Why Learning How to Write a Franchise Business Plan is Your First Step to Success

How to write a franchise business plan is a vital skill for any aspiring franchise owner. This document is your roadmap to success and a critical tool for securing financing and franchisor approval.

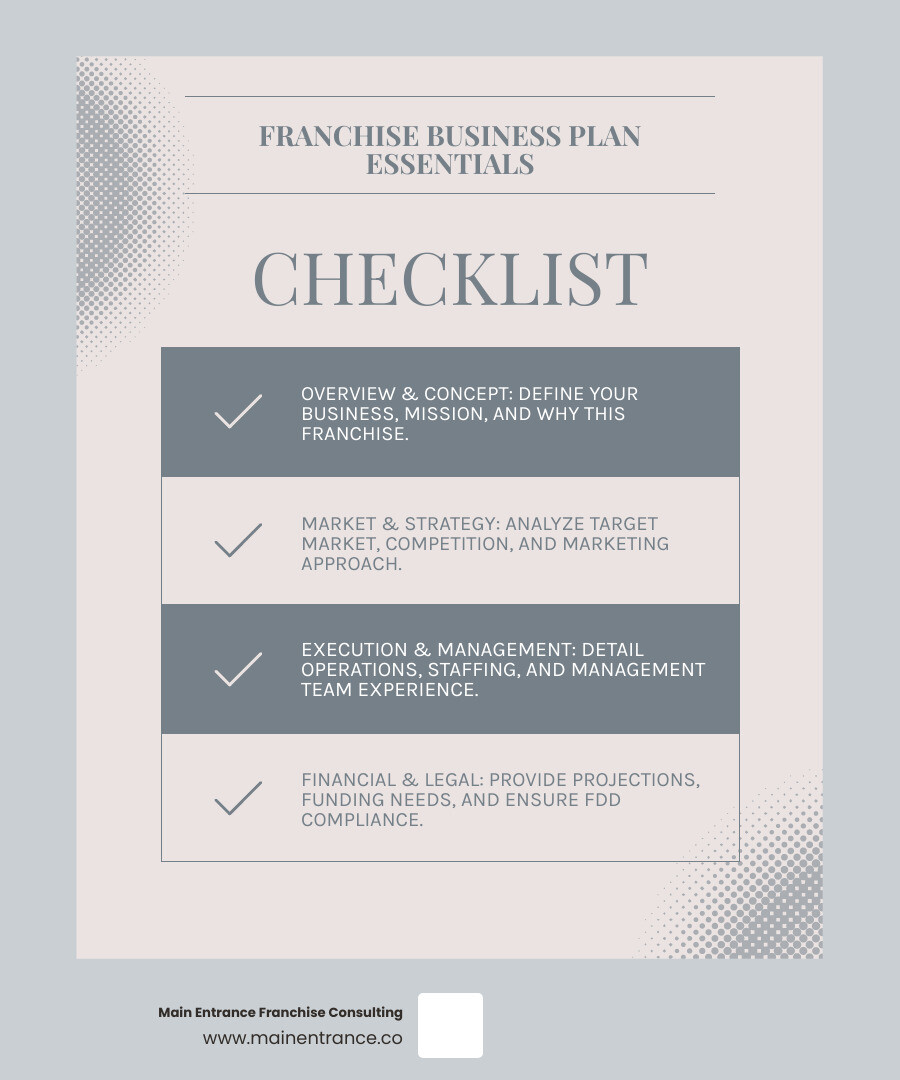

Here’s how to write a franchise business plan in 8 essential steps:

- Executive Summary – Your business concept, funding needs, and key objectives

- Company Description – Your franchise choice and why it fits your goals

- Market Analysis – Industry trends, target customers, and local competition

- Operations Plan – Daily workflows, staffing, and franchisor requirements

- Marketing Strategy – How you’ll attract customers using brand recognition

- Financial Projections – Startup costs, revenue forecasts, and break-even analysis

- Management Team – Your experience and organizational structure

- Legal Considerations – FDD compliance and franchise agreements

A franchise business plan differs from a traditional startup plan because it leverages an established brand, proven systems, and franchisor support. Instead of creating a new concept, you’re showing how you’ll execute a successful model in your local market.

The plan is crucial for securing financing, as lenders need to see realistic projections and a deep understanding of the business. It also serves as your strategic guide for the first few years, helping you set goals and track progress.

I’m Max Emma, a Certified Franchise Executive who has built successful franchise systems and guided over 100 brands. My experience has taught me what makes a compelling franchise business plan that gets approved by lenders and franchisors.

Foundations: Understanding Your Franchise Business Plan

Your franchise business plan is your roadmap to success. Unlike starting from scratch, how to write a franchise business plan involves adapting a proven system with existing market validation and operational guidelines to your local market.

A franchise plan is unique because it leverages an established brand, operating procedures, and marketing strategies. Your plan demonstrates how you’ll execute this tested system in your territory.

When should you write your plan? The ideal time is after choosing a franchise but before signing agreements or applying for financing.

Your franchisor is a key ally, providing data on market trends, customer demographics, and financial performance. Many offer business plan templates to help structure your document. Lenders and franchisors both rely on your plan. Lenders want to see profit potential, while franchisors need proof that you understand and are committed to their system.

As the U.S. Small Business Administration notes, a business plan is a formal written document outlining your goals. For franchise financing, a comprehensive plan is better than a lean startup approach.

If you’re still exploring options, our Franchise Buying Services can help you find opportunities matching your goals.

The Critical Role of the Franchise Disclosure Document (FDD)

The Franchise Disclosure Document (FDD) is a comprehensive legal document containing everything you need to know about the franchise, from its history to your obligations. It contains 23 required sections covering topics like initial investment costs, ongoing fees, and training.

Item 19 is particularly valuable for financial projections, as it may contain financial performance representations from existing franchisees, offering realistic benchmarks for revenue forecasts.

The FTC’s Franchise Rule requires franchisors to provide the FDD at least 14 days before you sign any agreement. You must review this document carefully to make an informed decision. Using FDD data means incorporating the franchisor’s requirements, fees, and support systems into your business strategy.

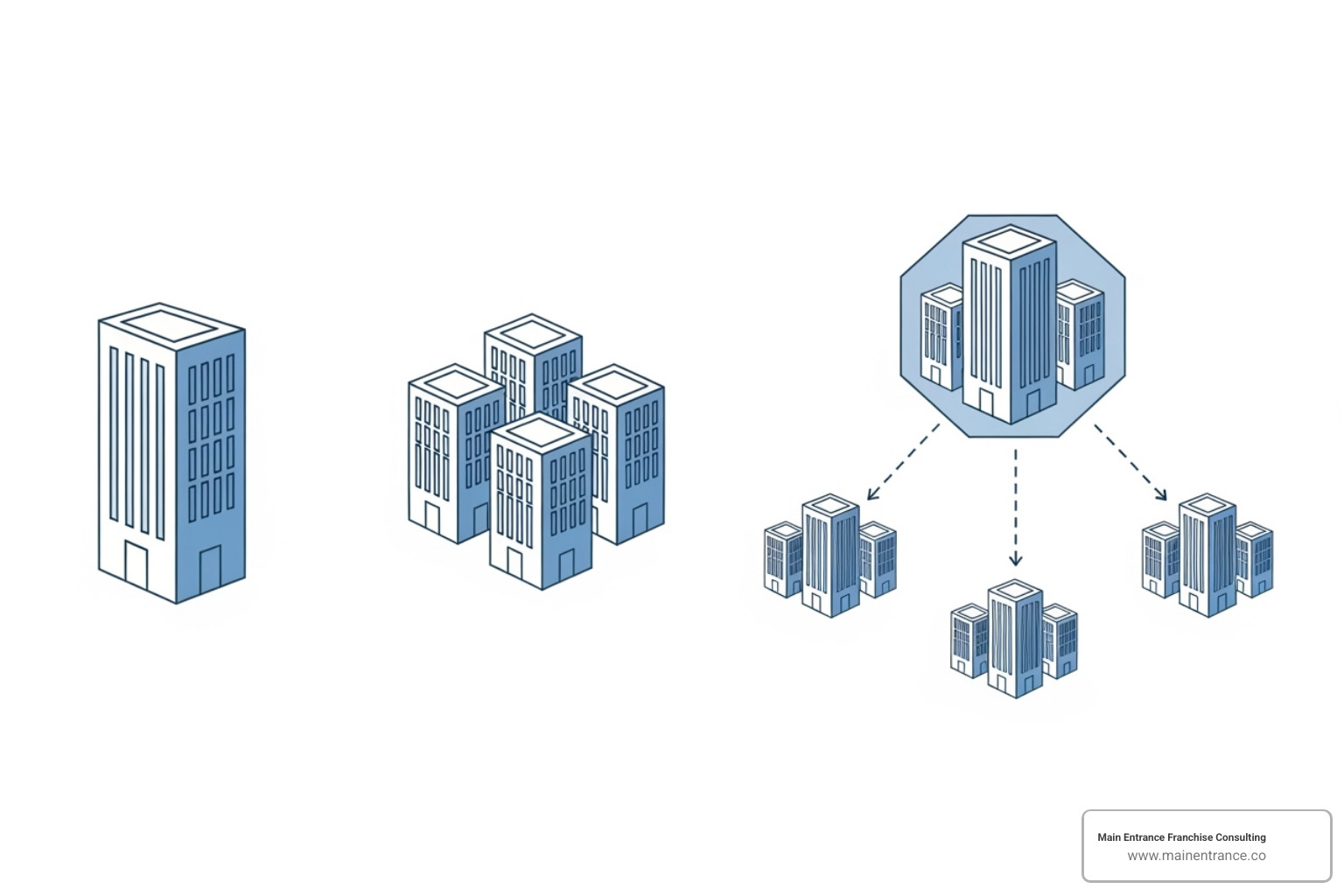

Understanding Different Franchise Models

Your chosen franchise model impacts your investment and growth strategy.

- Single-unit franchises: The most common starting point, involving the right to operate one location. This model offers hands-on control and lower startup costs.

- Multi-unit franchises: Allows operation of several locations, offering greater revenue potential but requiring more capital and stronger management skills.

- Master franchises: The highest level of ownership, granting rights to develop an entire region and sub-franchise to other operators. This requires substantial investment and business acumen.

- Job franchises: Typically service-based, home-based, or mobile businesses (e.g., cleaning, pet grooming) with lower initial investment.

- Business format franchises: Complete business systems with established branding and support, like fast-food restaurants or retail stores.

When writing your plan, you must clearly explain the type of franchise you’re pursuing. Choosing the right model depends on your capital, experience, risk tolerance, and long-term vision.

How to Write a Franchise Business Plan: A Step-by-Step Guide

This section breaks down the writing process into manageable steps, ensuring you cover every detail lenders and franchisors look for.

1. The Executive Summary: Your Plan’s First Impression

The Executive Summary is the elevator pitch for your business plan. It’s the first thing readers see and should be compelling. Though it appears first, it’s best to write it last.

Key components include:

- Business Concept and Mission: Introduce the franchise brand, its offerings, and your mission for the location.

- Franchise Opportunity Summary: Explain what the franchise does and the needs it meets in your local market.

- Key Objectives: State your short-term and long-term goals (e.g., “Achieve profitability within 18 months”).

- Financial Highlights: Provide a snapshot of projected revenue, profit margins, and funding needs.

- Funding Request: Clearly state the capital you are seeking and its intended use.

- Strategy for Success: Briefly outline how you’ll execute the franchise model in your market.

2. Company and Franchise Description

This section introduces your specific franchise venture. It should describe the franchise, its suitability for your market, and why you are the right person to run it.

Include the following:

- Business’s Legal Structure: Specify if you’ll operate as an LLC, corporation, or other entity.

- Franchise Brand’s History: Overview the franchisor’s successes and reputation.

- Products and Services Overview: Detail the core offerings, supply chain, and what makes them stand out.

- Competitive Advantages: Highlight what differentiates the franchise (e.g., unique service, technology).

- Why You Chose This Franchise: Share your personal motivation to demonstrate commitment.

3. Market Analysis: Proving Your Viability

Your market analysis proves there is a viable customer base for your franchise in your chosen location. You are strategically placing a proven concept where it can thrive.

This section should cover:

- Industry Overview and Trends: Provide a snapshot of the broader industry, including growth projections and key trends.

- Target Market Demographics: Be specific about your ideal customers’ age, income, location, and lifestyle. Knowing your NAICS code can help with this analysis.

- Local Market Conditions: Analyze your proposed site’s demographics, traffic patterns, economic health, and regulatory environment.

- Competitive Analysis: Identify direct and indirect competitors, their strengths and weaknesses, and how your franchise will capture market share.

- SWOT Analysis: Outline the Strengths, Weaknesses, Opportunities, and Threats for your specific franchise location to show a realistic understanding of the business environment.

4. Operations and Management Plan

This section details the day-to-day execution of the franchise, proving you can effectively run the franchisor’s proven system.

Outline the following:

- Organizational Structure: Clarify roles and responsibilities within your team.

- Management Team’s Experience: Highlight the qualifications of yourself and key personnel.

- Staffing Plan (Hiring and Training): Detail employee numbers, required qualifications, and your recruitment and training process.

- Daily Operations Workflow: Describe the typical flow of business activities, from opening to closing.

- Adhering to Franchisor’s Standard Operating Procedures (SOPs): Emphasize your commitment to following the franchisor’s established SOPs for consistency.

- Technology and Equipment: List the required technology and equipment, such as POS systems or specialized tools provided by the franchisor.

5. Marketing and Sales Strategy

A robust marketing plan is needed to attract customers to your location. This section shows how you’ll leverage the brand’s power while executing local initiatives.

Your strategy should include:

- Leveraging Brand Recognition: Capitalize on the brand’s reputation and national marketing efforts.

- National vs. Local Marketing: Detail your local marketing initiatives, such as community events or promotions.

- Digital Marketing (Social Media, SEO): Explain your online strategy for social media, local SEO, and email marketing.

- Customer Acquisition and Retention: Describe how you’ll attract new customers and keep them coming back, using methods like loyalty programs.

- Sales Process and Goals: Outline your sales approach, set realistic goals, and define key performance metrics.

6. Financial Projections: The Heart of Your Plan

This is the most critical section for securing financing. It demonstrates your understanding of costs and profitability with realistic, well-supported numbers.

You need to include:

- Initial Investment: Outline all estimated startup costs, including franchise fees, equipment, marketing, and working capital.

- Startup Costs Breakdown: Provide a detailed list of all expenses, including leasehold improvements, inventory, and professional fees. Crucially, account for enough working capital to cover expenses until profitability.

- 3-5 Year Financial Projections: Project future performance based on realistic assumptions and data from the franchisor’s FDD (Item 19). This includes:

- Projected Income Statements (P&L): Show anticipated revenues, costs, and net profit.

- Cash Flow Statements: Detail the movement of cash to show liquidity.

- Balance Sheets: Provide a snapshot of assets, liabilities, and equity.

- Break-Even Analysis: Calculate the point where total revenues equal total costs.

- Key Assumptions: State the assumptions behind your projections (e.g., customer spend, conversion rates) to build credibility.

Legalities, Best Practices, and Avoiding Pitfalls

This section covers crucial rules and common mistakes to ensure your plan is comprehensive, compliant, and realistic.

Key Franchise Rules and Concepts to Know

The Federal Trade Commission (FTC) has established guidelines to protect prospective franchisees. Understanding these is essential when learning how to write a franchise business plan.

- The FTC Franchise Rule: This is the foundation of franchise regulation, ensuring franchisors provide complete, honest information about their business opportunity.

- The 14-day rule: This rule requires franchisors to give you the Franchise Disclosure Document at least 14 days before you sign anything or pay money. This provides a mandatory cooling-off period for review. The 14-day rule is designed to prevent rushed decisions.

- The 7-day rule for contracts: You must receive all final contracts at least seven days before signing, giving you and your lawyer time to review the fine print.

- The 4 P’s of Franchising: Guide your plan with these pillars: Product (what you sell), Process (how you deliver it), People (your team), and Profit (the financial model).

How to write a franchise business plan that avoids common mistakes

Avoiding predictable traps can be the difference between approval and rejection.

- Overly optimistic projections: Lenders and franchisors can spot unrealistic numbers. Build in realistic timelines for growth.

- Ignoring local competition: Acknowledge and address the specific competitive landscape in your chosen location, not just the national brand’s dominance.

- Vague marketing plans: Instead of saying you’ll “use social media,” detail which platforms, your budget, and expected results.

- Underestimating working capital: Calculate startup costs accurately, but also include enough cash to cover at least six months of operating expenses.

- Not tailoring the plan: Your plan must reflect the unique demographics, economic conditions, and opportunities of your specific location.

Working with professionals can help you sidestep these pitfalls. Consider the Advantages of Working with a Certified Franchise Executive (CFE) to ensure your plan meets professional standards.

How to write a franchise business plan that adapts to change

The best business plans are living documents that evolve. Flexibility is essential for long-term success.

- Build a flexible plan: Include scenario planning in your projections (e.g., what if sales are 20% lower or higher than expected?).

- Set performance milestones: Establish quarterly goals for revenue and operations to spot problems early and track progress.

- Regularly review and revise: Schedule quarterly reviews to compare actual results to projections and adjust your strategies.

- Respond to market shifts: Stay connected to your industry and local market to adapt to economic changes or new competitors.

- Incorporate customer feedback: Use customer insights to refine your marketing, service, and growth strategies.

A flexible plan creates a framework to steer challenges with confidence.

Frequently Asked Questions about Writing a Franchise Business Plan

How does a franchise business plan differ from a plan for an independent startup?

When learning how to write a franchise business plan, the key difference is that you’re working with a proven concept. An independent startup plan must validate a new idea from scratch. A franchise plan leverages an existing brand, operational model, and data from the franchisor’s FDD. Your focus shifts from concept validation to demonstrating how you’ll execute a successful system in your specific territory. This is a major advantage of franchising, as you build on an already successful foundation.

How can a franchisor help me write my business plan?

Your franchisor is a key resource, as your success is their success. They provide the Franchise Disclosure Document (FDD), which contains crucial data like initial investment estimates, operational guidelines, and potentially financial performance data in Item 19. Many franchisors also offer business plan templates, market insights, and demographic data to guide you. They know what lenders and their own approval teams want to see. For additional expert guidance, you can Learn more from franchise consultants.

What are the most important financial projections to include?

Three financial elements are critical for lenders and franchisors:

- Initial Investment Calculation: A thorough and realistic breakdown of all startup costs, including the franchise fee, equipment, marketing, and sufficient working capital. Being conservative builds credibility.

- Break-Even Analysis: This calculation shows when your revenue will cover all expenses. It’s a key metric for lenders, with many franchises aiming for break-even within 12-18 months.

- 3-5 Year Pro Forma Statements: These tell your financial story. They include the Income Statement (projected profits/losses), the Cash Flow Statement (cash on hand), and the Balance Sheet (financial health snapshot). Base these on realistic assumptions, ideally using data from the franchisor’s Item 19.

Conclusion

Learning how to write a franchise business plan is a critical skill for any aspiring franchise owner. This guide has covered the essential steps, from understanding the unique aspects of a franchise plan to avoiding common pitfalls.

Your business plan is more than a document; it’s your foundational roadmap for success. It’s a powerful tool for securing funding from lenders and gaining approval from franchisors. More importantly, it serves as your strategic guide for growth during your first few years in business.

Combining a proven franchise system with a well-crafted business plan that shows your local market understanding and commitment is the key to success.

At Main Entrance Franchise Consulting, we know the right guidance makes all the difference. Our Certified Franchise Executives offer client-focused, expert guidance with flexible compensation models and no upfront costs. We are your partners in building a successful franchise.

Whether you’re exploring opportunities or ready to write your plan, we’re here to empower you to make informed decisions.

Ready to create an actionable plan that opens doors? Take the next step in your franchise journey with our expert Franchise Development services. Let’s craft a business plan that paves the way for your lasting success.