Why Business Ownership Through Franchising is Changing Lives

Business ownership through franchising is a proven path to entrepreneurship that combines the independence of running your own business with the support of an established brand. Instead of starting from scratch, you license a successful business model from a franchisor who provides training, marketing, and operational guidance. This model has a higher survival rate than independent startups, making it an attractive option for first-time business owners and those transitioning from corporate careers.

Quick Answer: What is Franchising?

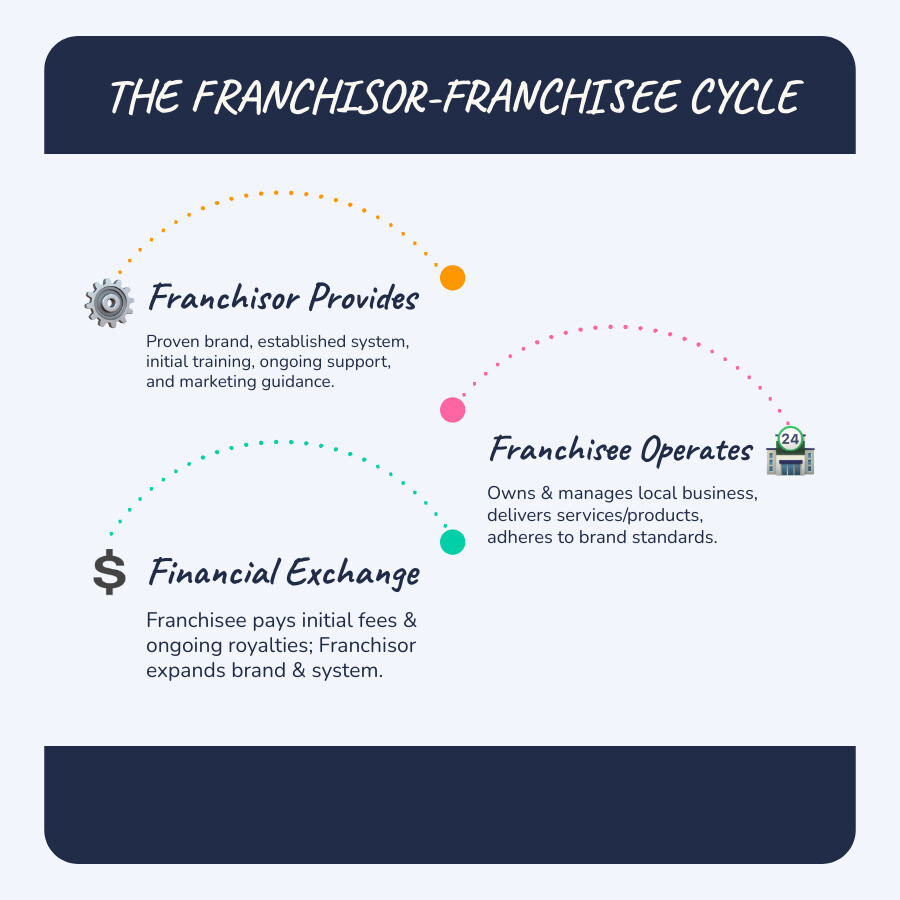

- The Model: A franchisee pays fees to use a franchisor’s brand, systems, and support.

- What You Get: A proven business model, training, ongoing support, and brand recognition.

- What You Give: An initial franchise fee, ongoing royalties, and adherence to brand standards.

- Key Advantage: Higher success rates than independent startups.

- Main Trade-off: Less creative control for a lower-risk path to ownership.

Franchising gives you a complete business framework from day one. You’re still a small business owner responsible for hiring, managing, and growing your location—but you’re not doing it alone. The franchise industry contributes nearly $900 billion to the U.S. economy, with most of its 830,000+ establishments owned by local entrepreneurs.

This guide will walk you through the fundamentals of franchise ownership: what it is, how it works, what it costs, and how to find the right opportunity. You’ll learn about the support systems, legal documents, and financial obligations involved. Most importantly, you’ll find how to evaluate if franchising is the right path for you.

I’m Max Emma, a Certified Franchise Executive and founder of Main Entrance Franchise Consulting. I’ve lived both sides of franchising—as a franchisor and as a consultant who has helped over 100 individuals on this journey. My mission is to help you turn complexity into a clear, confident decision.

What is Franchising? Understanding the Business Model

This section defines the core concepts of franchising, differentiating it from independent startups and outlining the various models and support systems available to a franchisee.

The Core Concept: Franchise vs. Starting from Scratch

At its heart, a franchise is a business agreement where a franchisor grants an independent entrepreneur (the franchisee) the right to use their business logo, name, and model. Many people mistakenly believe franchises are owned by large corporations, but they are small local businesses operated by community members. The franchisee gets to rely on a successful business model, benefiting from instant brand recognition and marketing efforts.

This model contrasts sharply with starting a business from scratch, which requires building everything yourself—brand, systems, and supplier relationships. While independent startups offer creative freedom, they also come with a higher risk of failure. Franchising provides built-in support and proven systems, leading to a higher success rate.

Here’s a quick comparison:

| Feature | Franchise | Independent Startup |

|---|---|---|

| Brand Recognition | Instant, established, and national/regional | Built from scratch, slow growth |

| Business Model | Proven, tested, and standardized | Developed from scratch, unproven |

| Support & Training | Extensive, ongoing from franchisor | Self-sourced, often limited |

| Costs | Initial franchise fee, royalties, startup costs | Varied, potentially lower initial, but unknown |

| Risk | Lower due to proven model and support | Higher, unproven concept |

| Autonomy | Limited creative control, adherence to standards | Full creative control |

Franchise businesses are a major part of local economies, creating jobs and generating revenue. For a deeper dive, a franchise is a business agreement where the franchisee relies on a successful business model.

Exploring the Different Types of Franchise Models

Franchises come in various types, each with different requirements and operational involvement. Understanding these models is crucial when considering business ownership through franchising.

- Business Format Franchising: The most common model, where the franchisor provides a complete system for running the business, including brand, operations, and marketing.

- Product Distribution Franchising: The franchisee sells products supplied by the franchisor, focusing on supply chain management (e.g., car dealerships, beverage bottlers).

- Investment Franchise: A large-scale operation like a hotel, where the franchisee invests significantly but may hire a team for daily management.

- Conversion Franchise: An existing independent business converts to a franchise brand to gain brand recognition and support systems.

- Home-Based or Low-Investment Franchises: These require no physical storefront and have lower startup costs, offering flexibility (e.g., mobile services, consulting).

To explore these models in more detail, Franchises comprise various types that cater to diverse entrepreneurial aspirations.

The Support System: What Franchisors Provide

One of the most compelling aspects of business ownership through franchising is the robust support system provided by the franchisor.

Here’s what you can typically expect:

- Initial Training: Comprehensive programs covering operations, product knowledge, customer service, and marketing before you open.

- Ongoing Operational Support: Continuous guidance through site visits, performance reviews, and access to business coaches.

- Marketing and Advertising Assistance: National marketing campaigns and local marketing materials to help attract customers.

- Site Selection and Build-Out Guidance: Assistance with finding a location, negotiating leases, and designing the space to brand specifications.

- Brand Standards and Quality Control: Strict guidelines to ensure a consistent customer experience and protect the brand’s reputation.

- Approved Supplier Network: Access to established suppliers for purchasing goods and services at negotiated rates, ensuring quality and cost-effectiveness.

This comprehensive support system is a key differentiator from independent startups, providing a safety net and a clear roadmap for your entrepreneurial journey.

Weighing the Opportunity: The Advantages and Risks of Franchising

This section provides a balanced look at the benefits that attract entrepreneurs to franchising and the potential challenges they should be aware of before investing.

The Upside: Key Benefits of Franchise Ownership

Choosing business ownership through franchising offers several compelling advantages:

- Reduced Risk and Higher Survival Rates: You’re investing in a proven concept, not experimenting. The franchisor has already refined the business model, which is why franchise businesses statistically have higher survival rates than independent startups.

- Instant Brand Recognition: You open with a name customers already know and trust, saving you years of effort in building brand awareness.

- Proven Business Model: You inherit a blueprint that has been tested and refined, including marketing, operations, and pricing.

- Pre-Established Supply Chains: Franchisors provide access to approved suppliers, often with negotiated pricing, which streamlines purchasing.

- Easier Access to Financing: Lenders are often more willing to finance franchises due to their established track records and lower risk profiles.

- Comprehensive Support and Training: You receive initial and ongoing training, operational assistance, and marketing support, so you’re never alone.

For many, franchising offers a structured path to business ownership, providing the freedom of being your own boss with the security of a supportive partner. We believe this is one of the The 4 Freedoms That Motivate Successful Franchise Owners.

The Downside: Potential Risks and Challenges

While the benefits are significant, it’s crucial to acknowledge the potential disadvantages of business ownership through franchising.

- Less Autonomy: As a franchisee, you must follow the franchisor’s rules. You won’t have the freedom to change products, branding, or operations.

- Strict Operating Rules: Franchisors enforce standards on everything from store layout to marketing to maintain brand consistency.

- Ongoing Fees: You’ll pay ongoing royalties (a percentage of revenue) and other fees, regardless of your profitability.

- Brand Reputation Risks: Your business is tied to the brand. A crisis at another location or at the corporate level can negatively impact you.

- Contractual Restrictions: Franchise agreements are long-term, legally binding contracts that are difficult and costly to break.

- Renewal Uncertainty: Renewal of your agreement is not guaranteed. The franchisor may impose new terms or choose not to renew.

- Dependence on the Franchisor: Your success is linked to the franchisor’s performance. If the franchisor falters, your business can suffer.

It’s important to recognize these pros and cons of franchising to make an informed decision. We encourage all our clients to consider these challenges carefully.

The Financials of Franchising: Costs, Fees, and Obligations

This section breaks down the complete financial picture of buying and running a franchise, from the initial investment to recurring fees.

Understanding the Initial Investment

Starting on business ownership through franchising requires understanding the full financial commitment. The initial investment covers all costs to get your business open.

Typical components include:

- Initial Franchise Fee: A one-time payment ($25,000 to $50,000+) for the right to use the brand, systems, and for initial support like training.

- Startup Costs: Expenses incurred before opening, such as:

- Real estate and construction

- Equipment, fixtures, and signage

- Initial inventory and supplies

- Technology systems (POS, computers)

- Licenses, permits, and insurance

- Working Capital: Funds to cover operating expenses (rent, payroll, marketing) for the first few months until the business becomes self-sustaining.

The total initial investment can range from under $10,000 for a home-based model to over $1 million for a large restaurant. Many franchisees use Small Business Administration loans or other financing, which can be easier to secure for a franchise due to its proven model.

Ongoing Financial Obligations for the Franchisee

Beyond the initial investment, business ownership through franchising involves ongoing financial commitments to the franchisor.

- Royalty Fees: A recurring payment, typically 4-12% of gross revenue, paid to the franchisor for ongoing support and the right to use the brand.

- Advertising Fund Contributions: Usually 2-4% of revenue, this fee is pooled for national and regional marketing campaigns that benefit the entire system.

- Technology Fees: Some franchisors charge for proprietary software, POS systems, or other tech platforms.

- Other Operational Costs: You are responsible for all standard business expenses, including rent, utilities, payroll, and local marketing.

Franchisors make money from these fees, which allows them to expand their brand and provide the support necessary for the system’s success.

The Legal Landscape of Business Ownership Through Franchising

This section demystifies the legal documents and obligations that define the franchisor-franchisee relationship, emphasizing the importance of due diligence.

The Franchise Disclosure Document (FDD): Your Most Important Tool

When considering business ownership through franchising, the Franchise Disclosure Document (FDD) is your most important tool. This legal document, required by the Federal Trade Commission (FTC), gives you a transparent overview of the franchise opportunity. Franchisors must provide the FDD at least 14 calendar days before you sign any agreement or pay money, giving you a critical “cooling off” period for review.

The FDD contains 23 “Items” of information. Key items to focus on include:

- Item 7: Estimated Initial Investment: A detailed breakdown of all expected initial costs, from the franchise fee to working capital.

- Item 19: Financial Performance Representations (FPRs): If a franchisor makes claims about potential earnings, they must be detailed here. Not all franchisors provide an FPR, but if they do, it must be substantiated.

- Item 20: Franchisee and Outlet Information: A list of current and former franchisees. This is invaluable, as it allows you to contact them for real-world insights—a critical step in your due diligence.

Thoroughly reviewing the FDD is non-negotiable. It’s your best source of information for understanding the opportunity’s benefits and risks. For more, consult the FTC’s A Consumer’s Guide to Buying a Franchise.

Your Path to Business Ownership Through Franchising: Contractual and Compliance Obligations

Your journey into business ownership through franchising is governed by the legally binding Franchise Agreement and other compliance obligations.

- The Franchise Agreement: This is the core contract between you and the franchisor. It outlines rights and responsibilities, including the term of the agreement, operating standards, territory rights, and renewal/termination clauses.

- Importance of Legal Counsel: Franchise law is complex. It is highly recommended to hire a franchise lawyer to review the FDD and franchise agreement before you sign. This can prevent costly issues later.

- Forming a Business Entity: To protect your personal assets, you should form a corporation or an LLC. This separates your personal liability from your business liabilities.

- Compliance Obligations: As a franchisee, you must adhere to all brand standards, reporting requirements, marketing guidelines, and training programs outlined in the agreement.

These obligations protect the integrity of the franchise system. While they limit autonomy, they provide the structure that contributes to franchising’s higher success rates.

The Findy Journey: Finding the Right Franchise for You

This section guides you through the process of self-evaluation and research, highlighting how professional guidance can help you find a franchise that aligns with your goals.

Self-Assessment: Aligning a Franchise with Your Personal Goals

The journey to successful business ownership through franchising begins with self-assessment. Before exploring brands, consider these critical questions to ensure a potential franchise aligns with your goals, strengths, and lifestyle.

- Skills and Interests: What are you passionate about? What skills do you enjoy using?

- Financial Capacity: How much capital can you realistically invest, including startup costs and working capital?

- Desired Role: Do you want to be a hands-on owner-operator or a semi-absentee manager overseeing a team?

- Lifestyle Goals: What work-life balance are you seeking? How many hours are you willing to commit?

- Risk Tolerance: How comfortable are you with financial risk?

Your answers are foundational to finding an opportunity that resonates with your entrepreneurial spirit. For more detailed self-assessment resources, check out More info about our Insights.

The Role of a Franchise Consultant in Your Search

Navigating the 3,000+ franchise brands in the U.S. can be overwhelming. A franchise consultant is an invaluable partner in this process.

- What is a Franchise Consultant?: A consultant acts as an educator and guide, helping you clarify your goals and filter through the noise. Our role is to bring objectivity and structure to your search.

- Navigating the Options: We have access to a national network of hundreds of proven franchise brands, allowing us to quickly identify opportunities that match your criteria and save you countless hours of research.

- Unbiased Expert Guidance: As certified IFPG franchise consultants, we provide unbiased, personalized guidance. Our compensation comes from the franchisor only after a successful match, ensuring our advice is always aligned with your goals.

- No-Cost Service Model: Our consulting services are free to you. Franchisors compensate us for bringing them educated, qualified candidates, so you get expert advice without adding to your investment costs.

We use an education-first approach to empower you with knowledge and clarity. To learn more, visit What is a Franchise Consultant? and explore the Advantages of Working with a Certified Franchise Executive (CFE).

Frequently Asked Questions About Business Ownership Through Franchising

How do I talk to existing franchisees and what should I ask?

Talking to current and former franchisees, known as “validation calls,” is a crucial step in your due diligence. Item 20 of the FDD provides their contact information. Be respectful of their time and have questions prepared.

Key questions to ask:

- Franchisor Support: “How would you rate the franchisor’s training and ongoing support? Do they deliver on their promises?”

- Profitability: “How long did it take you to break even? Are your results in line with what you expected?” (Note: They are not obligated to share financial data, but their general sentiment is telling.)

- Work-Life Balance: “What does a typical week look like? Has the business met your lifestyle expectations?”

- Franchisor Relationship: “How is your relationship with the franchisor? Do you feel heard?”

- Challenges: “What has been your biggest challenge? What do you wish you had known before starting?”

- Would You Do It Again?: “Knowing what you know now, would you still buy this franchise?”

These conversations offer candid perspectives on the day-to-day realities of the business.

Can I own more than one franchise unit?

Absolutely. Many successful entrepreneurs in business ownership through franchising become multi-unit franchisees, owning multiple locations of the same brand or even diversifying into different brands.

- Benefits: Multi-unit ownership allows for scalability, operational efficiencies, and increased influence within the system.

- Considerations: It also requires more capital, strong leadership, and effective management systems to handle the increased complexity. Franchisors often have higher financial qualifications for multi-unit owners.

If multi-unit ownership is your long-term goal, it’s important to identify brands that support this expansion from the start.

What are the signs a business is ready to be franchised?

While this guide focuses on becoming a franchisee, understanding what makes a business “franchisable” helps you evaluate the quality of an opportunity. A strong franchise concept should have:

- A proven and profitable business model.

- A system that is easily taught and replicated.

- A strong brand identity.

- Documented operational procedures.

- The ability to provide comprehensive training and support.

When a business has these elements, it is on solid footing to expand through franchising. If you’re a business owner exploring this path, learn more about our Franchise Development services.

Start Your Journey to Confident Franchise Ownership

Business ownership through franchising offers a structured path to entrepreneurship, blending the independence of owning your business with the advantages of a proven system. We’ve explored what franchising is, the support franchisors provide, and the financial and legal landscapes you’ll steer. We’ve also weighed the benefits, like reduced risk, against the limitations, like less autonomy.

The key to open uping your entrepreneurial dream through franchising lies in thorough research, honest self-assessment, and a diligent findy process. It’s about finding the right personal and professional fit that aligns with your skills, financial capacity, and lifestyle goals.

Navigating this journey can seem complex, but you don’t have to do it alone. Main Entrance Franchise Consulting provides the personalized, no-cost guidance you need to make a confident decision. We’re here to help you turn a wealth of information into a clear, actionable path forward.

Ready to explore if franchise ownership is right for you? Our expert consultants can guide you through every step of the Franchise Buying process, helping you find the ideal opportunity to build your future.