Why Smart Franchise Buyers Need a Clear Roadmap

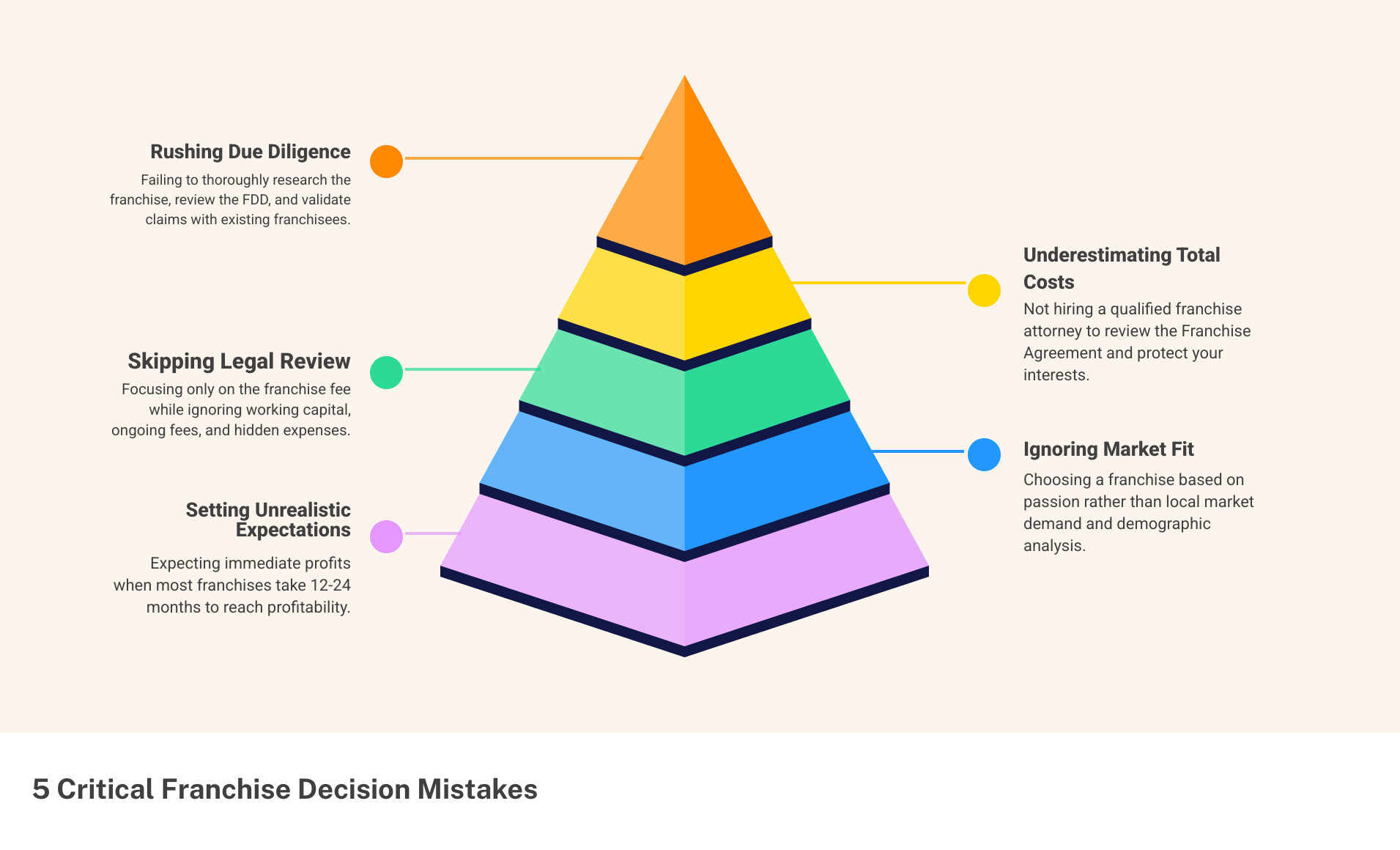

Franchise decision mistakes to avoid are numerous and costly—but they’re also entirely preventable with the right approach. Here are the five most critical errors that can derail your franchise investment:

- Rushing due diligence – Failing to thoroughly research the franchise, review the FDD, and validate claims with existing franchisees

- Underestimating total costs – Focusing only on the franchise fee while ignoring working capital, ongoing fees, and hidden expenses

- Skipping legal review – Not hiring a qualified franchise attorney to review the Franchise Agreement and protect your interests

- Ignoring market fit – Choosing a franchise based on passion rather than local market demand and demographic analysis

- Setting unrealistic expectations – Expecting immediate profits when most franchises take 12-24 months to reach profitability

The franchise industry is booming. According to the International Franchise Association’s 2024 Economic Report, more than 15,000 new franchises will open in the U.S. this year, bringing the total to 821,000 units. And for good reason—franchise failure rates are far lower than they are for independent startups. Some estimates suggest that 50% of franchises survive past their fifth anniversary, while only 4% of startups achieve the same milestone.

But these success rates don’t tell the whole story.

Behind every franchise failure is a preventable mistake. Maybe it was signing the Franchise Agreement without legal review. Perhaps it was underestimating the total capital needed by 30% or more. Or it could have been choosing a franchise based on personal passion instead of market viability.

The difference between franchise success and failure often comes down to the decisions you make before you sign.

The good news? These mistakes follow predictable patterns. And when you know what to look for, you can avoid them entirely.

That’s why I created this guide. I’m Max Emma, a Certified Franchise Executive and founder of Main Entrance Franchise Consulting, where I’ve helped hundreds of clients avoid franchise decision mistakes to avoid by providing unbiased, education-first guidance throughout the franchise findy process. My background as both a franchisor (BooXkeeping Franchise) and franchise consultant gives me a unique insider perspective on what works—and what doesn’t.

Mistake #1: Inadequate Research and Due Diligence

One of the most common franchise decision mistakes to avoid is rushing through the research and due diligence process. We understand the excitement of finding a promising franchise opportunity, but making emotional decisions without thorough investigation is a recipe for disaster. The foundation of your franchise’s success is built on careful, objective research. Many first-time franchisees stumble because they don’t dedicate ample time to truly understand the opportunity, the market, and the franchisor’s track record. This isn’t just about reading a brochure; it’s about becoming an expert on your potential future.

Skimming the FDD: A Critical Franchise Decision Mistake to Avoid

The Franchise Disclosure Document (FDD) is a comprehensive legal document mandated by the Federal Trade Commission (FTC). It’s designed to give you all the essential information about a franchise opportunity, but many aspiring franchisees treat it like a marketing brochure or a tedious legal read. This is a huge mistake. The FDD is your roadmap, outlining the franchisor’s management, background, fees, legal history, training, support, and initial investment costs.

We always advise our clients to pay close attention to specific items within the FDD:

- Item 3 (Litigation History): Reveals any lawsuits the franchisor or its executives have been involved in.

- Item 7 (Estimated Initial Investment): Provides a detailed breakdown of all startup costs, not just the franchise fee.

- Item 19 (Financial Performance Representations): If included, this can offer insights into the earnings potential of existing franchises. However, it’s crucial to remember that these are often best-case scenarios and not guarantees.

- Item 20 (Franchise Outlets and Franchisee Contact Information): This lists current and former franchisees—your golden ticket to real-world insights.

Skimming these sections, or worse, not having an experienced franchise attorney review them, leaves you vulnerable to unexpected obligations and potential pitfalls. The FDD contains details about initial fees, royalty structures, renewal terms, and territory rights that are often buried in legal jargon. Don’t let excitement blind you to the fine print. We can help you steer this complex document and ensure you understand every aspect. Find More info about our franchise buying process.

Failing to Validate with Current and Former Franchisees

The FDD gives you the franchisor’s perspective, but to get the unfiltered truth, you need to talk to the people who live and breathe the business every day: current and former franchisees. This is arguably the most crucial part of your due diligence. Franchisees will tell you what the franchisor promises versus what actually happens on the ground. They can share insights into the support they receive, the challenges they face, and the true profitability of their operations.

We encourage our clients to connect with at least 10-15 franchisees, and even seek out those who have struggled or left the system, as their experiences can be incredibly illuminating. Here are some key questions to ask:

- Is the franchisor support as advertised?

- How long did it take you to break even?

- What were your biggest unexpected costs?

- Knowing what you know now, would you make the same decision?

- What’s your relationship like with the franchisor?

- How effective is the training and support?

These conversations help you build a realistic picture and a valuable support network even before you start.

Ignoring Local Market and Location Viability

Even with a strong national brand, local market research is non-negotiable. A big brand name alone isn’t enough to guarantee success; your franchise still needs to thrive in its specific community. One of the critical franchise decision mistakes to avoid is assuming that what works elsewhere will automatically work in your chosen location. We emphasize conducting thorough local market research to analyze demographics, consumer spending habits, and local competition.

You need to understand if there’s sufficient demand for your franchise’s services or products in your chosen area. Factors like foot traffic, accessibility, and visibility are crucial, especially for retail or food concepts. Location can determine 80% of your success in retail/food franchising. We work with our clients to perform a comprehensive territory analysis, evaluate potential sites, and understand the implications of lease negotiations. Ignoring these local dynamics can lead to significant struggle, as a gas station’s revenue stream, for example, could be crippled by unforeseen road construction.

Mistake #2: Poor Financial Planning and Undercapitalization

Financial planning is often where excitement meets reality, and unfortunately, many aspiring franchisees underestimate the true financial commitment required. Poor financial planning and undercapitalization are among the most destructive franchise decision mistakes to avoid. Most business failures are due to running out of cash, not poor products or services. We help our clients create detailed financial projections to ensure they are adequately prepared for every stage of their franchise journey.

Undercapitalization: A Top Franchise Decision Mistake to Avoid

The franchise fee is just the tip of the iceberg. Many new franchisees make the mistake of focusing solely on this initial cost, completely missing the vast, submerged portion of the total investment. Beyond the franchise fee, you must account for build-out costs, equipment, initial inventory, grand opening marketing, and crucial working capital. We often see clients underestimate the need for working capital, which is the money needed to cover operational expenses (like payroll, rent, and utilities) until your business becomes profitable.

A common rule of thumb is to have 6-12 months of working capital readily available. This buffer is essential to sustain your business through its initial ramp-up phase without draining your personal finances or resorting to desperate measures. We recommend budgeting at least 20-30% more capital than initially estimated to cover unforeseen expenses. For example, while a franchise fee might be $45,000, the total investment could easily exceed $450,000 when you factor in build-out ($150,000), equipment ($100,000), initial inventory ($30,000), 12 months of working capital ($100,000), and marketing ($25,000).

Setting Unrealistic Profit Expectations

The “get rich quick” myth is another dangerous franchise decision mistake to avoid. While franchising offers a proven business model, it’s not a shortcut to instant wealth. Many new franchisees set unrealistic profit expectations, leading to disappointment and financial strain. We emphasize that most franchises take 12-24 months to reach profitability, and some may take longer depending on the business model and market conditions.

It’s vital to create your own financial projections, not just rely on the franchisor’s Item 19 (Financial Performance Representations), which are often based on the top-performing units. We guide our clients to calculate their break-even point and create worst-case scenario projections. This rigorous approach helps you understand the realistic timeline for profitability and ensures you have the financial runway to get there.

Overlooking Ongoing Fees and Expenses

The financial commitment doesn’t end after you open your doors. Overlooking ongoing fees and expenses is a common oversight. These recurring costs can significantly impact your cash flow if not properly budgeted for. Key ongoing expenses typically include:

- Royalty Fees: A percentage of your gross sales paid to the franchisor for continued use of the brand and system.

- National Marketing Fund Contributions: Fees paid into a pool for system-wide advertising.

- Local Marketing Spend: Your own budget for local advertising and community engagement.

- Technology Fees: For proprietary software, POS systems, and other tech support.

- Insurance: Business liability, property, and potentially other specialized insurance.

- Payroll: Wages, benefits, and taxes for your employees.

We help our clients perform a detailed financial analysis to create a realistic budget that accounts for all these costs, ensuring no financial surprises down the road.

Mistake #3: Neglecting Legal and Contractual Details

The Franchise Agreement is the backbone of your franchise investment, and neglecting its legal and contractual details is one of the most critical franchise decision mistakes to avoid. This isn’t just a formality; it’s a legally binding contract that outlines your rights, obligations, and the entire framework of your relationship with the franchisor. We always stress the importance of understanding every clause to protect your investment and future.

Not Hiring a Qualified Franchise Attorney

Believe it or not, some aspiring franchisees try to steer the complex legal language of the FDD and Franchise Agreement on their own. This is a colossal mistake. Franchise agreements are typically complex legal documents, often exceeding 200 pages, and are heavily tilted towards the franchisor. Without a qualified franchise attorney, you risk misunderstanding crucial clauses that could impact your business for years to come.

An attorney specializing in franchising can review these documents with you, explain the nuances, identify red flags, and advise you on potential negotiation points. They ensure you fully understand your rights and obligations, from operational requirements to termination clauses. Consulting a lawyer familiar with both federal and state franchising regulations is an actionable step to safeguard your investment. We connect our clients with trusted legal professionals who specialize in franchising to avoid Common Legal Mistakes When Buying A Franchise.

Misunderstanding Territory Rights

Territory rights are a foundational aspect of your franchise agreement, and misunderstanding them can lead to significant frustration and financial loss. We guide our clients to carefully examine whether their territory is exclusive or non-exclusive. An exclusive territory means no other competing franchise can open within your defined area, offering a degree of protection. Non-exclusive territories, however, mean other franchisees could operate nearby, increasing competition.

Beyond exclusivity, you need to understand:

- Protected Territory: How is your area defined, and what protections are in place against encroachment from other franchisees or even the franchisor itself?

- Carve-outs: Are there specific locations within your territory (e.g., airports, stadiums, universities) where the franchisor retains the right to operate or grant franchises to others?

- Online Sales Policies: How are online sales handled? Can the franchisor sell directly to customers in your territory, or can other franchisees sell into your area via e-commerce?

We’ve seen cases where a client thought they had a protected territory, only to find an aggressive franchisee from a neighboring area selling within their perceived boundaries. Clarifying these details upfront is essential to prevent disputes and ensure your business has the space it needs to grow.

Failing to Plan Your Exit Strategy

While it might seem counterintuitive to think about leaving a business before you even start, failing to plan your exit strategy is a critical franchise decision mistake to avoid. A franchise is a long-term commitment, and life happens. Understanding the terms and conditions for exiting the business will save you immense stress and potential financial penalties down the line.

We help our clients review clauses related to:

- Renewal Terms: What are the conditions for renewing your franchise agreement at the end of its term? Are there fees, and what are the requirements?

- Transfer Rights and Fees: If you decide to sell your franchise, what is the process? Does the franchisor have to approve the new owner, and are there transfer fees?

- Termination Clauses: Under what circumstances can either party terminate the agreement, and what are the financial implications?

- Right of First Refusal: Does the franchisor have the right to buy your franchise back before you can sell it to a third party?

Planning for your exit strategy provides peace of mind and ensures you maintain control over your investment, even if your plans change years down the road.

Critical franchise decision mistakes to avoid After You Sign

Signing the Franchise Agreement is just the beginning of your entrepreneurial adventure. Many franchise decision mistakes to avoid occur after you’ve officially become a franchisee. Navigating these post-purchase pitfalls requires diligence, a willingness to learn, and a strategic mindset. The goal is long-term success, and that means avoiding operational errors and adopting the right management approach.

Trying to Reinvent the Wheel

One of the biggest reasons people invest in a franchise is to leverage a proven business model. Yet, a common mistake we see is new franchisees trying to “reinvent the wheel.” They might think their way is better, or they want to put their own unique spin on things. However, a franchise system has been developed through years of trial and error, refining processes, marketing strategies, and operational standards. Deviating from the operations manual or the franchisor’s established system is a critical franchise decision mistake to avoid.

This “maverick” mentality can lead to operational inefficiencies, compromise brand consistency, and negatively impact quality control. Franchisors develop proven business models through trial and error; ignoring these systems can lead to conflicts with the franchisor and even potential violations of your franchise agreement. We always advise our clients to master the system first, learn why it works, and only then, if necessary, suggest improvements through the proper channels.

Failing to Leverage Franchisor Support

You’re paying royalty fees for a reason: ongoing support and training. Failing to leverage this support is like buying a car with roadside assistance and never calling when you have a flat tire. Franchisors are obligated to provide a network of assistance, including:

- Ongoing Training: For you and your staff, covering new products, services, or operational updates.

- Field Support: Visits from franchise representatives to help you optimize operations, marketing, and sales.

- Marketing Resources: Access to national campaigns, local marketing templates, and guidance.

- Peer Network: Opportunities to connect with other franchisees, share best practices, and learn from their experiences.

One of the advantages of franchising is that you’re in business for yourself, but not by yourself. Don’t “go it alone” when facing challenges or seeking growth opportunities. Actively participating in training programs, attending conventions, and communicating regularly with your franchisor are crucial steps to success. Working with professionals like those who hold the Advantages of Working with a Certified Franchise Executive (CFE) can help you maximize this support.

Micromanaging Instead of Leading

As a franchise owner, you’ll transition from being an individual contributor to a leader. A significant franchise decision mistake to avoid is micromanaging your team instead of leading them. Micromanaging can make employees feel overwhelmed and anxious, decreasing performance, fostering dependency, leading to burnout, and resulting in high staff turnover. Hiring a new team member costs companies nearly $5,000 on average, so high turnover is a costly problem.

Instead, we encourage our clients to focus on hiring the right team members, providing thorough training, and empowering them to excel within the established system. Building a positive workplace culture where employees feel valued and trusted leads to higher productivity, better customer service, and a stronger brand reputation. Customers are more likely to vent than to recommend, so a happy, empowered team is your best defense against negative experiences and your best asset for creating loyal customers. Lead with vision, delegate effectively, and foster an environment where your team can thrive.

Frequently Asked Questions about Avoiding Franchise Mistakes

What is the single biggest mistake a new franchisee can make?

The single biggest mistake a new franchisee can make is insufficient due diligence and rushing the process. This encompasses not fully understanding the FDD and Franchise Agreement, failing to validate the opportunity by speaking with a significant number of existing franchisees, and making an emotional decision without objective research. These omissions can lead to unexpected financial burdens, legal disputes, and operational challenges that could have been identified and avoided early on.

How can I tell if a franchise brand is trustworthy?

To determine if a franchise brand is trustworthy, look for several key indicators. First, connect with existing and former franchisees (as listed in Item 20 of the FDD) and ask candid questions about their experience, support, and profitability. A franchisor with high franchisee satisfaction and low turnover is a good sign. Second, review Item 3 of the FDD for any significant litigation history. A clean record suggests reliability. Third, evaluate the franchisor’s financial stability; a high default rate for SBA loans taken out by its franchisees, for example, could indicate problems. Finally, consider the brand’s overall reputation and market presence, ensuring it aligns with your long-term goals.

Do I really need a franchise consultant if the service is free?

Yes, absolutely! While some services might be free, the value a qualified franchise consultant brings is immense. We act as your unbiased advocate, providing industry expertise, helping you understand complex documents like the FDD, and guiding you through the entire findy process. We have access to a vast network of vetted franchise brands and can help you identify opportunities that align with your goals, budget, and lifestyle—something you might miss trying to steer the market alone. Our compensation comes from the franchisors, allowing us to offer our clients expert consulting and a guided franchise buying journey with total transparency, ensuring you make an informed choice without any additional cost to you.

Your Path to a Confident Franchise Decision

Navigating the franchise landscape can feel like a minefield, but with the right knowledge and guidance, you can confidently avoid the most common franchise decision mistakes to avoid. Our methodical approach helps you move from initial interest to successful ownership, building confidence every step of the way. We believe in providing education-first support, ensuring you understand every nuance of your potential investment.

We’re here to help you make an informed choice, aligning your personal and financial goals with a franchise opportunity that’s right for you. Don’t start on this journey alone. Let us be your guide through the franchise minefield, helping you make a decision you’ll celebrate for years to come.

Take the next step in your journey with our proven framework: How to Choose the Right Franchise Framework.