Why Your Franchise Exit Strategy Deserves Early Attention

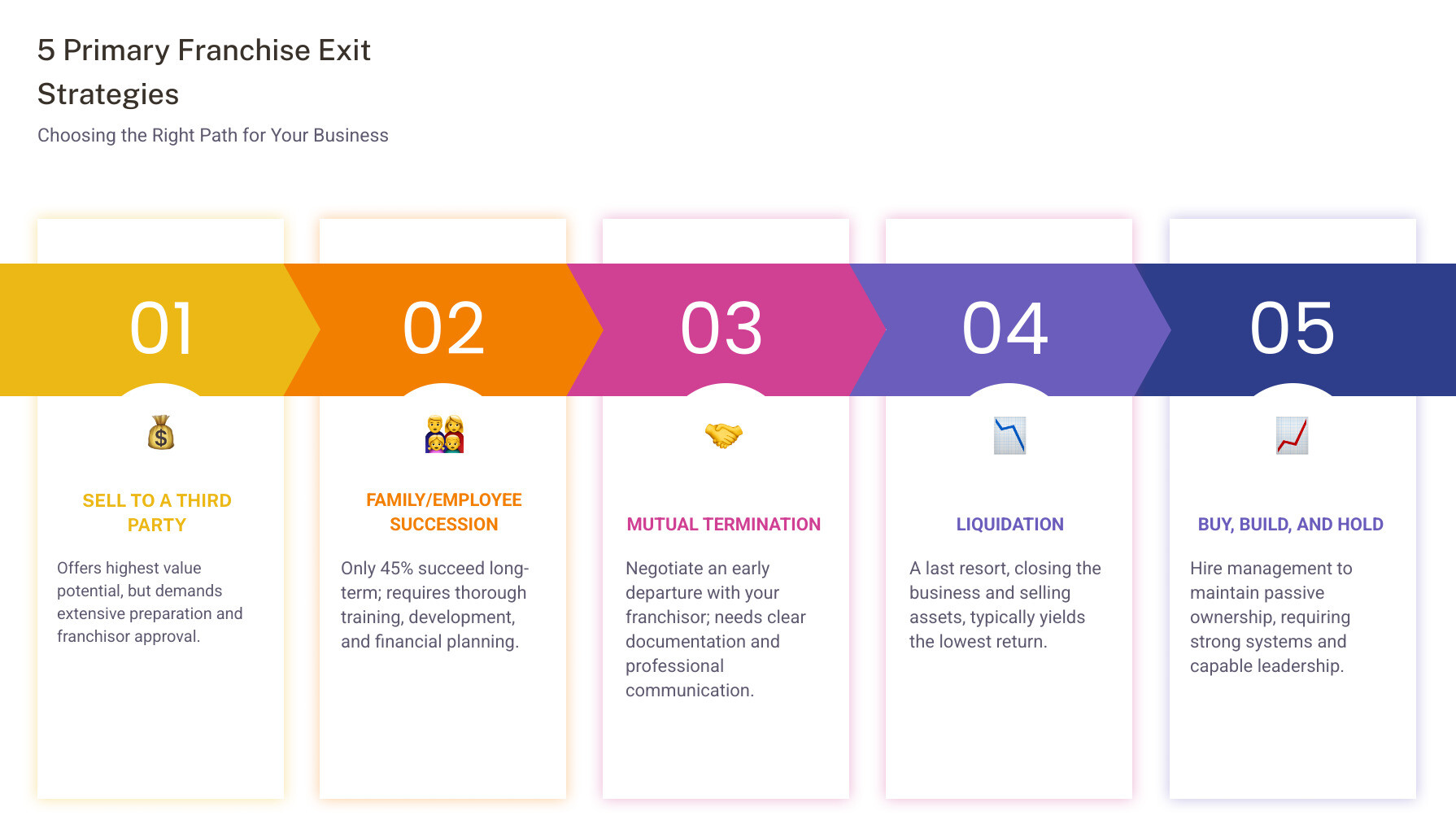

A franchise exit strategy is your plan for leaving your business. The five primary paths are:

- Selling to a Third Party: List and sell your business to an approved buyer.

- Family Succession: Transfer ownership to a family member or key employee.

- Mutual Termination: Negotiate an early exit agreement with your franchisor.

- Liquidation: Close the business and sell off assets.

- Buy, Build, and Hold: Hire management and maintain passive ownership.

The numbers tell a sobering story: nearly 45% of franchisees exit within seven years. With franchise failure rates between 20-50% and rising business costs, having a clear exit path isn’t optional—it’s essential.

Here’s what makes exit planning counterintuitive: the best time to think about leaving is before you even start. Just as you consider a house’s resale value, you must understand how you’ll eventually exit your franchise. Your exit strategy shapes every decision, protecting your investment and maximizing your return. A poor plan—or no plan—can cost you hundreds of thousands in lost value and legal fees.

I’m Max Emma, a Certified Franchise Executive. At Main Entrance Franchise Consulting, I’ve successfully guided countless franchise owners through the complex exit process, helping them build, scale, and plan for profitable sales and smooth transitions.

Franchise exit strategy word roundup:

Why Every Franchisee Needs an Exit Strategy from Day One

When you’re launching a franchise, thinking about leaving feels unnatural. But a franchise exit strategy isn’t about pessimism; it’s about protecting your future and building wealth. The decisions you make on day one—from location to operations—directly impact what you’ll walk away with years later.

Financial realities make this planning critical. In 2024, 86% of franchisees reported rising business costs, squeezing profit margins. An exit strategy helps you adapt to market shifts and evolving consumer preferences. Life also happens—health issues, new job offers, or changing priorities can trigger an exit. A well-crafted plan is your insurance policy for securing the 4 Freedoms That Motivate Successful Franchise Owners: Time, Money, Relationship, and Purpose.

Common Triggers for a Franchise Exit

Understanding these common triggers helps you plan proactively:

- Unprofitability: With franchise failure rates between 20-50%, ongoing losses can make an early exit the smartest financial move.

- Burnout: The long hours and constant problem-solving can drain your energy and passion.

- Personal Circumstances: Health challenges, family needs, or a spouse’s job transfer don’t follow a business plan’s timeline.

- New Opportunities: A new passion or business venture may align better with your evolving goals.

- Favorable Market Conditions: A booming economy might offer a chance to sell for a premium.

- Franchisor Relationship Issues: A deteriorating partnership due to lack of support or disputes can make continuing untenable.

The Benefits of Proactive Exit Planning

Planning years in advance offers enormous payoffs:

- Maximize Business Value: Thinking like a future buyer from day one helps you build a more valuable, transferable business.

- Ensure a Smooth Transition: Planning protects your employees, customers, and successor from chaos.

- Mitigate Risks: A solid plan helps you anticipate legal pitfalls, tax implications, and financial challenges, potentially saving you thousands.

- Achieve Personal Goals: Your franchise should be a vehicle for your dreams, not an obstacle. An exit plan ensures this.

- Maintain Your Reputation: A graceful, professional exit protects your standing in the community and franchising world.

- Reduce Stress: Knowing you have options brings remarkable peace of mind, letting you focus on running your business today with confidence about tomorrow.

Decoding Your Exit Options: Choosing the Right Path

Your franchise exit strategy can take several forms, each with unique advantages and challenges. Understanding these options early gives you the power to shape your business with the end in mind.

Primary exit paths include selling to a third party, a family succession plan, a Management Buyout (MBO), mutual termination with your franchisor, liquidation (a last resort), or a buy, build, and hold strategy where you step back into a passive ownership role.

Selling Your Franchise

Selling your franchise is often the most financially rewarding exit, but it requires careful preparation. Think of it like staging a house: you need immaculate financial records, streamlined operations, and a business that looks attractive on paper and in practice. Finding a buyer may involve your franchisor’s network or a business broker.

Your franchise agreement gives your franchisor the right to approve or reject any potential buyer, ensuring they meet the system’s standards. The negotiation process covers price, financing, and the length of your transition support. Finally, be prepared for due diligence, where the buyer will scrutinize every aspect of your business. Transparency and organized documentation are key to building buyer confidence. You can gain valuable insights by exploring resources on franchise buying.

Transitioning to Family or Employees

Passing your business to a family member or a key employee can create a meaningful legacy, but this franchise exit strategy is challenging. Statistics show that only 45% of family transfers succeed long-term, often due to inadequate preparation and unclear expectations.

Success hinges on three factors:

- Successor Readiness: Does your chosen successor have the skills, passion, and commitment to run the business? Start training them years in advance.

- Financial Arrangements: Will it be a gift, a sale, or a hybrid? These decisions have significant tax and family implications. Professional legal and financial advice is essential.

- Emotional Dynamics: Mixing family and business is complex. An objective third-party advisor can help facilitate conversations and ensure fairness.

Negotiating a Departure with Your Franchisor

If selling isn’t feasible due to financial struggles or personal circumstances, negotiating a departure with your franchisor is a viable option. Approach the conversation professionally, focusing on business reality, not blame.

Present your case with solid financial documentation and demonstrate the good-faith efforts you’ve made to succeed. Propose mutually beneficial solutions like an early termination with a reduced fee, resale support from the franchisor, or a buyback. A cooperative exit protects both parties from legal disputes and reputational damage. I strongly recommend consulting with a franchise attorney before approaching your franchisor to understand your rights and negotiating leverage.

The Ultimate Guide to Implementing Your Franchise Exit Strategy

Once you’ve chosen your franchise exit strategy, implementation begins. This process requires careful planning and execution, much like training for a marathon. The most successful exits come from franchisees who proactively prepare their business well in advance.

As noted in broader business discussions about different practice exit strategies, the core principle is universal: preparation is everything.

Step 1: Master Your Franchise Agreement

Your franchise agreement is the single most important document for your exit. It dictates nearly everything about how you can leave. Scrutinize these critical clauses:

- Termination Clauses: Define the conditions and penalties for ending the agreement early.

- Transfer Rights & Fees: Outline restrictions on who can buy your franchise and the fees charged for the transfer.

- Right of First Refusal: Gives the franchisor the option to buy your business on the same terms as an outside offer.

- Non-Compete Clauses: Restrict your ability to operate a similar business after you exit.

- Personal Guarantees: These obligations on leases or loans don’t disappear when you sell and must be formally resolved.

A qualified franchise attorney can help you steer these complexities. Understanding what is a franchise consultant can also clarify how professionals can assist with these challenges.

Step 2: Maximize Your Business Value for a Profitable Franchise Exit Strategy

To achieve a profitable exit, make your business irresistible to buyers. This means demonstrating stability, growth potential, and an easy transition. Start this process one to three years before your intended sale.

- Financial Housekeeping: Maintain immaculate, transparent financial records and clean tax returns for the past 3-5 years.

- Streamline Operations: Document all Standard Operating Procedures (SOPs) to show you have a turnkey system.

- Build a Strong Team: A business that can run without you is far more valuable. Delegate responsibilities and build a solid management structure.

- Improve Curb Appeal: Ensure your premises are well-maintained and your equipment is up-to-date.

Step 3: Determine Your Franchise’s Worth

You can’t execute a profitable franchise exit strategy without knowing what your business is worth. The most common method is a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Franchises typically sell for 2.5 to 3.5 times annual EBITDA—a premium over non-franchise businesses.

Engage a professional business appraiser for an objective valuation. This helps set a realistic asking price and validates your value to buyers. Also, research market comparables by looking at recent sales of similar franchise units. An objective valuation manages expectations and provides a basis for negotiation.

Step 4: Execute the Sale and Transition

This is the final phase where your preparation pays off. Create a compelling prospectus for marketing your business, and leverage your franchisor’s network or a specialized business broker to find qualified buyers. The franchisor will have strict criteria for buyers, and you should too.

Negotiations will cover price, financing, and the transition period. Keep emotions out of it and aim for a mutually beneficial deal. Throughout the process, communicate clearly with your employees, customers, and franchisor. Finally, be prepared to provide post-sale training and support to ensure a seamless handover. Working with a team of professionals, including those with a Certified Franchise Executive (CFE) designation, is critical during this phase.

Avoiding Pitfalls: Legal, Financial, and Reputational Risks

Exiting a franchise without a well-thought-out franchise exit strategy can lead to legal battles, unexpected tax bills, and a damaged reputation. With proper planning and professional guidance, you can steer around these hidden landmines. The expertise of a Certified Franchise Executive (CFE) is invaluable in protecting your investment.

Understanding the Legal and Tax Consequences

Before you make any moves, understand these critical legal and tax issues:

- Capital Gains Tax: Selling your franchise for a profit is a taxable event. A tax professional can help you structure the sale to minimize this burden.

- Personal Guarantees: Selling your business doesn’t automatically release you from personal guarantees on leases or loans. You must negotiate their release as part of the deal.

- Non-Compete Clauses: Most agreements restrict you from opening a competing business for a set time and distance. Understand these limitations before you exit.

Consulting with tax professionals and franchise attorneys early in the process is not optional—it’s a crucial step that can save you tens of thousands of dollars and prevent future liabilities.

What Happens if You Break Your Agreement Without a Franchise Exit Strategy?

Walking away from your franchise agreement improperly is a recipe for disaster. The consequences are severe:

- Lawsuits: The franchisor can sue you for breach of contract, leading to expensive and lengthy legal battles.

- Financial Penalties: Your agreement likely includes liquidated damages clauses, which could require you to pay the franchisor’s lost royalties for the remainder of your term.

- Loss of Investment: You will forfeit your franchise fee and any equity you’ve built in the business.

- Damage to Credit: Judgments and unpaid debts will appear on your credit report, making future financing difficult.

- Reputational Harm: A history of breaching contracts can close doors to future business ventures, as word travels fast in the franchising community.

A thoughtful, legally sound franchise exit strategy is essential protection for your financial future and professional reputation.

Frequently Asked Questions about Franchise Exits

How early should I start planning my franchise exit?

The best time to think about your exit is before you even buy a franchise. This forward-thinking approach separates successful franchisees from those who get backed into a corner. A concrete franchise exit strategy should be developed 3-5 years before your target exit date. This timeline gives you enough runway to optimize operations, clean up financials, and build a business that commands a premium price.

What is the franchisor’s role in the exit process?

Your franchisor is a key player, not a bystander. Their role is defined in the franchise agreement. They must typically approve any new buyer to protect the brand. Many also have a right of first refusal, giving them the first option to buy your unit. They also facilitate the transfer paperwork and new owner training. Collaboration and open communication with your franchisor are essential for a smooth, compliant process.

Can I sell my franchise for more than I paid for it?

Absolutely. This is the goal of a well-executed franchise exit strategy. If you’ve built a profitable business with strong cash flow and documented systems, you are selling a valuable, turnkey asset. Franchises often sell for 2.5 to 3.5 times their annual profitability (EBITDA), a premium over independent businesses. This is because buyers are paying for a proven system, brand recognition, and ongoing support, which reduces their risk. Your final sale price will depend on your unit’s performance, market conditions, and how well you’ve prepared the business for sale.

Conclusion: Secure Your Legacy with a Strategic Farewell

The most successful franchise owners think about their ending from the beginning. Your franchise exit strategy isn’t a distant concern; it’s the foundation that protects your investment and shapes your journey from day one.

Proper planning transforms a potentially stressful departure into a smooth, profitable transition. It involves understanding your franchise agreement, continuously building value in your business, and knowing when to ask for help. Planning your exit actually makes you a better owner today, as every decision is geared toward creating something of lasting value.

Don’t leave your most significant investment to chance. Start planning now, even if your exit is years away. Build your business with tomorrow’s buyer in mind and surround yourself with experienced professionals.

At Main Entrance Consulting, we help franchise owners steer every chapter of their business story, from the initial investment to a successful farewell. This isn’t just about closing a chapter; it’s about writing an ending you can be proud of. Let’s work together to develop your franchise for a successful future and ensure you exit on your terms, with your goals achieved and your legacy secured.