Why Choosing The Right Franchise Matters More Than Ever

How to Choose The Right Franchise is one of the most important decisions you’ll make as an entrepreneur. With over 770,000 franchised businesses operating across the United States and the franchise sector projected to contribute $827.4 billion to the economy in 2024, the opportunities are massive—but so are the risks.

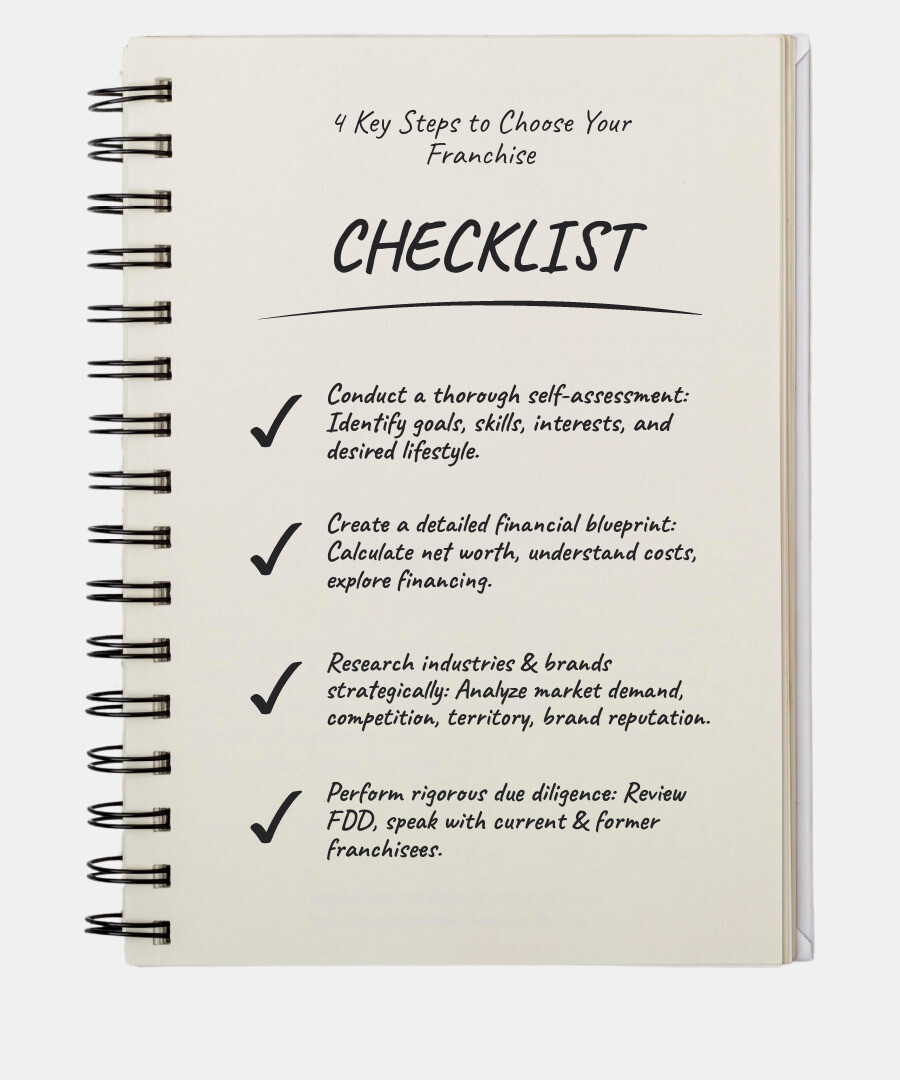

Here’s how to choose the right franchise in 4 key steps:

- Conduct a thorough self-assessment – Identify your goals, skills, interests, and desired lifestyle before exploring brands

- Create a detailed financial blueprint – Calculate your net worth, understand all costs (startup and ongoing), and explore financing options

- Research industries and brands strategically – Analyze market demand, competition, territory availability, and brand reputation

- Perform rigorous due diligence – Review the Franchise Disclosure Document (FDD) and speak directly with current and former franchisees

The U.S. franchise sector is growing by 2.1% in 2024 and will support 10.5 million jobs. But choosing the wrong franchise can cost you hundreds of thousands of dollars and years of your life. That’s why a structured, informed approach is essential.

Unlike starting a business from scratch, franchising offers a proven business model, established brand recognition, and ongoing support. But not all franchises are equal, and what works for one person might be completely wrong for another.

The difference between success and failure often comes down to alignment—choosing a franchise that matches your personal goals, financial capacity, skills, and lifestyle preferences. It’s not just about finding a profitable brand; it’s about finding your brand.

This guide will walk you through each step of the franchise selection process, from self-findy to signing the franchise agreement. You’ll learn what questions to ask, which red flags to watch for, and how to validate every claim a franchisor makes.

I’m Max Emma, a Certified Franchise Executive (CFE) and founder of Main Entrance Franchise Consulting, and I’ve spent decades helping individuals learn how to choose the right franchise that aligns with their goals and lifestyle. Through my work with over 100 franchise brands and countless aspiring franchisees, I’ve seen what makes the difference between a fulfilling, profitable venture and a costly mistake.

Step 1: Start with Self-Findy to Find Your Perfect Fit

Before we even begin looking at franchise opportunities, we need to look inward. The most successful franchisees are those whose businesses align with their personal aspirations, skills, and even their quirks! This isn’t just about finding a business; it’s about finding a business that fits you.

What are your personal goals and motivations for buying a franchise? Are you seeking more career control, a flexible schedule, or a path to building generational wealth? Perhaps you’re driven by a passion to help others, like the Christian Brothers Automotive franchise owner who started “Mechanics on a Mission” to provide free auto repairs to those in need. Understanding your core motivations is the first step in learning how to choose the right franchise.

We encourage you to reflect on The 4 Freedoms That Motivate Successful Franchise Owners to clarify what truly drives you. Is it freedom from the 9-to-5, financial freedom, freedom of purpose, or freedom of relationship?

What industry or type of business are you passionate about and have expertise in? While you don’t need to be an expert in the specific field (that’s what the franchisor’s system and training are for!), genuine interest makes the journey much more enjoyable. As one expert put it, “You’ll want to enjoy what it is you’re doing!” Whether it’s coffee, fitness, education, or home services, choose something that resonates.

What are your strengths and weaknesses as a business owner? Be honest with yourself. Are you a natural leader, a meticulous organizer, a sales dynamo, or a marketing whiz? Franchising allows you to leverage your strengths and delegate or outsource tasks where you’re less proficient. For example, if you excel at management but dread sales, you might look for a franchise with robust marketing support.

What level of involvement do you want to have in the day-to-day operations of the business? Some franchises are owner-operated, demanding your full-time presence, while others can be manager-run, allowing for a more semi-absentee role. This decision significantly impacts your lifestyle and how much time you’ll dedicate to the business.

Does the franchise align with your long-term financial and retirement goals? For many, franchising isn’t just a job; it’s an investment in the future. Some owners, like the Mathnasium franchise owners who view their investment as generational, plan for their children to eventually take over. Consider if the franchise offers scalability, multi-unit ownership potential, or a clear exit strategy to meet your retirement aspirations.

By asking these tough questions upfront, we narrow the field considerably, ensuring that the franchises we explore are a genuine fit for your unique profile.

Step 2: Create Your Financial Blueprint

Now that we have a clearer picture of your personal aspirations, it’s time to get down to brass tacks: money. Understanding your financial capacity is critical for how to choose the right franchise that fits your budget without undue strain.

What is your available investment budget, including initial costs and ongoing expenses? This is perhaps the most practical question. The average startup costs for a franchise can range dramatically, from as low as $10,000 for some home-based or mobile concepts to as high as $5 million for large-scale operations. However, most fall between $100,000 and $300,000.

First, calculate your net worth, including all your assets and available liquid capital (cash, stocks, easily convertible assets). Franchisors typically have minimum net worth and liquidity requirements. For instance, Scooter’s Coffee requires a net worth of $500,000 and at least $250,000 in liquidity.

Next, factor in the estimated startup costs. These include:

- Franchise fees: This is the initial payment to the franchisor for the right to use their brand and system.

- Equipment & inventory: Costs for necessary tools, machinery, and initial stock.

- Working capital: Funds needed to cover initial operating expenses (rent, utilities, salaries) before the business becomes profitable. This is often overlooked but crucial.

Then, consider the ongoing costs:

- Royalties: A percentage of your gross revenue paid to the franchisor, typically between 4% and 12%.

- Advertising fees: Contributions to a national or regional marketing fund.

- Supply chain expenses: Costs for purchasing goods or services, sometimes from franchisor-approved vendors who may have set markups.

Securing financing is a key part of this step. While some franchisors offer financing options, many franchisees rely on external sources. The Small Business Administration (SBA) offers various loan programs, such as SBA loans, that can help cover startup costs and provide working capital. You can review the SBA financial requirements and estimated investment costs to see what options might be available to you.

Don’t forget to account for your personal living expenses during the startup phase. It can take time for a new franchise to generate enough income to pay you a salary, so having a reserve is vital. Some franchises, like Our Town America, are attractive due to their low cost of entry and scalability, offering more financial flexibility.

Step 3: How to Choose The Right Franchise Industry and Brand

With your personal and financial landscapes clearly defined, we can now dive into the exciting world of industries and brands. This is where we match your profile to a viable business opportunity, ensuring that how to choose the right franchise is an informed, data-driven decision.

Researching industries and market demand analysis: Not all industries are created equal, and consumer preferences are constantly shifting. We’ll investigate current market trends, local demographics, and consumer demands for the products or services a franchise offers. For example, a franchise that’s willing to adapt to the latest trends has a better chance of sustainability.

To assess market demand effectively, we use resources like US Census Data. This allows us to evaluate a population’s age, income levels, lifestyle, and preferences, giving us insight into whether a location is a good fit for your franchise. Imagine opening a senior care franchise in an area with a booming young population – probably not the best fit!

Competition analysis: While a little competition can be healthy, too much can stifle growth. We’ll examine the local competitive landscape, assessing existing businesses’ strengths, weaknesses, prices, and services. Tools like Google Maps and Yelp can offer valuable insights here.

Territory availability and growth potential: A fantastic franchise concept is useless if there’s no available territory in your desired area. We’ll confirm what areas are open and how the franchisor plans for growth within those territories. Additionally, we’ll look for cities with steady population growth, reviewing long-range development plans through resources like the US Census Website to predict future success. This foresight is crucial for long-term viability.

Brand reputation and franchisor’s track record: A strong brand is a major advantage in franchising. We’ll investigate the franchisor’s overall reputation, looking at customer reviews, industry accolades, and testimonials. We also need to assess the franchisor’s track record—how long have they been in business? What is their history of franchisee success?

Attending franchise expositions or industry events, such as the International Franchise Association’s annual conference, can be an excellent way to meet franchisors, compare opportunities, and get a feel for different brands.

We’ve seen inspiring examples of franchisees, like the Wild Birds Unlimited owner, who after just a year and a half, is already looking to grow past their current location and aims to own five stores. This kind of growth potential is what we look for when matching you with opportunities.

Step 4: Conduct Your Due Diligence with the FDD

This is the most critical step in how to choose the right franchise and where we roll up our sleeves. The Franchise Disclosure Document (FDD) is your bible. It’s a comprehensive legal document that, by U.S. law, every franchisor must provide to prospective franchisees at least 14 days before you sign any contract or pay any money. This “14-day rule” is designed to give you ample time for thorough review.

The FDD contains 23 items that detail virtually everything you need to know about the franchisor, the franchise system, and your obligations. Think of it as a detailed roadmap, albeit one written in legal jargon. For a deeper understanding of this crucial document, we recommend reviewing A Consumer’s Guide to Buying a Franchise.

How to Choose The Right Franchise by Analyzing the FDD

We’ll guide you through the most important sections of the FDD:

- Item 3: Litigation History: This section reveals any past or current lawsuits involving the franchisor or its executives. Frequent litigation can be a red flag, indicating potential issues with the business model or franchisor-franchisee relations. It’s a unique insight into assessing brand reputation.

- Item 4: Bankruptcy: This item discloses any bankruptcies involving the franchisor or its key personnel. A history of financial instability is a serious concern.

- Items 5-7: Initial & Ongoing Costs: These items detail all the money you’ll be expected to pay, both upfront and continuously. This includes the initial franchise fee, estimated total investment (equipment, build-out, working capital), and ongoing fees like royalties and advertising contributions. Understanding these figures is crucial to align with your financial blueprint.

- Item 11: Franchisor’s Obligations (Training & Support): This outlines the training programs, ongoing support, and assistance the franchisor commits to providing. We want to see robust, comprehensive support that covers initial setup, marketing, operations, and continuing education. What kind of training and ongoing support does the franchisor provide to franchisees? This item will tell us.

- Item 17: Renewal, Termination, & Transfer: This section details the terms under which your franchise agreement can be renewed, terminated, or transferred. Pay close attention to these clauses, as they define your long-term commitment and exit strategies. Franchise agreements can last up to 10 years, sometimes up to 20 years, so understanding these terms is vital.

- Item 19: Financial Performance Representation (FPR): This is often the most eagerly anticipated section, as it may provide earnings claims or financial performance data for existing franchises. Franchisors are not legally required to provide an FPR, but if they do, it must be substantiated. We’ll help you analyze this data carefully, considering the sample size, averages, and geographical relevance, and how it compares to actual franchisee performance.

- Item 20: Franchisee Turnover & Contact List: This item provides a statistical overview of the franchise system, including the number of operating units, closures, transfers, and terminations over the past three fiscal years. It also provides a list of current and former franchisees. This is golden information.

Beyond the Document: Speaking with Franchisees

While the FDD provides the facts, talking to existing and former franchisees brings the information to life. This is arguably the most valuable part of your due diligence.

Why you must talk to current owners: They offer real-world insights into the day-to-day operations, the franchisor’s responsiveness, the effectiveness of training, and the actual returns on investment. They can tell you about unexpected costs, challenges, and the true culture of the system. We encourage you to ask: “Would you do it again?” and “Has the company provided adequate training and support?”

Questions to ask franchisees:

- What’s a typical day like?

- Were there any unexpected startup costs?

- How well did the franchisor’s training prepare you?

- How satisfied are you with the ongoing support?

- What is the true relationship between franchisees and the franchisor?

- What are the biggest challenges you face?

- What are the typical earnings you’re seeing?

Contacting former franchisees: Item 20 also lists franchisees who have left the system. While they might be harder to reach, their perspective can be invaluable, offering insights into potential pitfalls or reasons for leaving.

Validating the FDD information: Cross-reference what you read in the FDD with what franchisees tell you. This helps ensure transparency and confirms that the franchisor’s claims align with reality.

Understanding the culture: Beyond numbers, you’re joining a community. Do the franchisees seem happy and supported? Is there a collaborative spirit, or do they feel isolated? This cultural fit is crucial for your long-term satisfaction.

Frequently Asked Questions About Choosing a Franchise

We often get asked similar questions by aspiring franchisees. Here are some of the most common ones we address during the process of how to choose the right franchise:

What are the benefits of buying a franchise?

Franchising offers a unique blend of independence and support, making it an attractive option for many entrepreneurs.

- Proven Business Model: You’re investing in a system that has already been tested and refined.

- Brand Recognition: Instant recognition can significantly reduce the marketing effort needed to attract customers.

- Built-in Marketing: Franchisors often provide national and local marketing strategies and materials.

- Established Supply Chain: Access to vetted suppliers, often with bulk purchasing power, can reduce costs and simplify operations.

- Training & Support Systems: Comprehensive initial training and ongoing support help you get up to speed quickly and steer challenges.

How much does it cost to start a franchise?

The investment range for a franchise is incredibly broad. While the average startup costs for a franchise can range from $100,000 to $300,000, some can be as low as $10,000 (often mobile or home-based businesses) or as high as $5 million (for large-scale operations like hotels or major restaurants).

Factors influencing the cost include:

- Industry: Service-based franchises generally have lower overhead than brick-and-mortar retail or food establishments.

- Business Model: Home-based or mobile franchises typically cost less than those requiring a physical location.

- Territory: Larger or more exclusive territories can command higher fees.

- Build-out: The cost of renovating or constructing a physical space can be a significant portion of the total investment.

How to choose the right franchise agreement terms?

The franchise agreement is a legally binding contract outlining the relationship between you and the franchisor. It’s crucial to understand every clause, and we always recommend having an experienced franchise attorney review it.

Key terms to consider include:

- Contract Length: Franchise agreements typically last for 10 years, though some can extend up to 20 years. This is a long-term commitment!

- Renewal Clauses: Understand the conditions for renewing your agreement at the end of the term. Are renewals guaranteed? Will the terms change?

- Termination Conditions: What actions could lead to the franchisor terminating your agreement, and what are your rights if that happens?

- Transfer Rights: If you decide to sell your franchise, what are the franchisor’s rules and restrictions regarding transferring ownership?

- Dispute Resolution: How are disagreements between you and the franchisor handled? Is it through mediation, arbitration, or litigation?

Your Path to Confident Franchise Ownership

Congratulations! You’ve steerd the complex journey of how to choose the right franchise with a structured, systematic approach. We’ve explored self-assessment, financial planning, market research, and the critical due diligence of the FDD. By following these steps, you’re not just buying a business; you’re making an informed investment in your future.

The value of this systematic approach cannot be overstated. It helps you avoid common pitfalls like choosing a brand based solely on popularity, underestimating the importance of franchisor support, or going it alone without proper guidance.

This is where professional guidance truly shines. We believe in providing education-first support because the more informed you are, the better decisions you’ll make. If you’re feeling overwhelmed by the sheer volume of information or simply want an expert in your corner, consider partnering with a franchise consultant. What is a Franchise Consultant? A good consultant acts as your unbiased guide, helping you clarify your goals, explore suitable opportunities, and steer the entire process.

As a certified IFPG franchise consultant, I, Max Emma, am dedicated to helping individuals like you find and buy the right franchise through unbiased, personalized guidance — at no cost to you. We partner with hundreds of proven franchise brands, and our compensation comes from the franchisors, allowing you to receive expert consulting and a guided franchise buying journey with total transparency. Working with a Certified Franchise Executive (CFE) like me offers advantages of working with a Certified Franchise Executive (CFE) as we bring a deep understanding of the industry and ethical practices.

Your journey to confident franchise ownership begins now. Take the next step with confidence, armed with knowledge and support. We invite you to explore our comprehensive framework and find your ideal franchise opportunity.