Why Understanding Franchise Business Models Is Your Key to Smart Investment Decisions

A franchise business model example shows how entrepreneurs can use proven systems to build successful businesses while minimizing startup risks. These models range from Business Format Franchising (replicating a whole business like McDonald’s) to Product Distribution (selling a franchisor’s goods like Coca-Cola). Ownership structures also vary, from the common Franchise-Owned, Franchise-Operated (FOFO) model to passive investment options.

The franchise industry is a powerhouse, employing millions and generating trillions in economic activity. This is because franchising offers a unique balance: you get a proven business model with brand recognition and support, yet you own your business. The potential for returns is significant, with the average franchisee’s annual income reported at $102,910 in 2023.

However, not all franchise models are the same. Some require hands-on daily operations, while others are passive investments. As Max Emma, founder of Main Entrance Franchise Consulting, I’ve helped countless entrepreneurs steer these options. Understanding each franchise business model example is the first step to finding an opportunity that aligns with your goals, capital, and desired involvement.

The Core Franchise Models Explained

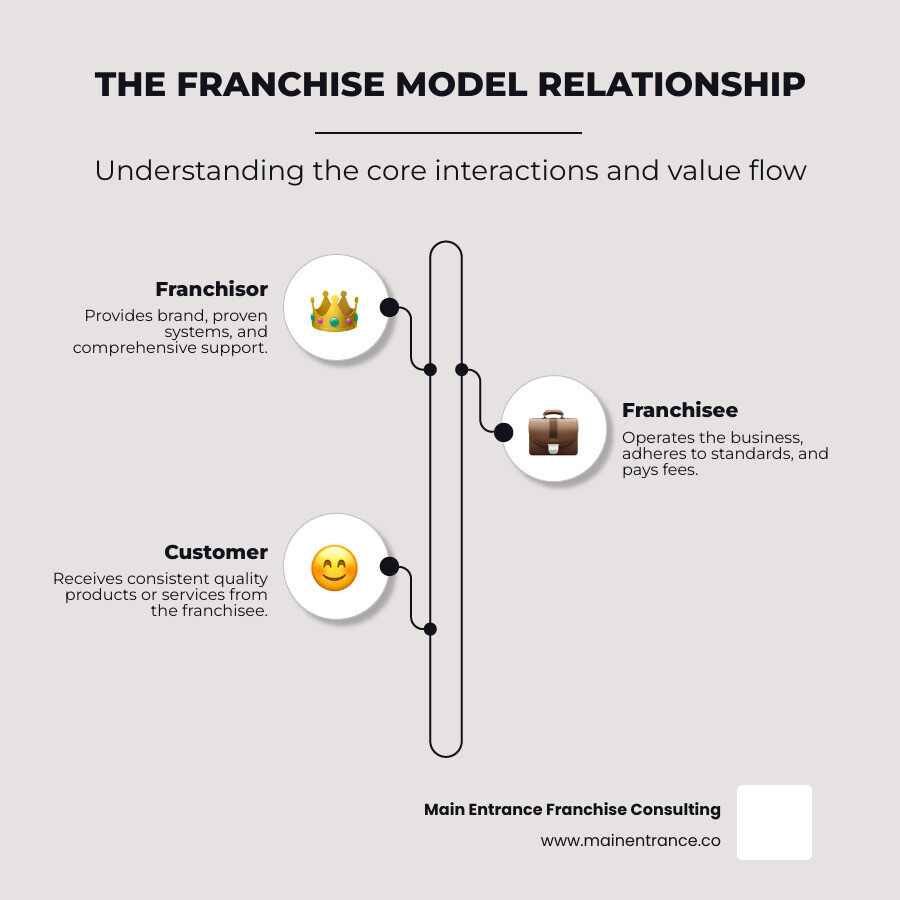

Before exploring specific types, understand the difference between franchising and licensing. Licensing simply grants you the right to use a brand name or product, with little to no ongoing support. Franchising, on the other hand, is a deep, collaborative relationship. You receive a proven business system, comprehensive training, and continuous support from a franchisor who is invested in your success.

Now, let’s explore the main franchise business model examples:

- Business Format Franchising: The most common model (think McDonald’s), where you buy a complete business blueprint with ongoing support.

- Product Distribution Franchising: Focuses on selling a franchisor’s products, like Coca-Cola distributors or car dealerships.

- Manufacturing Franchising: Gives you the right to produce and sell products using the franchisor’s formulas, such as in beverage bottling.

- Conversion Franchising: Allows an existing independent business to join a franchise network, like a local hotel becoming a Marriott.

- Investment Franchising: For owners who prefer to hire managers for daily operations, common in hotels and large fitness centers.

If you’re feeling overwhelmed, we help people steer these choices every day through our franchise buying services.

The Business Format Franchise Model

The Business Format Franchise Model is the franchise business model example most people imagine. It’s a complete “business in a box,” where you replicate an entire, proven business concept. The franchisor provides a detailed system for everything, from operations to marketing.

The bright side:

- Proven Business Model: Reduces guesswork and startup risk.

- Brand Recognition: Instant customer trust and awareness.

- Comprehensive Support: Extensive training and ongoing guidance mean you’re never alone.

- Buying Power: Access to better pricing on supplies through the franchise network.

The challenges:

- Limited Autonomy: You must follow the franchisor’s system, leaving little room for creativity.

- Ongoing Fees: You’ll pay continuous royalty and marketing fees.

- Shared Reputation: Your success is tied to the franchisor’s brand health and decisions.

This model is dominant in the fast food, fitness, and retail industries.

The Product Distribution & Manufacturing Models

The Product Distribution Model is a simpler, supplier-distributor relationship. Your primary role is to sell products that customers already know and trust. You gain the right to use the trademark and sell the products in exchange for royalty fees.

Advantages include leveraging established brand recognition and having simpler operations with greater autonomy. Challenges involve being limited to specific products, dependence on the franchisor’s supply chain, and receiving less comprehensive support than in the business format model. This model is common in the automotive, consumer goods, and beverage industries.

Manufacturing Franchising is a step further, granting you the right to produce the franchisor’s products. An excellent example of this is Marriott, which shows how different models can work across hospitality brands. This approach requires significant capital for facilities and equipment but can offer exclusive territories and greater control over production. It’s a strong franchise business model example for those with manufacturing experience who want the security of a proven product line.

The Ownership & Operations Matrix: COCO, FOFO, and Hybrid Models

Understanding who owns and who operates a franchise unit is crucial. This matrix defines who invests the capital, who manages daily operations, and how profits are shared.

There are four main models:

- Company-Owned, Company-Operated (COCO): The franchisor owns and runs the unit. This is often used to test and perfect the business concept before franchising.

- Franchise-Owned, Franchise-Operated (FOFO): The most common model. The franchisee invests in and operates the business, paying royalties to the franchisor.

- Franchise-Owned, Company-Operated (FOCO): The franchisee invests the capital, but the franchisor’s corporate team manages operations. This is ideal for passive investors.

- Company-Owned, Franchise-Operated (COFO): The rarest model, where the franchisor owns the location but a franchisee operates it.

How COCO, FOCO, FOFO, and COFO Models Differ

This table breaks down the key differences:

| Feature | COCO (Company-Owned, Company-Operated) | FOFO (Franchise-Owned, Franchise-Operated) | FOCO (Franchise-Owned, Company-Operated) | COFO (Company-Owned, Franchise-Operated) |

|---|---|---|---|---|

| Capital Investment | Franchisor (100%) | Franchisee (100%) | Franchisee (100%) | Franchisor (100%) |

| Operational Control | Franchisor (100%) | Franchisee (within guidelines) | Franchisor (100%) | Franchisee (under franchisor’s direction) |

| Risk | Franchisor bears all risk | Franchisee bears primary operational risk | Shared (franchisee capital, franchisor ops) | Franchisor bears primary capital risk |

| Profit Share | Franchisor keeps all profits | Franchisee keeps profits after royalties | Franchisee gets guaranteed return/revenue share | Franchisee gets operational fee/share of profits |

| Common Use | Testing ground, flagship stores | Most common expansion model | Passive investment, brand control | Rare, collaborative approach |

The FOFO model is the heart of franchising, used by over 80% of brands for expansion. It allows for rapid growth funded by franchisees. The COCO model acts as a brand’s laboratory for perfecting its systems. The FOCO model appeals to passive investors who want franchise returns without the daily operational responsibilities.

Hybrid Models and Their Advantages

Hybrid models blend elements from different structures to create flexible, customized solutions. They allow for optimized capital allocation and risk mitigation, adapting to unique market conditions.

A great franchise business model example is the Wendy’s Kitchen’s partnership with Reef Technology. Reef funds and operates delivery-only ghost kitchens, allowing Wendy’s to expand its reach without the cost of traditional restaurants. This innovative approach demonstrates the flexibility of hybrid models, which are becoming increasingly popular in industries like automotive services and health & wellness.

Scaling Your Investment: Franchise Ownership Structures

Once you understand the basic models, the next step is deciding on the scale of your investment. Franchising is highly scalable, allowing you to start with a single unit or commit to developing an entire territory.

There are four main ownership structures: single-unit franchisee, multi-unit franchisee, area developer, and master franchisee. Your choice will depend on your capital, experience, and long-term goals.

Single-Unit vs. Multi-Unit Ownership

Most franchisees begin with a single-unit. This approach allows you to master the franchisor’s systems, understand your local market, and prove operational success on a manageable scale. It’s a valuable foundation for any franchisee, whether you plan to expand or not.

Once your first location is consistently successful, expanding to multiple units is a natural next step. As a multi-unit owner, you can benefit from economies of scale, such as shared marketing costs and better supplier deals. However, this requires stronger leadership skills and robust management systems to oversee operations across several locations.

Area Developer vs. Master Franchisee

For entrepreneurs with significant capital and ambition, the area developer and master franchisee models offer control over larger territories.

An area developer signs an agreement to open a specific number of franchise units in an exclusive territory over a set period. In return for this commitment to develop the market for the brand, the franchisor grants them territorial protection from other franchisees.

The master franchisee model represents the ultimate level of territorial control. You act as a mini-franchisor in your region, with the right to both open your own units and sell franchises to other entrepreneurs. You recruit, train, and support these sub-franchisees, collecting a share of their initial fees and ongoing royalties.

This franchise business model example offers significant revenue potential but also comes with greater complexity and a much higher initial investment. You must be a skilled operator and an effective franchisor. This model is common in industries like automotive services and health & wellness, where local support is critical.

The Franchisee Journey: Costs, Support, and Legal Must-Knows

Joining a franchise means buying into a proven system, but understand the full picture before investing. While the average franchisee earned $102,910 annually in 2023, success requires careful consideration.

The upside of franchising includes a tested business model, instant brand recognition, comprehensive support, and group purchasing power. The trade-offs include less creative freedom, ongoing fees (royalties, marketing), and a success that is tied to the overall brand’s reputation. Franchise Business Review Announces 2023 Most Profitable Franchises highlights many thriving opportunities.

Choosing the right franchise business model example requires self-assessment of your strengths, goals, available capital, and time commitment. Professional guidance can be invaluable in this process.

Typical Costs and Financial Requirements

Understanding the full financial commitment is critical. Costs go far beyond the initial fee.

- Initial Franchise Fee: A one-time payment for the brand and system rights. This can range from $35,000 (Jiffy Lube) to $50,000 (Drybar).

- Royalty & Marketing Fees: Ongoing payments, typically a percentage of gross sales, for continued support and brand advertising. Jiffy Lube charges a low 4% royalty, while Drybar charges 7%.

- Startup Costs: The largest variable, covering everything from real estate and equipment to inventory and working capital. Total investment can range from under $200,000 (Sharkey’s Cuts for Kids) to over $2.6 million (McDonald’s).

- Financial Requirements: Franchisors require a minimum liquid capital (e.g., $250,000 for Drybar and Jiffy Lube) and net worth (e.g., $500,000 for Jiffy Lube, $750,000 for Drybar) to ensure you are financially prepared.

Beyond the numbers, it’s important to understand the freedoms that motivate successful franchise owners.

Understanding the Franchise Disclosure Document (FDD)

The Franchise Disclosure Document (FDD) is a legally mandated document that provides comprehensive information about the franchisor and the franchise agreement. You must receive it at least 14 days before signing or paying.

The FDD contains 23 sections covering the franchisor’s history, fees, and legal obligations. Pay close attention to:

- Item 19 (Financial Performance Representations): If provided, this section gives data on the financial performance of existing franchises.

- Item 20 (Outlets and Franchisee Information): A list of current and former franchisees you can contact for real-world feedback.

Given its legal complexity, it is essential to review the FDD with the assistance of a competent attorney who specializes in franchise law.

Support You Can Expect from a Franchisor

A key advantage of franchising is the robust support system. You’re not just buying a brand; you’re gaining a partner. Support typically includes:

- Initial and Ongoing Training: Comprehensive programs on all aspects of the business.

- Operational Guidance: Detailed manuals and software to ensure consistency and efficiency.

- Site Selection and Build-Out: Expert assistance in finding a location and preparing it for opening.

- Marketing and Advertising: Access to national campaigns and local marketing toolkits.

- Supply Chain Access: Established vendor relationships, often with negotiated pricing.

Real-World Franchise Business Model Example in Action

Theory is one thing, but seeing a franchise business model example in the real world shows its true potential. For instance, 93% of McDonald’s restaurants are owned and operated by local franchisees, not the corporation. Brands like Jiffy Lube succeed with low royalty fees, while Drybar built an empire on a single, focused service.

A Business Format Franchise Business Model Example: The Service Industry

Drybar is a prime franchise business model example in the service industry. Its concept is simple: “no cuts, no color, just blowouts.” This laser focus on a niche service created a replicable, high-end experience that builds tremendous customer loyalty.

Every location has a consistent look, feel, and quality of service, which is the hallmark of a strong business format franchise. For franchisees, the financial commitment is serious: $250,000 in liquid capital, a $750,000 minimum net worth, a $50,000 franchise fee, and 7% ongoing royalties. In return, Drybar provides comprehensive support, from site selection to staff training, demonstrating how a strong brand and focused service can create a winning formula.

A Product Distribution Franchise Business Model Example: The Automotive Sector

Jiffy Lube showcases a blend of product distribution and service delivery. Originally an oil change specialist, its “Multicare” approach now includes brakes, tires, and other maintenance, showing how franchises adapt to customer needs. Its connection to Shell and Pennzoil provides franchisees with instant credibility and access to trusted products.

Financially, Jiffy Lube is attractive. The fixed royalty fee of 4% is one of the lowest in the industry. To qualify, you need $250,000 in liquid assets and a $500,000 net worth. The potential is significant, with top quartile stores averaging $1.5 million in unit value. This franchise business model example shows how combining product credibility with proven operational systems creates a foundation for long-term success.

Frequently Asked Questions about Franchise Models

Here are answers to some of the most common questions entrepreneurs have about franchising.

What is the most common franchise business model?

The Business Format Franchise Model is the most common franchise business model example. This is the “business in a box” approach used by brands like Subway or The UPS Store. Within this category, the FOFO (Franchise-Owned, Franchise-Operated) structure is dominant. This combination is a win-win: franchisors can expand rapidly using franchisee capital, and franchisees get a proven system with built-in support.

Does a franchisee own the business?

Yes, as a franchisee, you are an independent business owner. You own the assets, manage the employees, and keep the profits after paying royalties. However, you operate under a license agreement that requires you to follow the franchisor’s specific rules and standards. Think of it like owning a home in a community with an HOA; you own the property but must adhere to community guidelines that protect the value of all homes (or in this case, the brand).

What is the difference between franchising and licensing?

This is a key distinction. The relationship, support, and control are vastly different.

Franchising is a deep partnership. You receive a complete business system, extensive training, and ongoing support. The franchisor maintains significant control to ensure brand consistency. You are buying a roadmap to run a business.

Licensing is a more limited transaction. You get the right to use a trademark, but there is minimal training, support, or operational control from the licensor. You have more freedom but also more risk.

For most entrepreneurs, franchising offers a more supportive and structured path to business ownership.

Conclusion

Understanding each franchise business model example is your roadmap to a life-changing investment. We’ve covered the core models, from the all-inclusive Business Format Franchise to passive FOCO structures, and the various ownership paths from single-unit to master franchisee.

We’ve also highlighted the financial realities and the importance of the Franchise Disclosure Document (FDD). The goal isn’t just to find any franchise; it’s to find the right one that aligns with your skills, finances, and personal goals. Due diligence is absolutely critical—research thoroughly, talk to existing franchisees, and get professional advice.

The beauty of franchising is its variety. There is a franchise business model example to fit nearly every entrepreneurial vision, from hands-on operator to multi-unit manager.

At Main Entrance Franchise Consulting, we specialize in helping you steer this journey. We provide expert, client-focused guidance to identify opportunities that match your goals, all with no upfront cost to you.

If you’re ready to explore your options, learn more about what is a franchise consultant and how we can support you. Or, if you have a great business concept, we can help you develop your own successful franchise model with our expert guidance.

The franchise industry works. With the right model and proper guidance, you can write your own success story.