Why a Solid Franchise Business Plan Example Is Your Blueprint for Success

A franchise business plan example is your roadmap to understanding how successful franchisees structure their path to profitability. Whether you’re seeking financing, franchisor approval, or simply a clear operational guide, a well-crafted plan is essential.

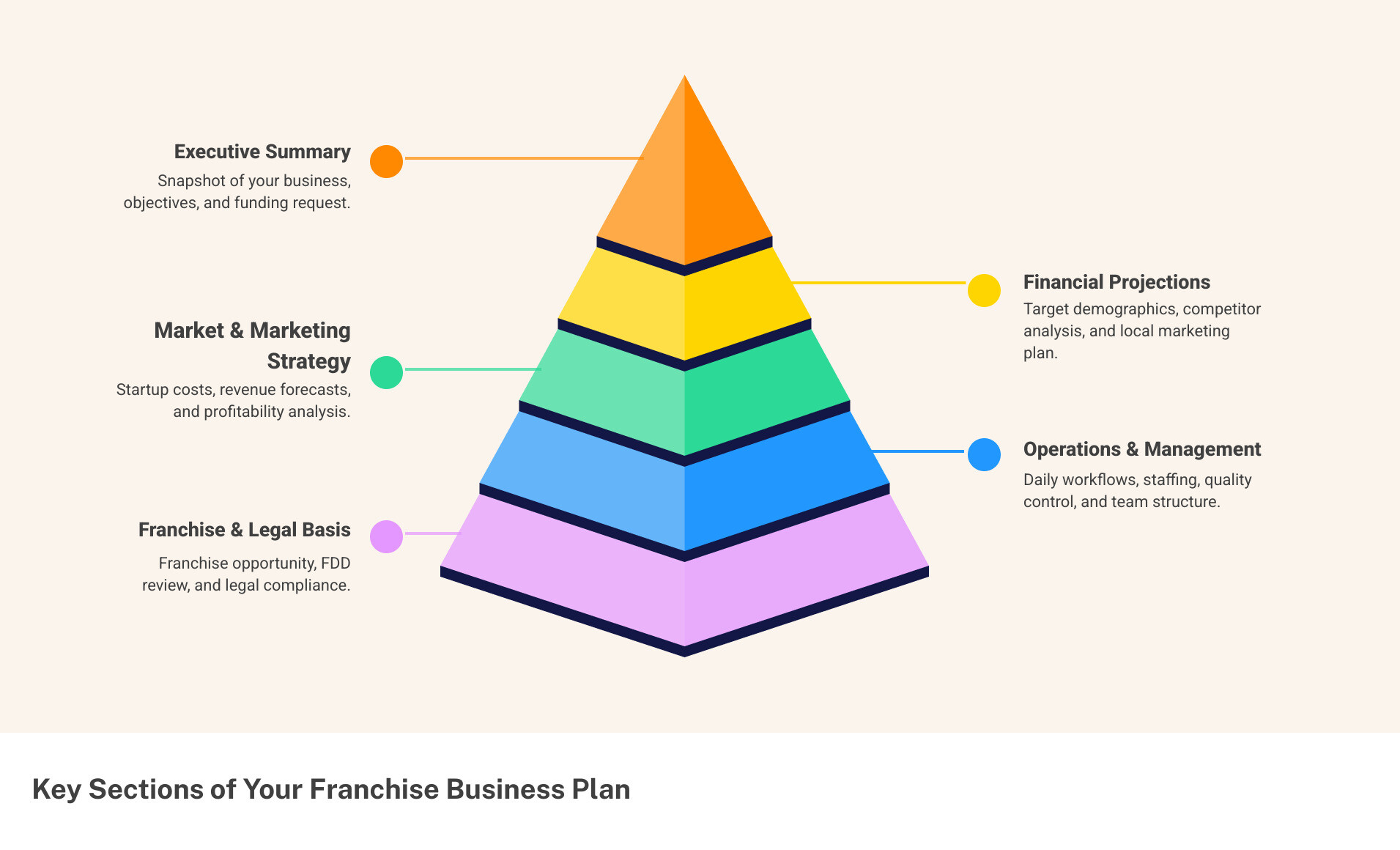

Key sections you’ll find in any strong franchise business plan example:

- Executive Summary – Your business at a glance, including funding needs and key objectives.

- Market Analysis – Target demographics, competitors, and local market conditions.

- Operations Plan – Daily workflows, staffing, training, and quality control.

- Marketing Strategy – How you’ll leverage both franchisor support and local tactics.

- Financial Projections – Startup costs, revenue forecasts, and break-even analysis.

Creating a franchise business plan is often easier than building one for an independent business because the franchisor provides proven systems, brand recognition, and operational guidelines. Your job is to adapt this framework to your local market and demonstrate you can execute their system successfully.

Research shows that businesses with detailed plans see significantly higher success rates. A franchise business plan serves three critical purposes: it secures financing, earns franchisor approval, and acts as your operational roadmap. The best operators treat it as a living document, updating it quarterly to guide decisions on staffing, marketing, and expansion.

I’m Max Emma, a Certified Franchise Executive who’s built and scaled multiple franchise systems. I’ve reviewed hundreds of franchise business plans as both a franchisor and consultant, and I know what lenders and successful operators look for in a winning plan.

Foundations: Why Your Franchise Needs a Specialized Business Plan

A franchise business plan example isn’t just another document; it’s the strategic tool that transforms a franchise opportunity into a profitable business. While a franchise gives you a proven system and an established brand, you still need a detailed plan showing how you’ll execute that system in your specific market.

Your plan serves three critical purposes:

- Roadmap for Success: It’s a living document guiding your decisions from day one.

- Securing Franchisor Approval: Many franchisors require a plan to see you’ve thought through your local strategy.

- Attracting Investors: It’s essential for securing financing, whether from an SBA loan or partners.

This differs from an independent business plan because you’re leveraging a franchisor’s track record while adhering to their system requirements. This balance—freedom within structure—is the essence of franchising.

At Main Entrance Franchise Consulting, we help aspiring franchisees steer this exact process. Learn more about our franchise consulting services and how we can guide you in creating a plan that wins approval.

What Makes a Franchise Business Plan Different?

Writing a franchise business plan example means working with a proven concept, not inventing a new one. This introduces unique elements:

- Franchisor Requirements: These are mandatory standards for everything from site selection to operational procedures.

- Brand Guidelines: You must adhere to strict standards for logo use, store design, and customer service to maintain brand consistency.

- Royalty Fees: Your financial projections must account for ongoing payments to the franchisor, typically a percentage of gross sales.

- The Franchise Disclosure Document (FDD): This legal document is the backbone of your plan, providing critical information on fees, financial performance representations (if available), and franchisor support.

- Proven Business Model: You gain a tested and refined concept, which means your plan focuses on execution, not experimentation.

- Less Creative Freedom: Major decisions about products, services, and pricing are dictated by the franchisor. Your plan must accept this structure.

- Focus on Local Execution: Your plan’s strength lies in detailing how you’ll adapt national marketing to your community, analyze local competitors, and build a local team.

The ‘4 P’s of Franchising’: A Framework for Your Plan

The ‘4 P’s of Franchising’ is a simple framework to ensure your plan covers all critical areas for success.

-

Product: This is the entire customer experience you’ll deliver. Your plan must detail how you’ll consistently provide the core offering, from quality control to presentation, showing you understand what makes the brand special.

-

Process: This refers to the standardized systems the franchisor provides—the “secret sauce” of franchising. It covers everything from how products are made to how inventory is managed. Your plan must show you can implement these processes efficiently.

-

People: This includes your entire team and their training. Outline your hiring strategy, training programs, and how you’ll create a positive work environment. Highlighting competitive wages can demonstrate a strategy for attracting and retaining top talent.

-

Profit: This is the financial model ensuring profitability for you and the franchisor. Detail your initial investment, ongoing expenses (including royalties), revenue forecasts, and path to ROI. This is where you prove the math works.

Deconstructing a Winning Franchise Business Plan Example

Let’s walk through a winning franchise business plan example section by section. We’ll use a hypothetical gourmet cookie franchise—let’s call it “Crumbl Cookies Las Vegas”—as our case study to see how successful franchisees structure their plans.

The Executive Summary: Your Plan’s First Impression

Written last but appearing first, the executive summary is a snapshot of your entire plan. It’s your elevator pitch to lenders and franchisors, so it must be compelling.

For our Crumbl Cookies Las Vegas franchise business plan example, the summary would include:

- Funding Request: State the exact amount needed, e.g., “Seeking $250,000 in financing to open a Crumbl Cookies franchise in Las Vegas, Nevada.”

- Business Objectives: Outline measurable goals, such as breaking even within 10 months and expanding to a second location within three years.

- Franchise Opportunity: Highlight the franchisor’s success. Crumbl Cookies grew from a single Utah bakery in 2017 to over 400 locations, backed by a massive social media following (5M+ on TikTok).

- Management Team: Emphasize your team’s relevant experience, such as local market knowledge and operational excellence.

- Financial Summary: Provide key projections grounded in the franchisor’s data (from the FDD), such as a projected net profit margin of 13.6% in Year 1.

- Mission Statement: A clear, authentic statement like, “To deliver fresh, gourmet cookies with exceptional service, fostering a vibrant community presence and a positive work environment.”

- Keys to Success: Identify critical factors, including leveraging Crumbl’s marketing, maintaining product quality, investing in employee satisfaction, and engaging with the local Las Vegas community.

Company & Franchise Opportunity Description

This section details the franchisor’s strength and your suitability as a franchisee.

Start with the franchisor’s history, noting Crumbl’s rapid growth and unique model of weekly rotating flavors combined with social media virality. Specify your legal entity (e.g., an LLC with dedicated owners). Explain why you chose this franchise, citing its proven profitability and alignment with your target demographic (e.g., Las Vegas’s growing population of young professionals and tourists).

Clearly state the franchise fees and royalty structure (e.g., 8% of gross sales) as outlined in the FDD. This transparency shows lenders you understand the full financial commitment. Finally, highlight the franchisor support and training you’ll receive, a key advantage of franchising. For more on maximizing these resources, see our franchise consulting services.

In-Depth Market & Competitive Analysis

Here, you prove you understand your specific local market, not just generic trends.

A PESTEL analysis examines external factors. For Las Vegas:

- Political/Legal: Nevada is a business-friendly, non-registration state for franchises, simplifying regulations.

- Economic: Las Vegas shows strong population growth and a robust tourism sector, creating a large customer base. A strategic decision to pay above Nevada’s minimum wage can be a competitive advantage in hiring.

- Social: A diverse, growing population of young professionals and millions of social-media-savvy tourists align perfectly with Crumbl’s marketing.

- Technological: The brand’s highly-rated app and tech-driven ordering system appeal to a modern customer base.

Your target market in Las Vegas includes local families and young professionals, plus the massive, ever-changing tourist demographic. The competitor analysis must be honest, assessing local dessert shops or high-end patisseries. Your competitive advantage is Crumbl’s national brand recognition, viral social media machine, and unique rotating menu that creates a “hype cycle” competitors can’t match. To go deeper, learn how to perform a SWOT analysis for your business.

A Detailed Marketing & Sales Strategy

This section outlines how you’ll attract and retain customers.

Start by leveraging the franchisor’s national marketing, tapping into Crumbl’s existing social media virality. Your local marketing plan adapts this to Las Vegas, perhaps with a dedicated local TikTok account engaging with community events and influencers. The social media strategy should center on the “hype cycle” of weekly rotating flavors, creating anticipation and driving repeat visits.

Customer acquisition tactics could include targeting tourists on the Strip, collaborating with local businesses for corporate catering, and building a campus presence. Customer retention relies on a loyalty program and exceptional service. Your sales forecast should be grounded in data from the FDD, projecting revenue based on the performance of comparable locations.

For more ideas, see our latest insights on franchise marketing.

The Operations & Management Plan

This section proves you can run the business day-to-day.

Outline the day-to-day workflow following the franchisor’s system, from dough prep to customer service protocols. The staffing plan should specify roles, schedules, and wages. Offering competitive pay (e.g., $14-19/hour vs. Nevada’s ~$12 minimum wage) is a strategy to reduce turnover and improve service. Include an organizational chart and management team bios highlighting relevant experience.

Detail quality control procedures for hygiene and product consistency. List the required technology and POS systems and describe your supplier relationships for equipment and ingredients, as dictated by the franchisor.

A Critical Franchise Business Plan Example for Financial Projections

This section must be realistic, detailed, and based on solid assumptions from the FDD.

- Startup Costs: List every expense before opening, including the franchise fee, build-out, equipment, initial inventory, and working capital. Crumbl, for instance, requires a minimum liquidity of $150,000.

- Funding Request: Specify the loan amount (e.g., $250,000 SBA loan) and your personal investment.

- Projected Statements: Include a 2-year projected operating statement (showing a path to profitability) and a 1-year projected cash flow statement (showing you can pay your bills).

- Break-Even Analysis: Calculate when the business will start generating profit, projecting a specific timeframe (e.g., 10 months).

- Key Assumptions: Be transparent about the data behind your projections, citing the FDD, local market growth rates, and average prices, while accounting for the 8% royalty fee.

- Projected Revenue and Profit Margins: Reference real-world data from the FDD, such as average location revenue and net profit margins, while using conservative estimates for your first year.

For a financial model custom to your opportunity, contact us for a sample plan with financials.

Legal Considerations & The Franchise Disclosure Document (FDD)

Understanding the legal framework is essential for protecting your investment.

Your plan should show you’ve reviewed the FDD, a 200+ page document detailing the franchisor’s history, fees, and legal obligations. Acknowledge the 14-day rule (you must have the FDD 14 days before signing) and the 7-day rule (for contracts). Summarize key franchise agreement terms like territory, duration, and renewal options.

List the local permits and licenses required in Las Vegas (business license, health permits, etc.). Note any state-specific regulations; for example, Nevada is a non-registration state, which simplifies the process. Finally, budget for insurance requirements as specified in the franchise agreement, including general liability, property, and workers’ compensation.

Leveraging Your Plan and Avoiding Common Pitfalls

Your franchise business plan example is more than a document for securing a loan—it’s your GPS for the entire franchise journey. The best franchisees use it as a living roadmap, pulling it out quarterly to measure actual performance against projections and guide strategic decisions.

Using the plan as a roadmap for growth means tracking your KPIs. Are you hitting revenue targets? Is your customer acquisition cost on track? For our Crumbl Las Vegas example, this could mean adjusting the local social media strategy or reallocating the marketing budget. Your plan also becomes a powerful tool when seeking financing for expansion, as a track record of meeting projections demonstrates you’re a solid bet.

If you want an experienced guide to help you maximize franchisor resources, find out what a franchise consultant does.

How Your Plan Secures Financing

A well-crafted business plan is your most powerful tool when speaking with lenders. It accomplishes several key goals:

- Demonstrates Viability: It shows you’ve done the research with detailed market analysis and realistic financial projections.

- Shows Repayment Ability: Your cash flow and profit projections prove you can pay back the loan.

- Details Use of Funds: Specific allocations for fees, build-out, and working capital build confidence.

- Proves Due Diligence: Citing FDD data and local demographic trends shows you are a serious operator.

- Reduces Perceived Risk: A thorough plan lowers risk for banks, which can lead to better loan terms.

Common Mistakes to Avoid When Writing Your Franchise Business Plan Example

Having reviewed hundreds of plans, I see the same mistakes repeatedly. Avoid these common pitfalls:

- Overly Optimistic Projections: Lenders are wary of revenue forecasts that far exceed the average performance of existing franchisees. Ground your numbers in the FDD and conservative assumptions.

- Neglecting Local Competition: Acknowledging local competitors and articulating your specific advantages (like Crumbl’s hype marketing vs. a traditional local bakery) is crucial.

- Not Customizing to Your Location: A generic plan won’t work. Your plan must reflect your specific market’s demographics, like Las Vegas’s unique mix of residents and tourists.

- Vague Marketing Strategies: Instead of “we’ll use social media,” detail your plan: “We will launch a local TikTok account for Crumbl Las Vegas to engage with the community and run targeted ads for tourists.”

- Underestimating Working Capital: Budget enough cash to cover expenses for the first several months before you reach profitability. This is a common reason new businesses fail.

- Ignoring the FDD: The Franchise Disclosure Document is a treasure map. Use its data on financial performance, fees, and support throughout your plan to create realistic projections.

Explore our franchise development services to get started with expert guidance, or contact us to ensure you get it right the first time.

Frequently Asked Questions about Franchise Business Plans

How is a franchise business plan different from a regular one?

A regular business plan is for creating a concept from scratch. A franchise business plan is for executing a proven concept in a new location. The franchisor has already done the heavy lifting of developing the brand and systems. Your plan’s focus shifts from innovation to implementation. It must incorporate the franchisor’s brand standards, operational systems, and royalty fees, while detailing how you’ll make their model successful in your specific local market.

How long should a franchise business plan be?

There’s no magic number, but a strong franchise business plan example is typically 20-40 pages, including financial statements. The goal is to be comprehensive enough to show you’ve done your homework, but concise enough that a busy lender or franchisor will actually read it. Quality and clarity always trump quantity. Don’t add fluff just to increase the page count.

Can I use a template for my franchise business plan?

Yes, a template is an excellent starting point. It provides a professional structure and ensures you don’t miss critical sections. However, a template is not a substitute for research. You must customize it with deep local market analysis, specific demographic data for your area, and financial projections based on the FDD and your market conditions. For our Crumbl Las Vegas example, that meant using data specific to Clark County, not generic national stats. A template is the skeleton; your research provides the muscle.

For a template customized for franchise businesses and expert guidance to help you fill it out correctly, Contact Main Entrance Franchise Consulting.

Chart Your Path to Franchise Ownership

You now have a clear picture of what goes into a winning franchise business plan example. This document is more than a hurdle to clear for a loan; it’s your strategic roadmap for launching, managing, and growing a profitable business. It’s the benchmark you’ll use to measure performance and make critical decisions.

By breaking down your market, operations, and financials, you transform an abstract opportunity into a tangible plan. This preparation is what separates franchisees who struggle from those who thrive.

One of the greatest advantages of franchising is that you’re not starting from zero. You leverage the franchisor’s proven systems, brand recognition, and support. Your job is to take these powerful tools and show exactly how you’ll execute their system brilliantly in your local market.

This process can feel overwhelming. That’s where expert guidance makes all the difference. At Main Entrance Franchise Consulting, we’ve walked hundreds of aspiring franchisees through this exact journey. We know what lenders look for and what franchisors require. Our client-focused approach means we tailor our support to your needs, with flexible compensation and no upfront costs—we succeed when you succeed.

Whether you need help crafting a business plan or stewarding the entire launch process, we’re here to help you chart your path with confidence.

Explore our franchise development services to get started, or Contact Us to discuss your franchise journey.