Why Franchise Ownership Could Be Your Smartest Business Move

Purchasing a franchise is a business model where you buy the rights to operate a business using an established company’s brand, systems, and support—instead of building everything from scratch. Here’s what you need to know:

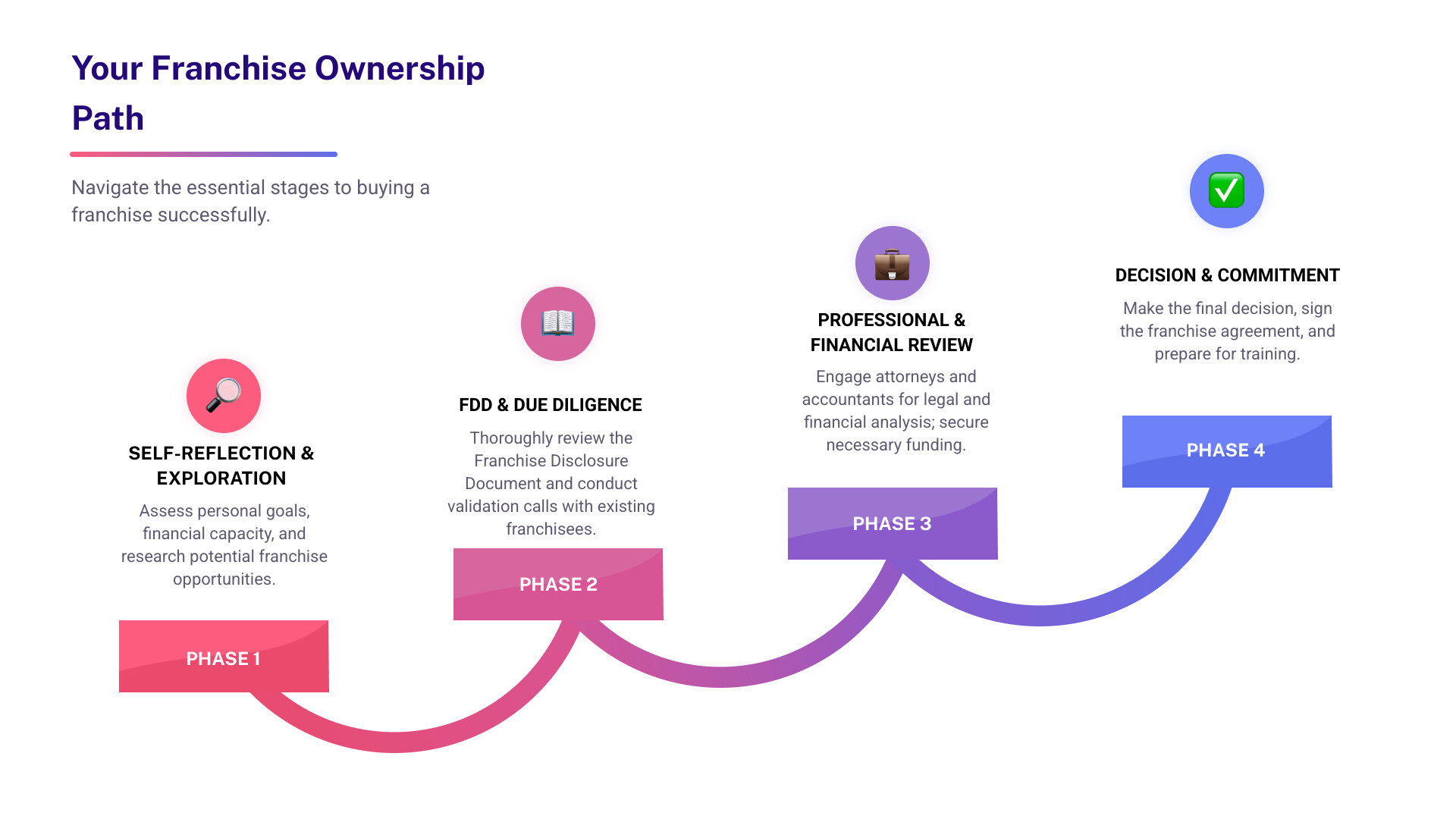

The Franchise Purchase Process:

- Evaluate your goals and finances – Assess your investment capacity, skills, and lifestyle preferences

- Research franchise opportunities – Explore different industries and business models that fit your profile

- Review the Franchise Disclosure Document (FDD) – Study this legal document containing costs, obligations, and franchisor background (you must receive it 14 days before signing)

- Conduct validation – Speak with current and former franchisees about their real experiences

- Attend Findy Day – Visit the franchisor’s headquarters to meet the team and see operations firsthand

- Secure financing – Explore options like SBA loans, business loans, or personal savings

- Sign the franchise agreement – Finalize your legal commitment and prepare for training

Typical Costs:

- Average initial franchise fee: $35,185

- Ongoing royalty fees: 4.47% to 6.98% of gross revenue

- Additional start-up costs: tens to hundreds of thousands depending on the industry

Key Benefits:

- Established brand recognition and customer base

- Proven business model with lower failure rates than starting alone

- Comprehensive training and ongoing support

Main Challenges:

- Significant upfront and ongoing costs

- Limited creative freedom and operational control

- Strict adherence to franchisor’s rules and standards

Dream of being your own boss without the risk of starting from scratch? That’s what franchise ownership offers. When you buy a franchise, you’re not just buying a business name; you’re investing in a complete system. The franchisor provides their business model, training, and brand recognition. In exchange, you pay an initial franchise fee and ongoing royalties and agree to operate according to their standards.

This model reduces many risks of a new business. You gain immediate brand recognition, benefit from tested systems, and receive training that helps you avoid costly mistakes. You’re in business for yourself, but not by yourself.

However, franchising isn’t a guarantee of success. The process is complex, the financial commitment can be significant, and the legal documents are filled with obligations. You’ll face restrictions on operations, products, and pricing. Choosing the wrong franchise or misunderstanding the agreement could lead to losing your investment.

That’s why education and due diligence are critical. You must understand the model, evaluate your goals, research opportunities, and steer the legal and financial complexities with care.

I’m Max Emma, a Certified Franchise Executive (CFE) and founder of Main Entrance Franchise Consulting. After building and scaling my own franchise, I now use my experience to guide others through purchasing a franchise, helping them find the right fit and avoid common pitfalls.

Understanding the Franchise Model: What Are You Buying Into?

When we talk about purchasing a franchise, we’re referring to a unique business partnership. It’s crucial to understand the roles, responsibilities, and expectations of both parties before you begin your search.

What is a Franchise and How Does it Work?

A franchise is a business model where a “franchisor” (the brand owner) grants an independent entrepreneur, the “franchisee,” the right to use their business logo, name, and operational model. The franchisor licenses their established brand, systems, and marketing strategies.

The franchisee operates their own business under the franchisor’s name. In exchange for using the brand’s reputation and proven model, the franchisee pays an initial franchise fee and ongoing royalties. They must also follow the franchisor’s operational guidelines, which ensures brand consistency. This relationship provides the franchisee with continued support from an established company.

Common Types of Franchises

Franchising comes in several forms:

- Product/Trade Name Franchising: The franchisee primarily sells the franchisor’s products, using their name and trademark. This model is common for car dealerships and gasoline stations.

- Business Format Franchising: The most common type, where the franchisor provides a complete business system, including operations, marketing, training, and ongoing support. Fast-food chains and hotels are classic examples.

- Job Franchises: These are often small-scale, home-based businesses with a lower initial investment, such as cleaning services or mobile repair.

- Investment Franchises: Large-scale, manager-run businesses like hotels or large gyms that require significant capital. The franchisee focuses on strategic oversight rather than daily operations.

- Conversion Franchises: An existing independent business converts to a franchise brand to gain its recognition and systems. This is common in real estate and home services.

The Franchisor-Franchisee Relationship: Support vs. Control

A primary reason for purchasing a franchise is the promise of support. Franchisors typically provide:

- Site Selection and Design: Help with finding a location and designing the layout.

- Comprehensive Training Programs: Initial and ongoing training on all aspects of the business.

- Marketing and Advertising Assistance: Access to national ad funds and local marketing materials.

- Operational Guidelines: Detailed manuals covering all procedures.

- Bulk Purchasing Agreements: Lower costs on supplies through the franchisor’s network.

- Ongoing Supervision and Management Support: Regular check-ins and expert advice.

However, this support comes with a trade-off: control. To maintain brand consistency, franchisors impose strict guidelines, limiting your independence. For example, you may not be able to change the menu or add new services. Franchisors seek individuals who can follow a proven system, not reinvent it. This structured environment is designed for replication, not creative experimentation. Understanding this balance is key to deciding if franchising fits your entrepreneurial style.

Weighing the Pros and Cons of Franchise Ownership

Deciding whether to pursue purchasing a franchise is a significant decision. It offers a unique blend of entrepreneurship and established support, but it also comes with its own set of challenges. Let’s look at a comparison to help you weigh your options.

| Feature | Franchising | Starting from Scratch |

|---|---|---|

| Brand Recognition | Immediate, established customer base | Build from zero, slow customer acquisition |

| Business Model | Proven, tested, and refined system | Develop your own, trial and error |

| Failure Rate | Generally lower (due to proven model and support) | Higher (due to unknown market, lack of experience, no established systems) |

| Support & Training | Comprehensive initial and ongoing training, operational support, marketing assistance | Self-taught or hired consultants, requires significant personal effort and expense |

| Buying Power | Access to bulk purchasing discounts for supplies and equipment | Negotiate independently, often higher costs |

| Creative Freedom | Limited, must adhere to franchisor’s system and guidelines | Unlimited, complete control over all aspects of the business |

| Initial Investment | Significant franchise fees, royalties, and startup costs | Variable, can be lower if home-based, but requires capital for all aspects of setup and branding |

| Operational Control | Restricted by franchise agreement | Complete control |

| Marketing | Benefit from national campaigns, local support, established materials | Develop all marketing strategies and materials independently |

| Exit Strategy | Often a clear resale market for established franchises | Can be challenging to sell an independent business without a recognized brand or system |

The Advantages: A Head Start in Business

Purchasing a franchise gives you a significant head start over an independent business.

- Established Brand Recognition: You benefit from a name customers already know and trust, providing a built-in customer base from day one.

- Proven Business Model: You adopt a system that has been tested and refined, which significantly reduces risk and contributes to the lower failure rate of franchises compared to solo businesses.

- Comprehensive Training and Ongoing Support: Franchisors provide extensive initial and ongoing training on everything from operations to marketing, which is invaluable for new entrepreneurs.

- Marketing Assistance: You benefit from large-scale marketing campaigns funded by national advertising contributions, which would be unaffordable for a startup.

- Buying Power: As part of a large system, you gain access to bulk purchasing agreements that lower your operational costs.

- Reduced Risk: A recognized brand, proven system, and continuous support mitigate many of the risks of launching a new business.

For those interested in exploring these benefits further, we offer more info about our franchise buying services to help you steer your options.

The Disadvantages: The Price of a Proven System

While the advantages of purchasing a franchise are numerous, it’s equally important to be aware of the potential drawbacks. The “price” of a proven system isn’t just financial; it also involves certain limitations on your entrepreneurial freedom.

- Restricting Agreements and Lack of Creative Freedom: Legally binding franchise agreements dictate how you operate, limiting your autonomy. You may not be able to change products or pricing, which can be frustrating for creative entrepreneurs.

- Initial Cost and Ongoing Fees: The financial commitment is substantial, including an initial franchise fee, ongoing royalty fees (a percentage of your gross sales), and advertising fund contributions.

- Potential for Conflict: Disagreements with the franchisor can arise over support, policy changes, or operational standards, which can be costly to resolve.

- Shared Reputation Risk: Your business’s reputation is tied to the brand. Poor performance by another franchisee or negative publicity for the franchisor can affect your location.

- Limited Ability to Experiment: Franchising prioritizes consistency, leaving little room for you to test new ideas. Innovation typically comes from the franchisor.

It’s crucial to weigh these limitations against the benefits and decide if the trade-off aligns with your personal entrepreneurial style and goals.

The Financial Realities: Costs and Funding Your Franchise

Purchasing a franchise is a significant financial commitment. Understanding all upfront and ongoing costs is essential for sound planning.

Understanding the Costs of Purchasing a Franchise

The total investment varies widely depending on the industry and brand. Key costs include:

- Initial Franchise Fee: This upfront payment gives you the right to use the brand and systems. The average fee is $35,185, but it can range from $15,000 for a brand like Subway to much higher for more established companies.

- Start-up Costs: Beyond the fee, you need capital to get your business operational, including:

- Real Estate/Leasehold Improvements: Costs for your physical location.

- Equipment and Inventory: Necessary machinery and initial product stock.

- Operating Licenses and Permits: Fees for legal authorization.

- Insurance: Business, employee, and property coverage.

- Grand Opening Fees: Costs for your business launch.

- Working Capital: Funds to cover initial operating expenses (payroll, utilities) until the business is profitable, which can run into six figures.

- Royalty Fees: These are ongoing payments to the franchisor, usually a percentage of your gross sales. Our research shows the average royalty is about $35,000 a year, with percentages ranging from 4.47% to 6.98% depending on the industry.

- Marketing/Advertising Fees: Most franchisors require contributions to a national advertising fund. This may be a flat fee or a percentage of sales.

When considering purchasing a franchise, it’s crucial to account for all these financial aspects in your business plan.

How to Finance Your Franchise Purchase

Securing capital is a critical step. Several financing options are available:

- Small Business Administration (SBA) Loans: The SBA guarantees loans from approved lenders, making it easier to secure funding. The agency offers specific SBA loans for franchise purchases, like the 7(a) and 504/CDC programs.

- Traditional Business Loans: Banks and credit unions offer conventional loans, though they typically require a strong credit history and a solid business plan.

- Personal Savings and Equity: Using your own funds demonstrates personal commitment and is a viable option, especially for lower-cost franchises.

- Equipment Financing: These loans are secured by the equipment itself, which is useful if your business requires substantial machinery.

- Business Term Loans: These loans have a fixed interest rate and repayment schedule, ideal for a large, one-time investment like a franchise purchase.

- E-2 Visa Options for Investors: For international entrepreneurs, an E-2 Visa Franchise is an excellent pathway to invest in and operate a U.S. business. We specialize in guiding clients through this specific process.

A solid financial plan with detailed cost projections is paramount for securing a loan.

Your Step-by-Step Guide to Purchasing a Franchise

Navigating the process of purchasing a franchise can feel like a complex maze. However, by breaking it down into manageable steps, we can approach it systematically and confidently. Due diligence, legal review, and careful financial planning are your best allies throughout this journey.

Step 1: Research Before Purchasing a Franchise

The first and arguably most crucial step is thorough self-assessment and research. This isn’t just about finding a business; it’s about finding the right business for you.

- Personal Goals and Financial Situation: Before looking at any specific franchise, honestly assess your investment capacity, financial risk tolerance, business abilities, and personal goals. Ask yourself: How much capital do you have to invest? How much can you afford to lose? What kind of income do you need? What are your motivations for becoming an entrepreneur? We often guide our clients through exercises to understand The 4 Freedoms That Motivate Successful Franchise Owners.

- Lifestyle Preferences: Consider the type of work you enjoy, the hours you’re willing to commit, and whether you prefer a hands-on or semi-absentee role. Do you want a home-based business, or a brick-and-mortar location?

- Exploring Opportunities: Once you have a clear picture of your ideal business, it’s time to explore the vast world of franchising. You can start by using reputable franchise directories, attending franchise expos, and reading industry publications. Look for franchises that align with your interests, expertise, and financial capacity. Franchising exists in almost every sector, from lawn care to tech services, not just fast food.

This initial research phase is about narrowing down the field to opportunities that genuinely fit your profile.

Step 2: Decoding the Franchise Disclosure Document (FDD)

Once you’ve identified potential franchise opportunities, the next critical step is to dig into the Franchise Disclosure Document (FDD). This is a comprehensive legal document that the franchisor is required to provide to prospective franchisees in the United States.

- FDD Definition and Legal Requirement: The FDD contains 23 items of crucial information about the franchise system, including the franchisor’s background, costs, obligations, and financial performance. It’s designed to give you all the material facts you need to make an informed investment decision. The Federal Trade Commission (FTC) mandates that franchisors must provide you with the FDD at least 14 days before you are asked to sign any contract or pay any money. This “14-day rule” gives you time to review it carefully.

- Key Items to Review: We always emphasize a meticulous review of the FDD. Some of the most important items include:

- Item 1: The Franchisor and any Parents, Predecessors, and Affiliates: Provides background on the company and its leadership.

- Item 7: Estimated Initial Investment: Details all startup costs, including the franchise fee, equipment, real estate, and working capital.

- Item 11: Franchisor’s Assistance, Advertising, Computer Systems, and Training: Outlines the support and training you can expect.

- Item 19: Financial Performance Representations: If provided, this section gives insights into the financial performance of existing franchises. Be cautious and always seek substantiation for any claims.

- Item 20: Outlets and Franchisee Information: Provides data on the number of franchised and company-owned outlets, including contact information for current and former franchisees.

- Item 21: Financial Statements: Contains audited financial statements of the franchisor, indicating their financial health.

- Litigation History (Item 3) and Bankruptcy (Item 4): Reveals any past legal issues or financial distress of the franchisor or its executives.

The FDD is your “holy grail” for understanding the franchise. We recommend you learn more about the FDD and consult resources like A Consumer’s Guide to Buying a Franchise from the FTC to fully grasp its importance.

Step 3: Due Diligence and Validation

After reviewing the FDD, it’s time to validate the information and gather real-world insights. This step is about connecting with people and getting an unbiased perspective.

- Speaking with Current and Former Franchisees: This is one of the most reliable ways to verify the franchisor’s claims. Item 20 of the FDD will provide contact information. Ask current franchisees about their experiences with the franchisor’s training, support, advertising, and profitability. Speak to former franchisees to understand why they left the system, which can sometimes reveal potential issues.

- Attending a Findy Day: Once you’ve shortlisted a franchise, you may be invited to a Discovery Day. This is your chance to visit the franchise headquarters, meet the leadership team, and get a behind-the-scenes look at the operations. It’s a crucial step to evaluate whether the franchise’s culture and operations are the right fit for you.

- Hiring a Franchise Attorney: The franchise agreement is a complex legal document with significant implications. It is highly recommended to hire a franchise attorney who specializes in franchise law to review the FDD and the franchise agreement. They can explain your legal obligations, rights, and potential risks, ensuring you understand every clause before signing.

- Consulting an Accountant: A qualified accountant can help you analyze the franchisor’s financial statements (Item 21 of the FDD), assess any financial performance representations (Item 19), and help you develop a realistic business plan and financial projections for your specific location. They can also advise on the tax implications of purchasing a franchise.

This validation phase is your opportunity to “kick the tires” and ensure the opportunity is as good as it seems on paper.

Step 4: The Final Decision and Legal Commitments

The final stage of purchasing a franchise involves making your ultimate decision and formalizing your commitment.

- Reviewing the Franchise Agreement: With your franchise attorney, carefully review the final franchise agreement. This document will outline the terms of your relationship with the franchisor, including fees, territory, operational requirements, renewal options, and conditions for termination. Ensure it aligns with all verbal discussions and your understanding of the FDD.

- Understanding Legal Obligations: Be fully aware of all your legal obligations and contractual terms. Franchise agreements are typically non-negotiable in their core terms, but understanding what you’re agreeing to is paramount.

- Signing the Contract: Once you are completely satisfied and all your questions have been answered, you will sign the franchise agreement. This is the official start of your journey as a franchisee.

- Finalizing Financing: Ensure all financing arrangements are securely in place. This includes drawing down loans, transferring funds, and setting up accounts.

- Preparing for Training: After signing, you’ll typically begin the initial training program provided by the franchisor. This prepares you to launch and operate your new business according to their proven system.

This final step transforms your dream into a tangible business reality.

Don’t Steer the Franchise Maze Alone

As we’ve explored, the journey of purchasing a franchise is multifaceted and complex. From understanding the nuances of different franchise models to decoding the Franchise Disclosure Document, navigating financial realities, and undertaking thorough due diligence, it’s a path filled with critical decisions. Trying to steer through this maze alone can be overwhelming, increasing the risk of costly mistakes or choosing an opportunity that isn’t truly aligned with your goals.

This is where expert guidance becomes invaluable. The right support can significantly reduce your risk and empower you to make a confident decision. At Main Entrance Franchise Consulting, we believe in providing unbiased, personalized guidance throughout this entire process—at no cost to you.

As a certified IFPG franchise consultant, I provide education-first support, in-depth franchise matching, and a streamlined findy process. Our goal is to help you confidently choose a franchise that is truly aligned with your goals, budget, and lifestyle. We partner with hundreds of proven franchise brands, and because we are compensated by franchisors, our clients receive expert consulting and a guided franchise buying journey with total transparency. This means you get expert guidance without a price mark-up on the franchise itself, as franchise sales and fees are federally regulated.

Working with a certified franchise executive (CFE) like myself brings numerous Advantages of Working with a Certified Franchise Executive (CFE). We act as your advocate, helping you understand the landscape, ask the right questions, and avoid common pitfalls. We help you cut through the noise and focus on opportunities that genuinely fit your profile, saving you time and effort.

Ready to find the right franchise for you and start on your entrepreneurial journey with confidence? Let us guide you through every step, ensuring you have all the information and support you need to make an informed decision. Learn more about what a franchise consultant does and how we can help you achieve your business ownership dreams.