Your Path to Entrepreneurship on a Budget

Low investment franchises offer a practical path to business ownership without massive capital. You can find legitimate franchise opportunities starting under $10,000, with many excellent options available for less than $50,000 or $100,000.

Quick Answer: What are low investment franchises?

- Under $10K: Home-based travel agencies, fitness instruction, vending machines

- $10K-$50K: Commercial cleaning, mobile services, event planning, photography

- $50K-$100K: Real estate services, tutoring centers, home services, specialized cleaning

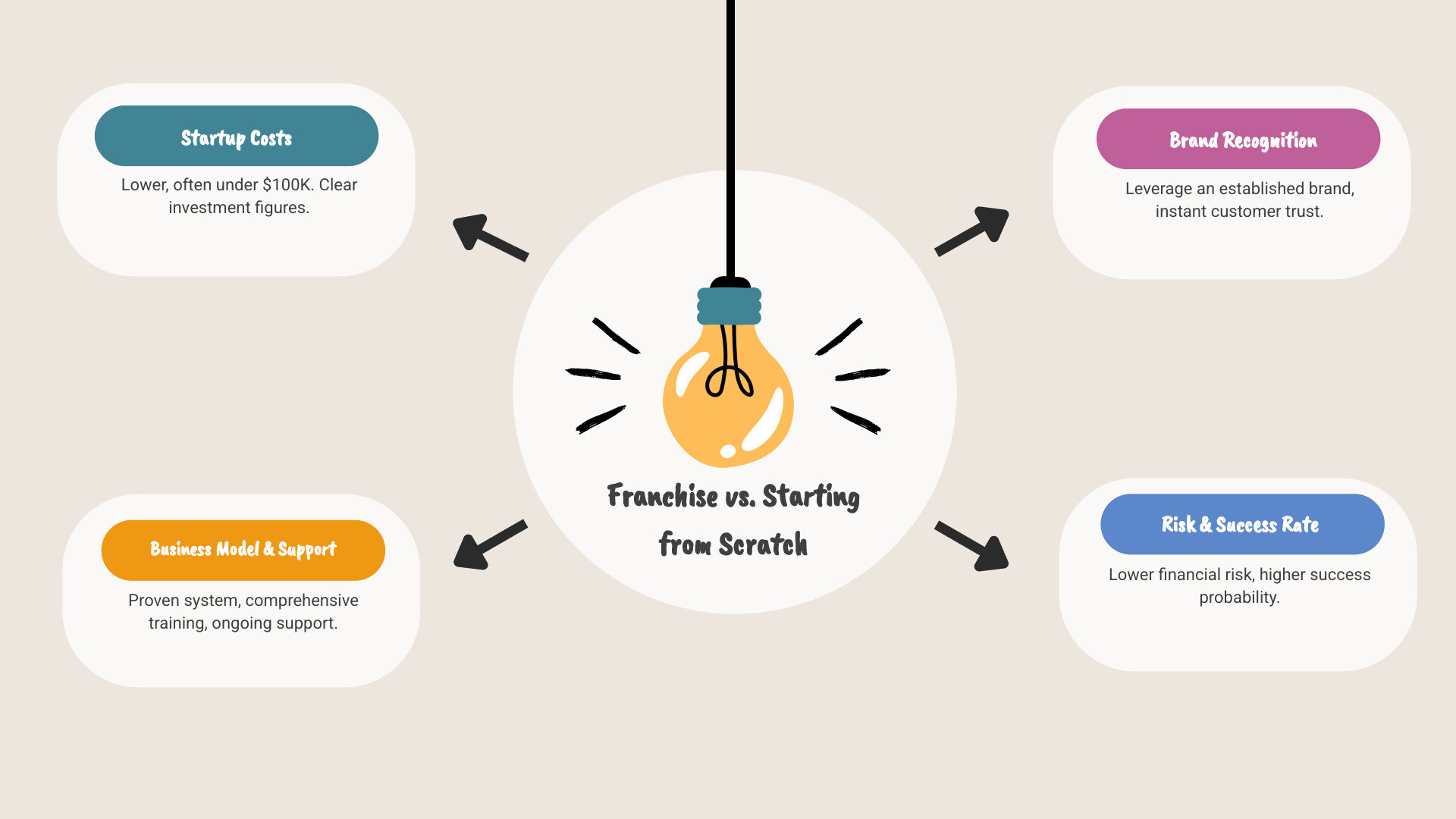

Key benefits: Proven business model, comprehensive training, brand recognition, lower financial risk than starting from scratch, faster path to profitability.

What makes these opportunities compelling isn’t just their affordability. Low-cost franchises often come with flexible models—home-based, mobile, or part-time—that let you ease into ownership while maintaining other income sources. Many also operate in recession-resistant industries with consistent demand, like cleaning services, senior care, and essential home maintenance.

Lower startup costs don’t mean lower potential. Many of the most successful franchise owners started with a single, affordable unit and scaled from there. Some of today’s largest multi-unit operators began by learning the business from the ground up before investing in their own franchise.

As Max Emma, a Certified Franchise Executive and founder of Main Entrance Franchise Consulting, I’ve spent decades helping entrepreneurs steer low investment franchises—both as a franchisor and franchisee. My experience building BooXkeeping, a national bookkeeping franchise, taught me how smart, scalable models can create real wealth without massive upfront costs.

Why Choose a Low-Cost Franchise? The Smart Benefits

Starting a business is risky, with many independent startups failing within a few years. Low investment franchises offer a smarter path to ownership that stacks the odds in your favor.

With a franchise, you buy a proven business model. The franchisor has already refined operations, marketing, and pricing, providing a blueprint for success from day one. This saves you from costly trial and error.

A proven system means lower financial risk and reduced debt. Low-cost franchises can start for under $10,000, reducing the need for large, high-risk loans. It’s a calculated investment in a working system, not a bet on an untested idea.

Consider the time value of money. Waiting years to save for a large investment means lost revenue. Starting now with a smaller franchise investment can generate returns sooner. Smart entrepreneurs often start small and scale, outpacing those who wait.

Brand recognition provides an immediate advantage. An established franchise brand comes with built-in trust and reputation, making it easier to attract customers than starting as an unknown independent business.

Franchisor training and support are invaluable, especially for new business owners. You receive comprehensive initial training on operations, marketing, and service, plus ongoing guidance and access to a network of fellow franchisees—a community for sharing advice and best practices.

Many low investment franchises also promote work-life balance. Home-based and mobile models offer flexibility best by traditional businesses. You can often start part-time, building your business without leaving your current job, ensuring financial security as you grow. This flexibility is ideal for supplementing retirement income, starting a second career, or gaining schedule control.

In short, low-cost franchises offer a faster startup and higher success rates. You leverage a proven brand, system, and support network while minimizing financial risk. It’s a structured path to entrepreneurship designed for stability and growth.

This path offers the freedom to control your financial future and build a life on your terms. You can learn more about what motivates franchise owners by exploring The 4 Freedoms That Motivate Successful Franchise Owners.

Exploring Popular Low Investment Franchises by Industry

The world of low investment franchises is diverse and flexible. Many are home-based or mobile, which keeps overhead low. Here are some popular sectors where entrepreneurs are finding success.

Service-Based & Home Services

Home services are a top sector for accessible franchises. They address constant needs like cleaning, repairs, and pest control, ensuring steady demand.

Commercial cleaning and janitorial services are among the most affordable entry points. Brands like Stratus Building Solutions, Jan-Pro Cleaning & Disinfecting, and Jantize America offer comprehensive training and support, with initial investments ranging from $2,445 to $79,750. These models focus on recurring revenue from long-term clients and offer flexible hours, making them ideal for part-time starts.

Other popular areas include residential cleaning (MaidPro, The Maids), handyman services (Mr. Handyman), pest control (Mosquito Joe), and lawn care (Lawn Pride). These niches often rely on recurring service models, creating predictable income streams. In a growing city like Las Vegas, NV, the demand for these services is endless.

Travel & Event Planning

This sector lets you turn a passion for travel or events into a home-based business.

Home-based travel agencies like Dream Vacations and Cruise Planners have low startup costs (as low as $3,500 cash required). They provide training, support, and exclusive travel deals, allowing you to run a full-service agency from home. Franchisee travel perks are a common bonus.

Wedding and event services are a huge market. Complete Weddings + Events bundles services like photography and DJs for around a $10,000 investment. Sign Gypsies offers creative yard signs for celebrations with startup costs as low as $4,000. For those with an eye for design, Showhomes Home Staging helps prepare homes for sale, typically requiring around $10,000 to launch.

Fitness & Children’s Enrichment

Health and education are evergreen industries. These franchises often use shared spaces instead of dedicated facilities, keeping overhead low.

Fitness instruction franchises like Jazzercise allow you to teach classes in shared community spaces, with investments starting around $2,140.

Youth sports and educational programs have consistent demand. Kumon has a franchise fee of just $2,000. Other strong, low-overhead options include Young Chefs Academy, Mathnasium, Soccer Shots, and i9 Sports. Creative programs like Singers Company and Young Rembrandts also offer manageable entry points.

Real Estate & Business Services

B2B and real estate franchises leverage your professional skills rather than requiring retail space or inventory.

Real estate franchises have evolved. Help-U-Sell and United Country Real Estate offer models with startup costs around $15,000. Motto Mortgage focuses on connecting loan originators with agents for a $12,500 franchise fee.

Business coaching (FocalPoint Coaching) and digital marketing (SiteSwan Website Builder) are essential services with low entry costs. Medical billing franchises like ClaimTek Systems require around $25,000-$30,000 cash. Publishing opportunities like Stroll have low entry points. And bookkeeping services, like my own franchise BooXkeeping, are essential to every business and can be scaled effectively.

If you’re intrigued by any of these industries, I encourage you to learn more through Franchise Buying, where we can help you find the perfect match.

Your Due Diligence Checklist: Vetting Franchise Opportunities

Finding an exciting low investment franchise is the first step. The most important work is due diligence—ensuring the opportunity is legitimate. Just like buying a car, you need to look under the hood before you invest.

Your first stop is the Franchise Disclosure Document (FDD). This critical legal document, required by the Federal Trade Commission (FTC), details everything about the franchise system, including fees, obligations, litigation history, and training. Review it carefully, preferably with a franchise attorney.

Beyond the FDD, ask key questions: Is there real market demand in your area? Can the business scale for future growth? What is your exit strategy? Knowing the resale and transfer policies upfront is crucial.

A key indicator of a healthy system is franchisee satisfaction. Use independent resources like Franchise Business Review, which surveys franchisees about their experiences. Their unbiased ratings are a valuable tool; high scores are a good sign, while low scores are a red flag.

Most importantly, talk to current and former franchisees. The FDD provides their contact information. Ask about their daily operations, the quality of franchisor support, actual costs versus projections, and their profitability. These conversations provide unfiltered insights.

Key Factors for Evaluating Low Investment Franchises

For low investment franchises, look beyond the initial low cost to understand the full financial and operational picture.

- Potential ROI: A low cost is only good if it leads to profit. Determine the break-even timeline and potential earnings by reviewing Item 19 of the FDD (if available) and speaking with existing franchisees.

- Initial vs. Total Cost: The franchise fee is just one part. Budget for equipment, inventory, insurance, and working capital to cover expenses before you’re profitable.

- Ongoing Costs: Factor in monthly royalty fees (typically 3%-6% of gross sales) and marketing fees (1%-5% of sales). These recurring costs significantly impact your bottom line.

- Support and Training: A low investment shouldn’t mean low support. Expect comprehensive onboarding, ongoing coaching, and marketing materials. A lack of robust support is a major red flag.

- Brand Strength: A recognized brand builds instant trust with customers, reducing your marketing burden and cost.

To help you tell the difference between a legitimate opportunity and a potential scam, here’s a quick comparison:

| Feature | Legitimate Franchise | Business Opportunity / Potential Scam |

|---|---|---|

| Initial Investment | Clear, itemized, disclosed in FDD | Often vague, hidden fees, pressure for immediate payment |

| Support & Training | Comprehensive, ongoing, structured, documented in FDD | Limited, one-time, or non-existent after initial sale |

| Brand Recognition | Established, proven system, consistent branding | Unknown, generic, or newly created brand |

| Operational Control | Follows franchisor’s system, some autonomy | High degree of autonomy, less systemized |

| Legal Documentation | Provides FDD, follows FTC rules | May avoid FDD, vague contracts, pressure to sign quickly |

| Franchisee Network | Access to existing franchisees for validation | Limited or no access to other “owners” |

| Revenue Claims | Item 19 in FDD (if provided) is regulated, realistic projections | Unrealistic income guarantees, “get rich quick” promises |

Avoiding Scams and Finding Legitimate Opportunities

The low-investment space can attract scams. Know the red flags to protect yourself.

Watch out for high-pressure sales tactics, unrealistic income guarantees, and a lack of transparency. A legitimate franchisor will encourage you to take your time and do thorough research. By law, you must receive the FDD at least 14 days before signing or paying. Any failure to provide this document means it’s not a legitimate franchise.

The Federal Trade Commission (FTC) enforces franchise laws. Use their resources on spotting potential fraud to protect yourself. Always verify claims and trust your instincts.

Financing Your Low Investment Franchises Venture

Even with a low investment, you may need funding. Several accessible options exist.

- SBA Loans: Government-backed loans like the 7(a) program offer favorable terms. Many franchises are pre-approved, which can speed up the process. Check the SBA Franchise Directory.

- Franchisor Financing: Ask if the franchisor offers direct financing or has relationships with preferred lenders.

- Business Line of Credit: Provides flexible access to capital for short-term needs. You only pay interest on the funds you use.

- Equipment Financing/Leasing: Finance or lease necessary equipment. The asset itself often serves as collateral.

- Rollover for Business Startups (ROBS): Use your retirement funds (e.g., 401(k)) to invest in your business tax-free and without penalties. Consult a ROBS specialist to ensure it’s done correctly.

- Unsecured or Portfolio Loans: Unsecured loans don’t require collateral but have higher interest rates. Portfolio loans use your investments as collateral, potentially at a better rate.

- Loans from Family and Friends: Can be a great source of capital, but always put the terms in a formal written agreement.

Always consult with financial and legal advisors before choosing a financing path.

Frequently Asked Questions about Low-Cost Franchises

What is the typical profit margin for a low-cost franchise?

Profit margins for low investment franchises vary widely by industry, brand, and location. A cleaning business has different costs and revenue models than a travel agency, leading to different margin potentials.

Key factors influencing profit include royalty fees, operating costs, marketing fees, and your own management efficiency. For the best data, review Item 19 of the Franchise Disclosure Document (FDD), which may contain Financial Performance Representations from the franchisor. This provides a realistic, though not guaranteed, look at potential earnings.

Can I run a low-cost franchise part-time?

Yes. Many low investment franchises are designed for part-time operation, allowing you to start while keeping your current job.

- Home-based models, like travel agencies (Dream Vacations, Cruise Planners), offer maximum flexibility to work around your schedule.

- Mobile businesses, such as cleaning or educational programs, also allow you to set appointments that fit your schedule.

- Some franchisors, like Buildingstars and Jantize America, offer tiered investment levels designed for part-time owners.

Starting part-time is a smart way to supplement income, learn the business with less risk, and scale up when you’re ready. Many successful owners begin this way.

What kind of support does a low-cost franchisor provide?

Good support is crucial, and reputable low investment franchises provide it. This support is key to success, especially for new owners.

Support typically includes:

- Initial training covering all aspects of the business, from operations to marketing.

- Marketing materials and brand resources, including professionally designed campaigns and digital tools.

- Operating manuals and systems, often including proprietary software, to provide a blueprint for efficient operations.

- Ongoing guidance and coaching from field representatives and support staff.

- A network of fellow franchisees for sharing best practices and advice.

The details of the support are outlined in Items 11 and 12 of the FDD. Review this section carefully, as strong support is essential for long-term success.

Conclusion: Take the First Step Towards Ownership

Low investment franchises are a strategic path to entrepreneurship, offering the independence of ownership with the safety of a proven system. They provide brand recognition, training, support, and lower financial risk.

With options spanning from home services to travel and fitness, there’s a franchise to match your interests and budget. Many models offer part-time flexibility, allowing you to grow at your own pace.

However, not all franchises are equal. Due diligence is critical. Thoroughly review the FDD, understand all costs, research franchisee satisfaction, and talk to current owners. These steps are your roadmap to success.

Financing is also accessible, with options ranging from SBA loans to ROBS. Finding the right franchise is about personal fit—matching your skills, passions, and goals. The right match can provide both income and fulfillment.

Main Entrance Franchise Consulting can guide you through this process. As a Certified Franchise Executive with experience as both a franchisor and franchisee, I offer expert, no-cost advice focused on education and transparency. My goal is to help you make an informed decision without pressure.

Business ownership is more accessible than you might think. If you’re ready to explore if a low investment franchise is right for you, let’s connect. Learn What is a Franchise Consultant? and Start your franchise buying journey today. Your future as a business owner could be closer than you imagine.