchise Consulting, we provide unbiased, personalized guidance at no cost to you. As certified IFPG franchise consultants, we offer education-first support, in-depth franchise matching, and a streamlined findy process. Our goal is to help you confidently choose a franchise aligned with your goals, budget, and lifestyle, and that meets the stringent E-2 visa requirements. We partner with hundreds of proven franchise brands and are compensated by franchisors, ensuring that our expert consulting and your guided franchise buying journey come with total transparency.

Don’t let the complexities of how to choose an e-2 visa franchise deter you from your American dream. With the right team and a clear strategy, your path to U.S. franchise ownership can be a smooth and successful one.

Ready to take the first step toward your American dream with confidence? Explore our E-2 Visa Franchise services to get started.