What Is Franchise Due Diligence and Why Should You Care?

Franchise due diligence support is the comprehensive research you must complete before buying a franchise. It’s your safety net, protecting you from costly mistakes and confirming that an opportunity matches your goals, budget, and lifestyle.

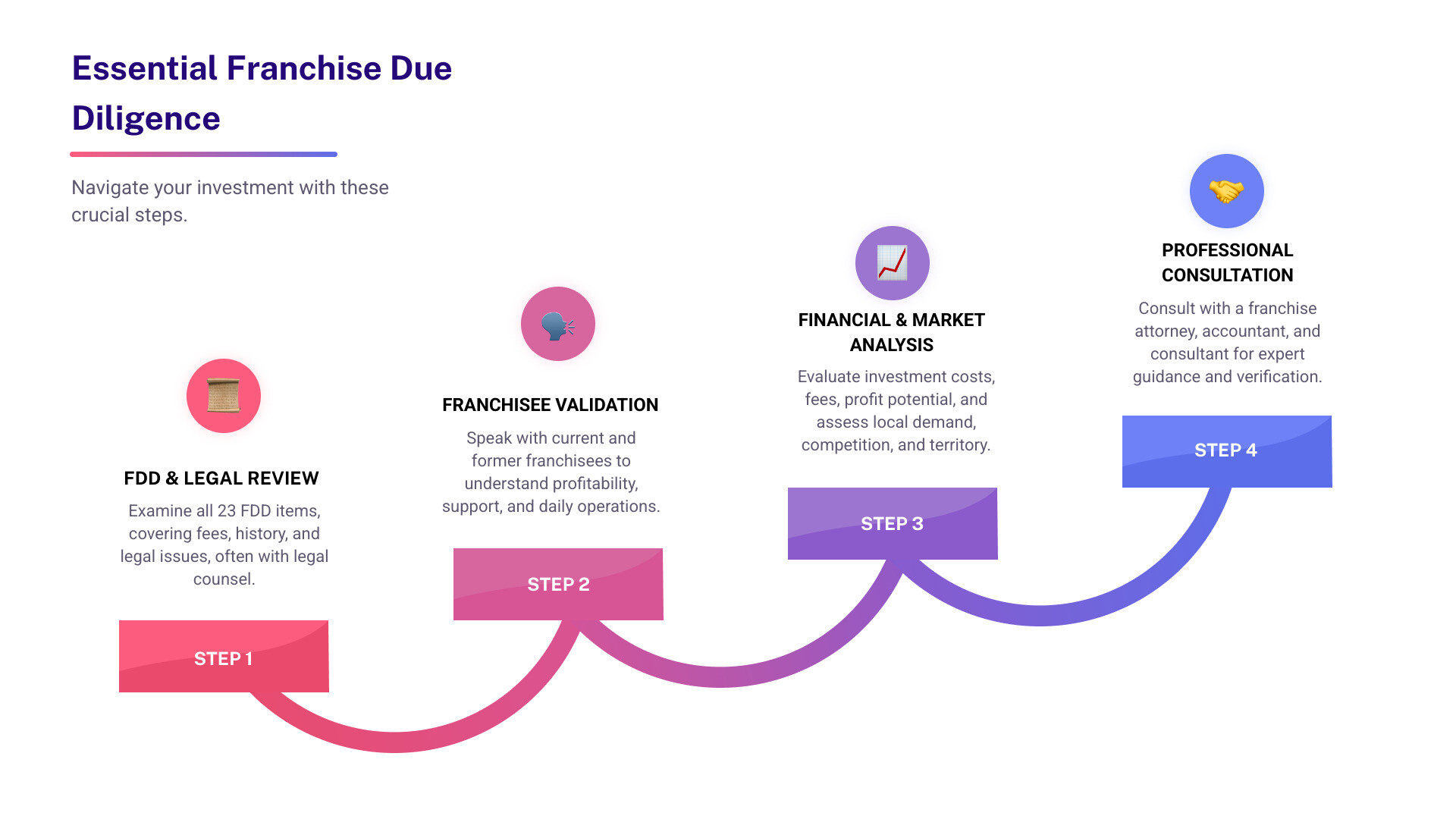

Here’s what franchise due diligence includes:

- Review the Franchise Disclosure Document (FDD) – Examine all 23 items, including fees, franchisor history, and legal issues

- Speak with current and former franchisees – Get real insights about profitability, support, and daily operations

- Analyze the financial investment – Understand initial costs, ongoing fees, hidden expenses, and profit potential

- Research the market and competition – Confirm there’s demand for the franchise in your target location

- Evaluate franchisor support – Assess training, ongoing assistance, and field consultant availability

- Consult professional advisors – Work with a franchise attorney, accountant, and consultant who specialize in franchising

Without thorough due diligence, you’re betting your investment—often $50,000 to $200,000 or more—on incomplete information. Since most franchise agreements last 10 to 20 years, a mistake can lead to a decade of regret. This process helps you identify risks, verify claims, and make a fact-based decision.

The good news? You don’t have to steer this process alone.

I’m Max Emma, a Certified Franchise Executive (CFE) and founder of Main Entrance Franchise Consulting. I’ve guided over 100 individuals through the franchise findy and franchise due diligence support process. Having built and franchised my own national firm, I understand how to evaluate a franchise from both sides—and I’m here to help you avoid common pitfalls.

The Essential Due Diligence Checklist: A Step-by-Step Guide

Starting on the journey of franchise ownership is exciting, but it demands a systematic investigation. Think of due diligence as detective work to paint a complete picture of your potential investment. This isn’t just about protecting your money; it’s about safeguarding your future. Let’s walk through the essential components of a robust franchise due diligence support process.

Deconstructing the Franchise Disclosure Document (FDD)

The Franchise Disclosure Document (FDD) is the most critical piece of your due diligence. Required by the Federal Trade Commission (FTC), this legal document contains 23 distinct items detailing the franchise system. You’ll have at least 14 days to review it before signing any agreements, and we encourage you to use this time wisely.

Here are some critical FDD items we’ll dive into together:

- Item 1: The Franchisor and Any Parents, Predecessors, and Affiliates: Provides background on the franchisor’s business experience and history, helping you understand the company’s foundation.

- Item 3: Litigation: Reveals past or present litigation involving the franchisor. A history of lawsuits with franchisees is a major red flag.

- Item 4: Bankruptcy: Discloses any bankruptcy filings by the franchisor or its leaders. Recent bankruptcies can signal financial instability.

- Item 5 & 6: Initial and Other Fees: Details the initial franchise fee and ongoing payments like advertising (often 2-4% of gross revenue) and technology fees.

- Item 7: Estimated Initial Investment: Provides a detailed breakdown of total startup costs, including real estate, equipment, and working capital, which is crucial for budgeting.

- Item 19: Financial Performance Representations (FPRs): If included, this section offers claims about potential earnings. These are not guarantees, but we can help you interpret these figures.

- Item 20: Outlets and Franchisee Information: Provides contact information for current and former franchisees—a direct line to real-world experiences for validation.

- Item 21: Financial Statements: Contains the franchisor’s audited financial statements, which are essential for assessing its financial health and stability.

- Item 22: Contracts: Lists all contracts you must sign, including the Franchise Agreement.

- Item 23: Receipts: The receipt page acknowledging you received the FDD.

We cannot stress enough the importance of thoroughly reviewing every section of the FDD. For more details, we recommend reviewing resources such as A consumer’s guide to buying a franchise.

Analyzing the Numbers: Investment, Fees, and Profitability

Understanding the financial side of a franchise is paramount. This involves a deep dive into all costs and a realistic assessment of potential profitability.

Here’s what we’ll carefully examine:

- Total Investment: As noted in Item 7 of the FDD, this covers everything from the initial franchise fee (often $50,000 to $200,000+) to real estate, equipment, and working capital.

- Ongoing Fees: These include royalties (typically 4-8% of gross revenue) and advertising fees (often 2-4% of gross revenue).

- Hidden Costs: We’ll help you uncover less obvious costs, such as technology fees, training expenses, insurance, and professional services.

- Profitability Potential: If available in Item 19, we’ll analyze Financial Performance Representations (FPRs) and cross-reference them with franchisee feedback. We’ll also help you create a break-even analysis and build financial models to project cash flow and set realistic profitability expectations.

Neglecting financial analysis is a common and costly mistake. We’ll ensure you have a clear picture of the financial commitment and potential rewards.

Talking to the Real Experts: Current and Former Franchisees

While the FDD provides the official story, franchisees offer the real-world narrative. Their experiences are invaluable for your franchise due diligence support process. Item 20 of the FDD provides their contact information, and we encourage you to speak with as many as possible.

Here’s how we’ll guide you through this crucial step:

- Preparing Questions: We’ll help you craft a comprehensive list of questions covering profitability, franchisor support, daily operations, work-life balance, and overall satisfaction.

- Asking the Key Question: We’ll encourage you to ask: “With the knowledge you have today, would you still invest in this franchise?”

- Validating the Experience: During these calls, you can verify the quality of franchisor support, from training to marketing. Speaking with former franchisees is also critical, as they can offer candid insights into why they left the system—high turnover is a major red flag. As you speak with multiple people, look for recurring positive or negative themes, as these often reflect the system’s true strengths and weaknesses.

These conversations are your opportunity to get unbiased feedback and identify potential red flags not found in official documents.

Investigating the Franchisor’s Health and Reputation

Beyond the numbers, understanding the franchisor’s overall health and reputation is vital. You’re not just buying a business; you’re partnering with a brand.

We’ll help you assess:

- Brand Reputation: We’ll guide you through online reviews, media coverage, and social media to understand public perception.

- System Growth: The FDD shows whether the franchise system is growing or shrinking. A shrinking system could indicate underlying problems.

- Leadership Team: We’ll look into the experience, stability, and vision of the franchisor’s key players.

- Litigation History: Revisit Item 3 of the FDD. Recurring lawsuits, especially from franchisees, warrant serious investigation.

- Company Culture: The franchisor’s culture—whether supportive or demanding—will significantly impact your experience.

- Financial Stability: We’ll help you look for signs of financial strength that ensure the franchisor can continue to support its network.

For a deeper level of investigation, especially for larger investments, it’s possible to go beyond typical database checks. This might include more comprehensive background checks on leadership to get a more accurate view of their legal and financial history. This level of inquiry, while not always necessary, highlights the depth of research possible.

Assessing Your Market and Competitive Landscape

Even a great franchise can struggle in the wrong market. Thorough market research is essential to confirm viability.

We’ll help you consider:

- Local Demand: Is there a need for the franchise’s products or services in your area? We’ll help you analyze demographics and consumer behavior. Your local SBDC can be a valuable resource.

- Target Demographic: Does your location have enough of the franchisor’s ideal customers?

- Competitor Analysis: Who are your competitors, and how will your franchise stand out?

- Territory Rights: Item 12 of the FDD details your territory rights. An exclusive territory is a significant advantage.

- Future Growth Potential: Is the industry growing? How might technology impact it?

- Real Estate: The availability and cost of suitable real estate can significantly impact your investment and operational costs.

This market intelligence helps confirm that your chosen location offers the best chance for success.

Evaluating Franchisor Support and Training Systems

A key advantage of franchising is the proven system and support you receive. We’ll help you assess the quality of this crucial aspect of franchise due diligence support.

We’ll look into:

- Initial Training Program: What does the initial training cover? Does it include business management, hands-on practice, and online modules?

- Ongoing Support: What kind of assistance can you expect, such as field consultants, operational guidance, and marketing support?

- Marketing Assistance: What is the franchisor’s market introduction program, and do they provide local marketing support?

- Technology Systems: What software does the franchisor provide? Is it up-to-date and user-friendly?

- Peer Support Networks: Does the system foster a sense of community through Franchise Advisory Councils (FACs) or other groups?

- Responsiveness: How quickly does the franchisor respond to franchisee issues? Validation from current franchisees is key here.

The level of support directly impacts your ability to succeed. Working with a Certified Franchise Executive (CFE) like Max Emma means you’re guided by someone who understands franchisor support systems. Learn more about the Advantages of Working with a Certified Franchise Executive (CFE).

How Main Entrance Franchise Consulting Supports Your Franchise Due Diligence

Navigating franchise due diligence can feel like a full-time job. Main Entrance Franchise Consulting offers comprehensive franchise due diligence support to simplify this process, provide clarity, and ensure you make a confident, informed decision. Our guidance is unbiased and comes at no cost to you, as we are compensated by franchisors for successful placements.

The Role of Franchise Due Diligence Support in Legal Review

The Franchise Agreement is a binding legal contract for the next 10 to 20 years. It’s critical to have an expert review this document.

While we are not attorneys, our franchise due diligence support includes:

- Franchise Attorney Referrals: We connect you with experienced franchise attorneys. Franchise law is a niche specialty, and a good franchise lawyer should save you more money than their legal fees.

- Understanding Legal Obligations: We help you understand common clauses like non-compete clauses, termination rights, and renewal options.

- Identifying Areas for Negotiation: While many terms are standardized, due diligence can sometimes identify areas for negotiation, such as territorial rights. Expert legal counsel is key to understanding what’s possible.

We ensure you understand the legal framework of your investment before you sign.

Leveraging Financial Analysis and Guidance

Analyzing financial data is a cornerstone of effective franchise due diligence support. We help you build realistic financial expectations and verify the franchisor’s health.

Our franchise due diligence support helps you with:

- Financial Statement Review: We guide you through the franchisor’s audited financial statements (Item 21 of the FDD) to assess their stability.

- Creating Realistic Projections: We work with you to develop cash flow projections for your specific location to understand your potential return on investment.

- Verifying Franchisor Claims: We help you cross-reference any Financial Performance Representations (FPRs) with real-world franchisee experiences.

- Exploring Financing Options: We can connect you with trusted lenders who specialize in franchise financing, including SBA loans and 401(k) rollovers.

A franchise consultant’s expertise is invaluable here. Find more about What is a Franchise Consultant?.

Improved Franchise Due Diligence Support with Main Entrance

For larger investments or multi-unit opportunities, an improved level of investigation is often warranted.

Our franchise due diligence support can extend to:

- In-depth Research and Background Checks: We can guide you to resources for more rigorous background checks on the franchisor’s leadership, offering a clearer view of their legal and financial history.

- Verifying Credentials: This includes verifying employment, education, and professional licensing of the franchisor’s key personnel.

- Guidance for Complex Opportunities: The due diligence for acquiring an existing franchise or multi-unit opportunities is more complex. It involves deeper analysis of unit-level performance, market competitiveness, and organizational structure. We provide insights for these scenarios to help you assess KPIs and franchisee satisfaction.

- Custom Solutions: Our support is custom to your specific needs, budget, and the complexity of the opportunity you’re considering.

This improved franchise due diligence support is recommended when you need a deeper layer of confidence and risk mitigation.

Common Mistakes and Red Flags to Avoid

Even with the best intentions, it’s easy to stumble during the due diligence process. We’ve seen many prospective franchisees make common mistakes that can lead to regret. Here are some pitfalls we’ll help you steer clear of:

- Rushing the Decision: Don’t rush into a franchise investment without conducting thorough due diligence. Take the time to gather information, analyze data, and assess the opportunity carefully. Slow and steady wins the race.

- Emotional Buying: Falling in love with a concept or a brand without doing your homework is a recipe for disaster. Base your decision on facts and thorough research, not just excitement.

- Ignoring Red Flags: Sometimes, the hardest thing to do is walk away from an opportunity that initially seemed promising. If you uncover persistent issues—like excessive franchisee turnover, repeated litigation, or a lack of support—don’t ignore them. These are warning signs.

- Neglecting Financial Analysis: Failing to analyze the financial aspects of the franchise can lead to unexpected financial challenges. Carefully review the franchise’s financial documents and projections before making a decision.

- Skipping Legal Counsel: Attempting to review and understand the complex legal language of the FDD and Franchise Agreement without the help of a specialized franchise attorney is a major risk.

- Overlooking Franchisee Feedback: Not speaking with enough current and former franchisees, or not asking the right questions, means missing out on invaluable real-world insights.

- Unrealistic Expectations: Believing every claim or projection made by the franchisor without independent verification can lead to disappointment. Franchisors are prohibited by regulation from evaluating a franchisee’s financial plan before signing the agreement, so it’s up to you to verify.

- High-Pressure Sales Tactics: Be wary of franchisors who pressure you to make a quick decision or discourage you from consulting with professionals. A reputable franchisor will welcome your thorough due diligence.

- High Franchisee Turnover: If Item 20 of the FDD shows a significant number of franchisees leaving the system, it’s a serious red flag that needs investigation.

Frequently Asked Questions about Franchise Due Diligence

How long does franchise due diligence take?

The timeline for franchise due diligence support can vary depending on the complexity of the opportunity and your personal pace. Typically, the entire franchise buying process, including due diligence, may take anywhere from a few weeks to a few months. This allows ample time to review the FDD, speak with franchisees, conduct market research, and consult with your professional advisors. Rushing this process is a common mistake we help our clients avoid.

What is the single most important part of due diligence?

While every component of due diligence is crucial, we believe that speaking with current and former franchisees (franchisee validation) stands out as the single most important part. The FDD provides the legal and financial framework, but franchisees offer the unfiltered, real-world perspective on profitability, franchisor support, daily operations, and the overall health of the system. Their insights can either confirm the opportunity’s viability or reveal critical red flags not found in any document.

Can I negotiate the terms of the Franchise Agreement?

Franchise agreements are largely standardized legal documents, and franchisors often state that they are non-negotiable. However, with thorough franchise due diligence support and the assistance of an experienced franchise attorney, there can be opportunities for negotiation on certain terms. These might include specific territorial rights, renewal options, or minor operational details that don’t alter the core franchise system. It’s important to have realistic expectations and expert legal counsel to guide you on what is truly negotiable and what is not.

Your Next Step: Turn Diligence into a Confident Decision

Franchise due diligence isn’t just a hurdle to clear; it’s a journey of findy that empowers you to make one of the most significant investment decisions of your life with confidence. By systematically researching, analyzing, and questioning, you gain clarity, build conviction, and ultimately increase your chances of long-term success as a franchise owner.

We at Main Entrance Franchise Consulting are here to guide you through every step of this process. From helping you understand your personal fit for franchise ownership to connecting you with the right opportunities and providing comprehensive franchise due diligence support, we ensure you have all the tools and expertise you need. Our goal is to transform what can be an overwhelming process into a clear, supported pathway to your entrepreneurial dreams.

Ready to explore franchise opportunities with expert guidance? Let’s turn your diligence into a confident decision. Learn more about our Franchise Buying Services and how we can support your journey.