Why Choosing the Right Franchise Is Your Most Important Business Decision

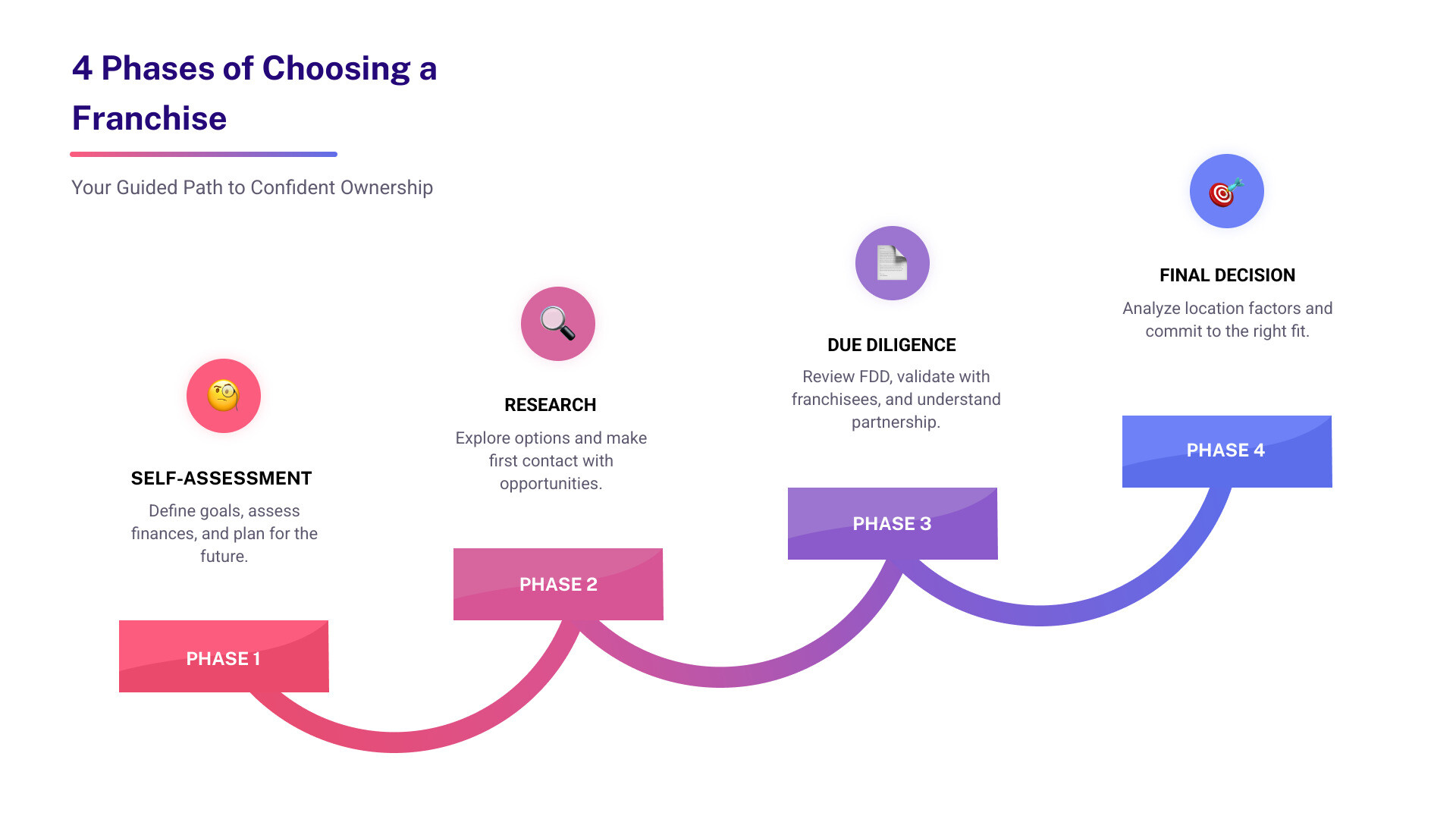

The best way to choose a franchise is to follow a structured, step-by-step evaluation process that aligns your personal goals, financial capacity, and lifestyle preferences with the right franchise opportunity. Here’s the quick framework:

- Assess yourself first – Define your goals, skills, budget, and work style

- Research systematically – Explore industries and brands that match your profile

- Analyze the numbers – Review the Franchise Disclosure Document (FDD) and Item 19 earnings data

- Talk to franchisees – Validate claims by speaking with current and former owners

- Evaluate support systems – Understand training, marketing, and operational assistance

- Assess location factors – Analyze demographics, competition, and territory rights

- Review legal obligations – Understand the franchise agreement terms and restrictions

- Calculate total investment – Account for all upfront and ongoing costs

- Attend Findy Day – Meet the franchisor team and experience the culture

- Make an informed decision – Balance data, intuition, and expert guidance

Franchising offers a proven path to business ownership. Unlike starting from scratch, you get an established brand, operational playbook, and support system. But not all franchises are created equal.

The franchise sector contributed $827.5 billion to U.S. GDP in 2021 and supported 8.5 million jobs. Franchise businesses are 5 times more likely to succeed than independent startups, and over 75% of franchisees report being profitable.

Yet these impressive statistics don’t guarantee your success. The wrong franchise can drain your savings, consume your time, and leave you trapped in a business that doesn’t fit your life.

The real challenge isn’t finding a franchise – it’s finding the right one.

With thousands of franchise opportunities across dozens of industries, the selection process can feel overwhelming. How do you know if a franchise is financially viable? What questions should you ask current owners? How do you spot red flags in a Franchise Disclosure Document? When should you trust your gut versus the data?

This article breaks down the best way to choose a franchise into ten manageable steps across four clear phases. You’ll learn how to assess your personal readiness, research opportunities systematically, conduct deep due diligence, and make a final decision with confidence.

I’m Max Emma, a Certified Franchise Executive and founder of Main Entrance Franchise Consulting who has guided hundreds of individuals through the best way to choose a franchise that aligns with their unique goals and circumstances. My experience as both a franchisor and franchisee gives me insider perspective on what truly matters in this life-changing decision.

Phase 1: Building Your Personal Franchise Framework (Steps 1-3)

Laying the Groundwork: The best way to choose a franchise starts with you

Before diving into the vast sea of franchise opportunities, the best way to choose a franchise is to start with an honest self-assessment. This is about understanding what truly drives you and what kind of business owner you aspire to be. We encourage you to ask yourself:

- What are your personal goals and motivations? Are you seeking more control over your career, a flexible schedule, or a chance to build something tangible? Reflect on The 4 Freedoms That Motivate Successful Franchise Owners to clarify your aspirations.

- What industries or sectors genuinely interest you? Aligning with your passions can lead to long-term satisfaction and commitment. Do you envision yourself in a service-based business, retail, or perhaps a niche market?

- What role do you envision yourself playing day-to-day? Will you be an owner-operator, deeply involved in daily tasks, or do you prefer a more managerial role, overseeing staff and operations? Your comfort level with direct involvement is crucial.

- What are your core strengths and weaknesses? How can these be leveraged or mitigated within a franchise model? If you’re great with people but less so with numbers, a franchise with strong operational support might be a better fit.

- Are you good at following rules? Franchising is inherently a system-driven business. If you thrive on independent innovation, you might find the structured nature of a franchise challenging.

- Will you be working full-time or easing into it? Some franchises allow for semi-absentee ownership, while others demand your full attention from day one. This impacts your lifestyle and financial planning.

This introspection is a critical first step, ensuring that any potential franchise aligns with your deepest desires and practical realities.

Aligning Your Finances with Your Ambition

Once you understand your personal fit, the next crucial step in finding the best way to choose a franchise is to assess your financial landscape. This isn’t just about how much you have, but how much you’re willing to invest and what your financial objectives are.

- What is your realistic investment budget? This includes not just the upfront costs like initial franchise fees and equipment, but also ongoing expenses such as royalties, marketing contributions, and working capital to sustain operations until profitability. The average initial investment for a franchise can range from $10,000 to over $1 million, with many falling between $100,000 and $300,000.

- How much capital are you willing and able to invest, and what is your risk tolerance? We help you calculate your net worth, including savings, assets, and available credit, to determine your true financial capacity.

- What is your current financial situation, and what are your future earning objectives? Are you looking for steady, gradual growth, or potentially quicker returns on a larger investment? The typical profit margin for a franchise is between 4% and 12% of gross revenue, but this can vary significantly by industry and location.

- Will you require financing, and if so, how much? Understanding your capital needs early allows us to explore various financing options, such as SBA loans or portfolio-based funding.

- What is the realistic income potential during the first and subsequent years of operation for the franchises you are considering? We emphasize understanding profit, not just revenue, as a high-grossing business can still have low net income.

A clear financial picture ensures you target opportunities that are not only exciting but also financially feasible and aligned with your wealth-building goals.

Planning Your Future: Retirement and Succession

Franchise ownership can be more than just a business venture; it can be a cornerstone of your long-term financial and retirement planning. We encourage our clients to think ahead:

- When do you plan to retire, and how much income will you need during retirement? This helps us identify franchises that offer stable income potential or the opportunity to build significant equity.

- Does the franchise system offer succession planning as part of its support programs? Some franchise systems, like Mathnasium, encourage a generational approach, with owners planning for their children to eventually take over. This can be a powerful way to build lasting family wealth.

- Are you considering investing in multiple units to improve retirement savings? Multi-unit ownership can accelerate wealth accumulation and provide a diversified income stream.

- Does the franchise have a proven track record of providing steady income suitable for retirement planning? Industries like senior care or financial services often align well with demographic trends that support long-term stability for retirement-focused investors.

By integrating your retirement and legacy goals into your franchise selection, you’re not just buying a job; you’re building a future.

Phase 2: Navigating the World of Franchise Opportunities (Steps 4-5)

How to Systematically Search for Your Franchise Fit

With your personal and financial framework established, it’s time to explore the market. The best way to choose a franchise involves a systematic approach to finding opportunities that align with your unique profile.

- Exploring franchise options: There are thousands of franchise brands in the United States across virtually every industry. We help you cut through the noise by focusing on sectors that resonate with your interests and skills.

- Industry research: You don’t necessarily need prior experience in a specific industry, but understanding its dynamics, growth potential, and how your skills can transfer is vital. For example, an experienced electrician might find a home inspection franchise a natural fit.

- Matching skills to industries: We look for franchise systems that capitalize on your strengths and provide training or support in areas where you might need it. The most successful franchise owners often do work that suits them and delegate or outsource other functions.

- Budget alignment: We filter opportunities based on your defined investment budget, ensuring we only explore franchises that are genuinely affordable for you.

- Using reputable franchise directories and resources: While many online platforms list franchise opportunities, we guide you to reliable sources for initial research. Some franchises even hold “Findy Days” or similar events where you can speak to representatives and learn more. Attending industry conferences is another excellent way to identify opportunities.

Our goal is to narrow down the vast field to a curated list of promising candidates that fit your criteria.

Making First Contact and Gathering Intelligence

Once you have a list of potential franchises, the next step is to initiate contact and start gathering more specific information. This is where your investigative work truly begins.

- Connecting with franchise representatives: We help you reach out to promising franchisors. Pay close attention to their responsiveness and professionalism. If a franchisor takes a long time to reply or seems disengaged, it could be a red flag.

- Initial questions: Beyond requesting basic information, we encourage you to ask about territory availability, the franchisor’s requirements, and their expectations of franchisees. This early interaction helps gauge the potential for a strong partnership.

- Brand recognition and reputation: How well-known is the brand? Does it have a positive image? A strong brand can significantly impact customer draw.

- Online reviews and forums: What are current franchisees saying about their experiences with the franchisor in online reviews and forums? This can provide unfiltered insights into the franchisor-franchisee relationship and support quality.

- Franchisor professionalism: Observe how the franchisor communicates, the quality of their materials, and their overall business practices. This reflects the type of partner they will be.

This initial intelligence gathering helps us decide which opportunities warrant deeper investigation.

Phase 3: The Best Way to Choose a Franchise is Through Deep Due Diligence (Steps 6-9)

Decoding the Franchise Disclosure Document (FDD)

The Franchise Disclosure Document (FDD) is arguably the single most important tool in your franchise evaluation process. It’s a comprehensive legal document that every franchisor in the United States must provide to prospective franchisees at least 14 days before any contract is signed or money is exchanged. Think of it as the franchise’s full biography – all 23 items of it.

You can learn more about this critical document in A Consumer’s Guide to Buying a Franchise. Here’s what we focus on:

- Litigation history (Item 3): This item details any past or current lawsuits involving the franchisor or its executives. A pattern of litigation, especially with franchisees, can signal potential issues.

- Bankruptcy history (Item 4): This section discloses any bankruptcies involving the franchisor or its key personnel. This is crucial for assessing financial stability.

- Item 19 Financial Performance Representations (FPRs): This is often the most anticipated part of the FDD. While franchisors are not required to provide earnings claims, if they do, they must have a reasonable basis for them. We help you analyze these representations carefully:

- Focus on net profits, not just gross sales: A franchise might boast high gross sales, but if overhead is equally high, net profits can be minimal.

- Understand the data’s limitations: Are the claims based on averages that might inflate success? Do they reflect specific geographic areas or franchisees with unique backgrounds that may not apply to you?

- What if Item 19 is blank? If a franchisor chooses not to include FPRs, it doesn’t mean the franchise isn’t profitable. It simply means you’ll need to rely more heavily on information from existing franchisees to project potential earnings.

- Startup costs (Items 5-7): This outlines the initial franchise fee, equipment costs, build-out expenses, and working capital requirements. Ensure you account for every potential cost.

- Ongoing fees (Items 5-7): Understand royalties, marketing fund contributions, and any other recurring fees. We also check if the franchisor profits from mandatory supplies or materials you must purchase.

- Territory rights (Item 12): Does the franchise agreement offer exclusive operating rights within a specific territory? This protects you from direct competition from other franchisees or even the franchisor itself.

| FDD Item | Description | Example for Franchise A (Coffee Shop) | Example for Franchise B (Home Services) |

|---|---|---|---|

| Initial Fee | Upfront payment to the franchisor for the right to operate. | $35,000 | $49,500 |

| Royalty | Ongoing percentage of gross sales paid to franchisor. | 6% of gross sales | 8% of gross sales |

| Item 19 Data | Financial Performance Representations (if provided). | Avg. Gross Sales: $500,000/year | Avg. Gross Sales: $300,000/year |

| Avg. Net Profit (after royalties/marketing, before owner salary/debt service): | $75,000/year | $60,000/year |

(Note: The figures in this table are hypothetical examples for illustrative purposes only and do not represent actual franchise performance.)

We stress the importance of having a qualified franchise attorney review the FDD and the entire franchise agreement before you sign anything. This document is the cornerstone of your investment.

Validating the Opportunity: The best way to choose a franchise is to talk to people

Reading the FDD is essential, but the best way to choose a franchise also involves talking to the people living the experience: current and former franchisees. The FDD (Item 20) provides a list of current and sometimes former franchisees – use it!

- Contacting franchisees: We guide you on how to approach these conversations, emphasizing that you’re seeking honest insights, not a sales pitch.

- Key questions for owners:

- What are their businesses like, including their revenue and profitability? (Are they willing to share actual numbers, or can they give you ranges to compare with Item 19?)

- How satisfied are they with the franchisor’s support, training, and marketing efforts?

- What are the day-to-day realities and common challenges they encounter?

- What do they wish they had known before buying the franchise?

- Would they do it again, knowing what they know now?

- How professional is the franchisor in their communication and business practices?

- Franchisor support quality: What level of training and ongoing support does the franchisor actually provide? Does it live up to the promises in the FDD?

- Training effectiveness: Does the initial training prepare them adequately, and is ongoing support helpful?

- Turnover rate reasons: Item 20 of the FDD also provides data on franchisee turnover. Why are franchisees closing or leaving the system? This can reveal underlying issues.

Visiting franchise locations in person to observe operations and talk to owners (without the franchisor present) can offer invaluable perspective. Look for patterns in feedback, rather than overreacting to isolated comments.

Understanding the Partnership: Support, Systems, and Expectations

A franchise is a long-term partnership, and understanding the expectations and obligations of both parties is vital for success. The franchise agreement, typically a 10-year contract, defines this relationship.

- Franchisor obligations vs. franchisee obligations: The FDD and franchise agreement clearly outline what the franchisor must provide (e.g., training, operational guidance, marketing materials) and what the franchisee must do (e.g., adhere to systems, pay royalties, maintain brand standards).

- Marketing approach: What is the franchisor’s approach to sales, marketing, and advertising? Is it sustainable and effective? What are their policies on social media and online marketing for franchisees? Do they provide assistance with sales leads or customer acquisition?

- Supply chain rules: What are the franchisor’s policies on purchasing supplies and materials? Do they profit from these sales, and if so, how does that affect your margins?

- Technology systems: Does the franchisor provide robust, up-to-date technology for point-of-sale, customer relationship management, and operational efficiency?

- Renewal & termination clauses (Item 17): What are the terms for renewing your agreement? What happens if you need to terminate early, or if the franchisor terminates your agreement?

- Transfer policies: What are the franchisor’s policies regarding the transfer or sale of your franchise location? This is crucial for your exit strategy.

- Expansion rights: If things go well, what are the franchisor’s policies on opening additional locations or expanding your territory?

- Future renovations/remodels: Does the franchisor have requirements for future renovations or remodels, and what are the associated costs? These can be significant and unexpected expenses.

We help you scrutinize these details to ensure mutual expectations are clearly defined and aligned, preventing surprises down the road.

Phase 4: Pinpointing Your Location and Making the Final Call (Step 10)

Location, Location, Location: Analyzing Your Territory

While some franchises are home-based or mobile, many require a physical location, and this decision can significantly impact your success. The best way to choose a franchise location involves thorough market analysis.

- Demographics: Evaluating the population’s age, income levels, lifestyle, and preferences gives insight into whether the location is a good fit for your franchise. You can start by examining US Census Data for your prospective area.

- Traffic counts, accessibility, and visibility: How accessible and visible is the location to customers? What is the daily traffic count and ease of access? A successful franchise must be easily found and seen.

- Local competition analysis: What is the level of local competition, and what are their strengths and weaknesses? We love a little competition, but not the kind that’s bad for business!

- Parking availability: Is there ample and convenient parking available at potential franchise locations? Difficulty finding parking can deter customers.

- Real estate costs: What are the real estate costs associated with potential locations? You need to balance these costs with the accessibility and desirability of the site. A low-cost site might be cheap for a reason.

- Future city development: What are the future growth and development plans for the city or area? Look for steady population growth and planned developments that could affect traffic or customer base. The US Census Website can also provide insights into population trends.

- Proximity to sports and entertainment venues: For some businesses, being near sports arenas, concert halls, or other attractions can drive significant foot traffic and business.

Selecting the right location is a strategic decision that requires careful research and often a visit to the proposed sites.

The Final Decision: Is This The Right Fit?

After all your research and due diligence, the final step in the best way to choose a franchise is making that pivotal decision. This often culminates in a “Findy Day” – a critical on-site meeting with the franchisor.

- Findy Day purpose: This is a mutual evaluation. You meet the top executives, potentially visit operating units, and get a feel for the company culture. It’s your chance to ask any remaining questions and see if you feel comfortable with the team.

- Assessing cultural fit: Does the franchisor demonstrate a commitment to your professional success and growth? Are mutual expectations between you and the franchisor clearly defined and aligned? How professional is their communication?

- Balancing data with intuition: You’ve gathered data, crunched numbers, and talked to franchisees. Now, it’s time to listen to your gut. Does this opportunity feel right?

- Final legal review: Before signing, ensure your franchise attorney has reviewed the final agreement and all your questions have been answered.

- Comparing your top options: If you’re weighing two or three strong contenders, use a structured comparison framework to evaluate the economics, personal fit, and risks of each side-by-side.

- Benefits vs. starting from scratch: Remember why you chose franchising in the first place. Franchise businesses are significantly more likely to succeed than independent startups, offering a proven model and support system.

Making this decision can be a mix of anxiety, excitement, and fear – and that’s perfectly normal. If you’ve done your homework, sought expert advice, and followed these steps, you can move forward with confidence.

Frequently Asked Questions About Choosing a Franchise

What are the biggest benefits of buying a franchise versus starting a business from scratch?

When you buy a franchise, you’re investing in a proven business model, not just an idea. This means you gain instant brand recognition, an established operational playbook, and often a built-in customer base. Franchises typically offer comprehensive training, ongoing support, and established supply chains, significantly lowering the risk and shortening the learning curve compared to an independent startup. The failure rate for franchises is significantly lower than for independent startups, and studies show that franchise businesses are 5 times more likely to be successful.

What is a Franchise Disclosure Document (FDD) and why is it so important?

The Franchise Disclosure Document (FDD) is a legally required document that franchisors must provide to potential franchisees in the United States. It contains 23 sections detailing key points about the franchise, including the franchisor’s obligations, all possible fees, litigation history, and financial performance representations (Item 19). It is the single most important tool for due diligence, offering transparency and allowing you to make an informed decision by understanding the full scope of the opportunity, risks, and obligations before you commit.

How much does it really cost to start a franchise?

The cost to start a franchise can vary dramatically. Initial investments can range from as low as $10,000 for some home-based or mobile services to over $1 million for larger, brick-and-mortar operations, such as restaurants. The average initial investment often falls between $100,000 and $300,000. This includes the initial franchise fee, real estate or leasehold improvements, equipment, initial inventory, working capital to cover expenses until the business becomes profitable, and various other startup costs like licenses and insurance. It’s crucial to account for all these components in your budget.

Your Guided Path to Confident Franchise Ownership

Choosing a franchise is a life-changing decision, not a simple purchase. Following a structured, ten-step process transforms an overwhelming task into a manageable journey of findy. By starting with self-reflection, conducting thorough research, and performing deep due diligence, you can move forward with clarity and confidence. For those seeking an expert partner on this journey, Main Entrance Franchise Consulting provides unbiased, no-cost guidance to help you steer every step and find a franchise that truly aligns with your life’s goals. Our team is dedicated to providing education-first support, in-depth franchise matching, and a streamlined findy process.

Ready to explore how franchise ownership can transform your future? Let us help you steer the complexities and pinpoint your ideal opportunity.